How to Protect Your Profits Using Stop Orders

Post on: 29 Июнь, 2015 No Comment

How to Protect Your Profits Using Stop Orders

Start your Free Tomorrow In Review Preview — Sign Up Here: />

Many of us do not have time to actively monitor our trading accounts over the course of the day. But there is an effective tool you can use to limit your losses — or, better yet, another one to protect your profits.

I’m talking about stop losses. Placing a stop loss or a trailing stop order with your broker is a great way to secure your exit from a falling position without actively monitoring your account. You can consider them a “free” insurance policy on your investment.

Many investors and traders spend hours deciding when is the best time to enter a position, but very few spend time on an exit plan. Emotion can sometimes plays a large role in your portfolio. Trying to remove emotion and establishing an exit plan can be the difference between small and large losses in your portfolio. While it is impossible to avoid every single loss, you can still limit them whether you are a short- or long-term investor.

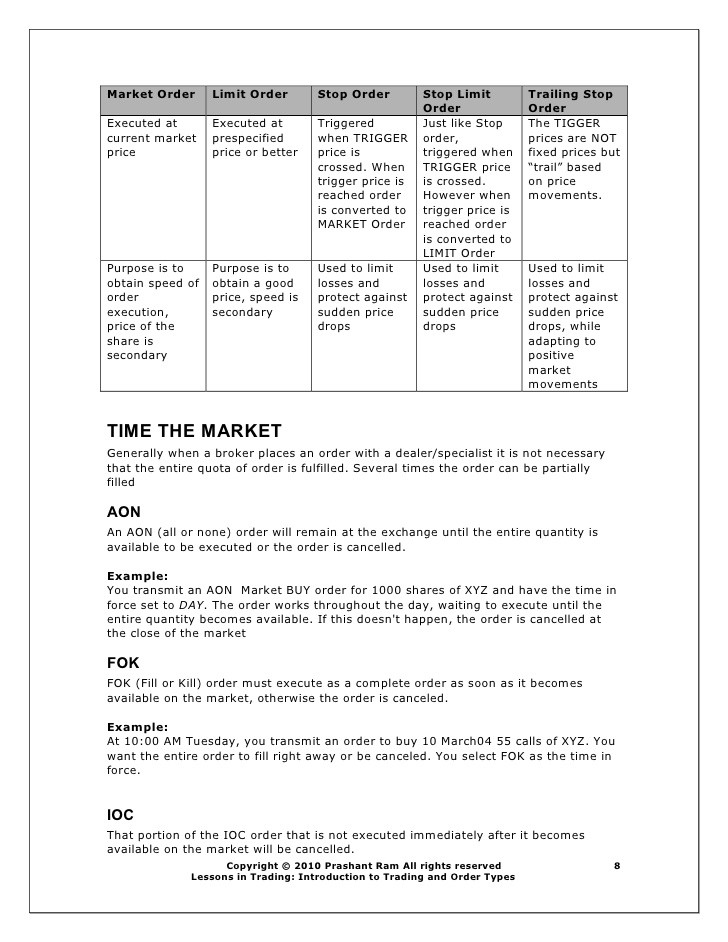

A stop loss is an order placed with your broker to sell shares of a stock when the stock reaches a predetermined price. It is designed to limit your losses on a certain position.

A trailing stop is a stop loss order set at a percentage level or an absolute price below the market price. Trailing stops are adjusted as the share price fluctuates — this not only limits your losses, but over time can protect your profits as the stock rises in price. For example, say you purchase a stock and set your trailing stop at 10% below your buy price, and then the stock moves up 30%. Your trailing stop will then move, resetting itself to 10% below the current price of the stock, protecting 20% of your profit. A trailing stop will always move up as the stock rises, but will never move down.

As you can see, the main difference between the two is a stop loss order is a fixed value, while a trailing stop will shadow the upward price movement of a stock.

Highly volatile stocks are best managed with stop loss orders. This is because if the price range within a day is large, it will better limit your risk. Setting a price is really up to what you are comfortable with. But it is important to note that a stop order can be activated due to short-term fluctuation in the stock price, a price fluctuation that may recover within the trading day. As a general guide, fundamental investors should set a stop loss at their absolute pain threshold — the amount they are willing to lose on a particular position. Traders should set their stop loss below the stock’s support, or price floor. If a trader is below a strong support, they will not run the risk of getting stopped out too early.

Trailing stops, based on a percentage, not a set price, are very useful to an investor. As the stock reaches new highs, the trailing stop moves and will start protecting your profits. Similar to with a traditional stop loss order, you don’t want to get stopped out too early with a trailing stop. So be sure to monitor the average price fluctuation of a company over a day before setting a trailing stop.

Without risk, there is no reward. If a stock gaps down — meaning it closes at a higher price than it opens the following day — there is a chance your stop will not get filled. Also, as I mentioned earlier, there is a chance you may get stopped out too early. If a stock falls below your stop level and then shoots back up within the trading day, you could miss out on profits.

Risk management is at the core of every successful investor’s strategy. By adding stop loss and trailing stop orders to your investing toolbox, you can enhance your returns and lower your risk.