How to Pick Industry Sectors Based on the Business Cycle XLK XLI XLB Investing Daily

Post on: 16 Март, 2015 No Comment

Ive always considered myself a bottom up investor, which means that I start my search for attractive investment opportunities by analyzing individual companies, regardless of their industry sector. I keep a list of outstanding businesses in a watch list and wait for the inevitable irrational market decline to let me buy the stock at an undervalued price. I also like to run stock screens based on a set of fundamental and technical criteria that allows me to discover stocks that I never would have found otherwise.

Something is Missing

But, in the back of my mind, Ive always known that something is missing in my investment process. In William ONeils investment classic How to Make Money in Stocks. his research shows that three out of every four stocks follows the trend of their respective index. In other words, no matter how good one is at isolating great businesses with improving fundamentals, if its industry group is out of favor, the stock will most likely go down anyway. Similarly, David Swensen, the investment guru who runs Yale University s $17 billion endowment, wrote in his book Pioneering Portfolio Management that a bottom-up approach is insufficient:

Asset allocation relies on a combination of top-down assessment of asset class characteristics and bottom-up evaluation of asset class opportunities. Because bottom-up insights into investment opportunity provide information important to assessing asset class attractiveness, effective investors evaluate portfolio alternatives with simultaneous consideration of top-down and bottom-up factors.

Lets face it, finding winning stocks that outperform the indices is a difficult process that often feels like finding a needle in a haystack. We need every possible edge available and simply analyzing individual stocks wont get the job done.

Top-Down Analysis to the Rescue!

I think I have found an easy button to help me along. Specifically, a top down analysis, which analyzes the macro economy and business cycle, helps steers me towards those industry sectors most likely to outperform. Once I find the good sectors, then and only then is it time for me to focus in on individual companies.

Market Cycle Charts

All well and good, but how do you find which industry sectors perform best in each part of the business cycle? Actually, it is pretty easy with a little Internet research. I was able to find five separate market cycle charts on the subject from the following sources: (1) stockcharts.com ; (2) EquiTrend Weekly Market Watch ; (3) Standard & Poors ; (4) The Market Oracle ; and (5) Jim Cramer. Although a bit different, they share similar conclusions. The stock market anticipates the economy by a few months, so you need to differentiate between the industry and the stocks of that industry. For example:

- Some industries are interest-rate sensitive and do best early in an economic recovery when interest rates have bottomed, so their stocks anticipate and start outperforming late in a recession (e.g. financial and utilities).

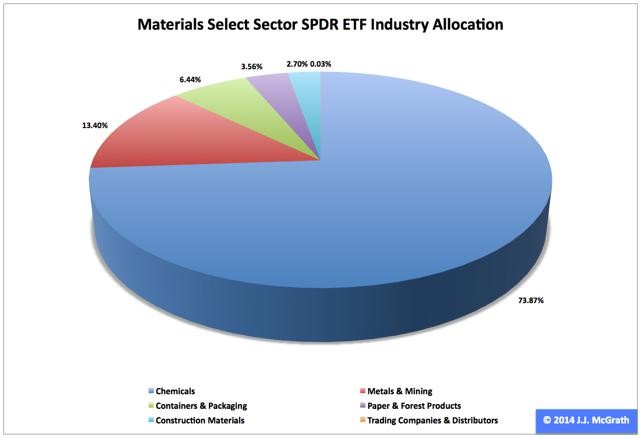

- Others benefit from inflation and do best when the economy is peaking, so their stocks outperform starting in the middle of the economic recovery (e.g. energy, basic materials, and precious metals).

- Technology and big-ticket consumer discretionary industries like autos and housing do best in the middle of an economic recovery when prices are still moderate yet people are employed, so these stocks outperform at the start of the economic recovery.

- Early in a recession, consumer staples like food and healthcare do relatively well because everything else that is more economically sensitive does much worse, so these stocks outperform near the economic peak.

Check any of the market cycle charts I link to above for more details.

Analyzing the Business Cycle With the Help of the WLI

These relationships between the business cycle and industry sectors are interesting, but this knowledge is only useful if it is possible to know where in the business cycle the economy is right now. Analyzing the business cycle is difficult! After all, there are professional economists with Ph.Ds that cant agree where the economy is headed.

True enough, so you just have to choose one source that you trust and go with it. In my case, Ive chosen to follow the Economic Cycle Research Institutes (ECRI) Weekly Leading Index (WLI), which forecasts cyclical turns in economic growth with an average lead time of eight months. The ECRI was founded by Geoffrey Moore, the same man who developed the original leading economic indicators (LEI) used by the U.S. government. The WLI follows in the LEIs footsteps but is considered a more advanced, accurate, and timely forecasting tool. Right now, the WLI just hit a 99-week high. which means that the economic recovery is going to continue full-steam ahead. According to ECRIs managing director Lakshman Achuthan, a double dip recession remains out of the question .

However, the WLIs rate of growth has fallen to a 37-week low, so future economic growth, while positive, will not be as strong as in the recent past. Furthermore, the ECRIs Future Inflation Gauge (FIG) has been rising continuously for a year but remains at moderate levels so inflation is not a problem. Bottom line: continued economic growth with moderate inflation is on tap for at least the next eight months, which seems like a perfect backdrop for continued stock market gains.

As far as choosing industry sectors, however, I still need to know where exactly in the cycle we currently are. The WLI tells me that the U.S. isnt in recession and wont enter one in the next eight months. But it doesnt go much beyond that because it is designed to forecast economic cycle turns, not the length of economic expansions. So I need to do some more sleuthing.

Cruising Economic Websites and Counting the Days

My next source is economist Gary Zimmerman of the Federal Reserve Bank of San Francisco. who under the guise of Dr. Econ states that the average economic expansion lasts 57 months (4.75 years). Next stop, the National Bureau of Economic Research (NBER), which confirms that the recent recession began in December 2007. It refuses to declare the recession over, however, which I find ridiculous so I quickly move on to the Bureau of Economic Analysis (BEA). The BEA releases quarterly GDP figures and the latest release, pertaining to Q4 2009, shows 5.6% annualized growth. In addition, it provides data on the GDP growth rate going back several quarters: