How to Profit From October s Volatile Market Stockpickr! Your Source for Stock Ideas

Post on: 16 Март, 2015 No Comment

Senior Contributor

10/16/14 — 12:25 PM EDT

BALTIMORE (Stockpickr ) — Volatility is back with a vengeance this month — but that doesn’t have to be a bad thing. Today, I want to show you how you can profit from the bigger swings in stock prices.

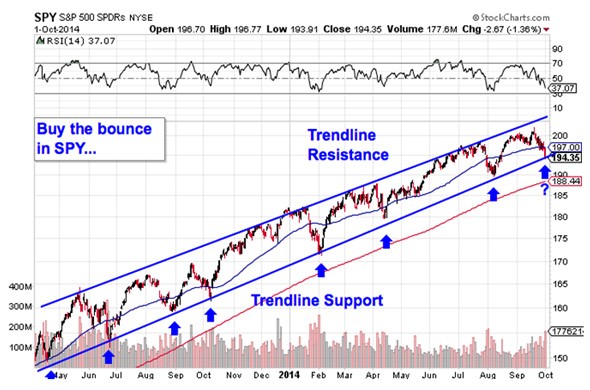

You don’t need to look at some sort of volatility graph to figure out that volatility has come back into stocks. For the last two years, the S&P 500 has been in an extremely orderly uptrend, on average seeing around 5% to the downside on every correction. Historically speaking, that’s one of the longest-stretches of low stock market volatility we’ve seen.

For anyone who just started investing in late 2012, the last few sessions’ price action seems insane. Yesterday, for instance, the S&P came close to shedding 3% intraday. And since the last week of September, we’ve seen five sessions close with more than a 1.5% price swing in either direction. There were only six sessions that swung that widely in the first nine months of 2014.

Higher volatility doesn’t just mean that the price swings are bigger now in both directions — it means that downside risks are becoming dominant. That’s because big volatility increases typically come with bear markets or deep corrections. (In contrast, the last two years’ rally has been fueled by prolonged low volatility.) Many investors don’t realize it, but some of the biggest up moves come during bear market rallies — last Wednesday’s 1.78% pop was a good example of that.

So don’t get lured into stocks by a smattering of big up-days in the next few sessions; the down-days are statistically more likely to be bigger and badder.

But there’s still money to be made here. To find it, we’ll start with one of the most popular tools used to measure volatility, the VIX Volatility Index .

As I write, the VIX sits at 26.25, which means that traders are pricing in the possibility of a 7.57% move in the next 30 days. That’s a much higher level of volatility priced into stocks than we’ve seen recently, but it’s not that high on an absolute basis. The problem is that, contrary to popular belief, the VIX isn’t a very good volatility indicator in the first place, because it measures the implied volatility of S&P 500 index options. It reflects how traders feel about volatility right now, but it’s subject to bias. (For more, see my previous article, How to Trade the VIX .)

Instead, take a look at how the VIX has looked relative to a raw statistical measure of volatility called average true range:

While these two volatility measures move more or less in step with one another, there are some big important differences between them. First, while the VIX (the upper chart) is hitting 2012 highs, our statistical volatility measure has actually already broken out above those and is at highs we haven’t seen since the big market correction in mid-2011.

Translation: The VIX is under-reporting volatility in the S&P 500 right now.

There’s an important trading opportunity there. It makes sense to buy the VIX and wait for it to play catch-up.

One of the best ways to do that is through the iPath S&P 500 VIX Short Term Futures ETN (VXX ). This exchange-traded note is a good short-term trading vehicle that’s meant to mirror the VIX. Keep in mind that you don’t want to own VXX long-term. Because it has to roll its VIX futures, contango eats into the long-term performance of this note.

VXX isn’t a direct investment in the VIX. Instead, it attempts to track the performance of an index of VIX futures, as do all of the other VIX ETFs and ETNs out there. That means that this ETN is literally a derivative of a derivative of a derivative of a derivative. Bear that in mind if its moves diverge from VIX itself.

Here’s what it looks like now:

If this were a typical technical chart, I’d call the setup in VXX a double bottom. But don’t fall into the trap of applying classic technical tools to the VIX chart. Technical analysis works on instruments whose price is determined by supply and demand, and those market forces are ideally irrelevant in VXX because the VIX is a statistic.

But since the VIX is cyclical (it moves from periods of low volatility to periods of high volatility), the reversal off of lows adds some cyclical upside potential to our VXX trade. Now is a good time to buy VXX — just add a protective stop to the downside.

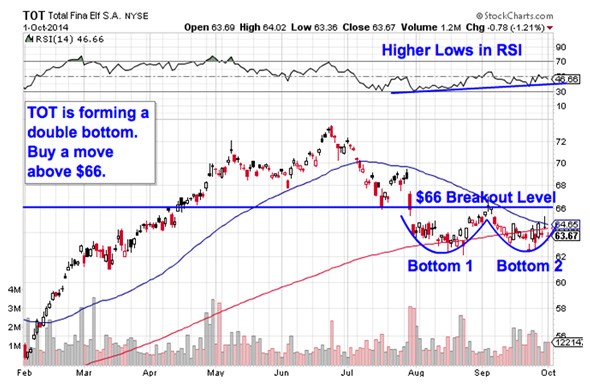

For a more vanilla way to play the volatility spike, think income. Anything that pulls more of its total returns from income (through dividends or coupons, for instance) than from capital gains is going to have lower correlation with a volatile market — and since volatility and bear markets go hand-in-hand, that’s a very good thing.

Think dividend stocks and bond ETFs.

That makes the defensive names I mentioned last week — Abbott (ABT ), Digital Realty Trust (DLR ) and Reynolds American (RAI ) — a great way to take advantage of the volatility spike. (On average, those three names are already beating the S&P 500 by 1.13% less than a week later.)

Spiking volatility is understandably worrying for most investors. But VXX and our three income-focused names offer an easy way to profit while other names are dropping.

— Written by Jonas Elmerraji in Baltimore.