How to Place a Trailing StopLoss Order Example Pros Cons

Post on: 16 Март, 2015 No Comment

One of the most difficult decisions investors have to make is when to take profits and when to cut losses short. Some traders will prematurely sell as a stock rises while others will hang onto their shares far too long as prices plummet.

How can you prevent from making the latter mistake? The trailing stop-loss order is one tool that can help you trade with discipline.

Lets look at what the trailing stop-loss is, how it works, and the pros and cons of using it.

Trailing Stop-Loss Order

The trailing stop-loss order is actually a combination of two concepts. There is the trailing component and the stop-loss order.

A stop-loss order is when you specify a certain action to be taken at a certain price. If you buy a stock at $100 per share and you set up an order for the shares to be sold if prices dip to $90, you have placed a stop-loss order. You can set a stop-loss order at any value. Essentially, a stop-loss order is a form of investment risk management .

The problem with stop-loss orders is their lack of adaptability; they are static and do not move. For example, if your $100 per share stock moves up to $200 and the stop order stays at $90, your downside protection will be worthless.

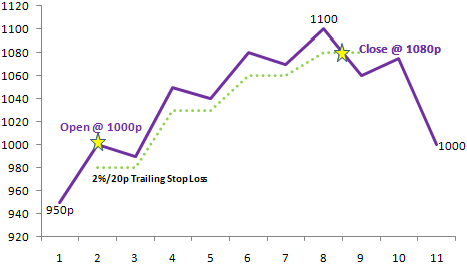

The trailing stop-loss order adds in a dynamic component to overcome this hurdle. With the trailing feature, the stop-loss order is no longer fixed, but rather trails the price by a certain amount (usually a set percentage) that you specify. In doing so, one of the key advantages of the trailing stop-loss order is that it allows you to lock in profits rather than hold on to a stock for too long only to see your profits disappear.

One of the keys to a successful trailing stop-loss order is making sure to analyze the specific stock and its historical volatility. Dont set an order that will likely be triggered by a stocks normal daily price fluctuations or you will find yourself selling stock without good reason.

Another thing to keep in mind is that while the trailing stop-loss order price will automatically rise with share prices, it will never decrease. That is, the stop-loss order will always be based off of the stocks highest price, which is usually calculated based on closing-day prices rather than intra-day prices.

Trailing Stop-Loss Example

You purchase shares of Xerox Corporation (NYSE: XRX) at $10 per share. You set the trailing stop-loss order at 5%. Thus, if the price falls to $9.50, your stock will automatically be sold. But as the shares of Xerox rise, so does your trailing stop-loss.

- If share prices appreciate to $14, your trailing stop-loss order now sits at $13.30.

- If Xerox rises to $20, your trailing stop-loss order will be at $19.

- If the price jumps to $30 per share, the order is at $28.50.

Of course, you can set the value to any amount you like. This could be 1%, 5%, or 50%.

Advantages

- This order type will sell your stock automatically when share levels drop, giving you peace of mind when youre away from your trading platform during any significant downward action in price.

- This order does not put a cap on profits. Shares can continue to rise and you will stay invested as long as prices do not dip by your predetermined percentage.

- The trailing stop-loss order is flexible. You can enter any trailing stop-loss percent for a customized risk management plan and change it as you please.

- There is no cost to placing a stop-loss order.

- This order allows investors to take emotions out of their trades and instead stick to predetermined goals.