How to monitor your mutual fund s performance Economic Times

Post on: 11 Июнь, 2015 No Comment

In January this year when Fidelity India announced plans to exit the Indian mutual fund industry, it stumped everyone, especially the investor community. Eyebrows were raised because Fidelity is one of the largest and most reputed mutual fund houses in the world and enjoys a healthy track record in terms of scheme performance here.

In end-March, L&T Mutual Fund, a relative newcomer and little-known brand in mutual fund circles, announced that it will be acquiring the assets of Fidelity and running operations.

This sudden exit and distress sale by an otherwise top performing fund house left many of its existing investors biting their fingernails. Most of them wondered: What will happen to the money that I invested in Fidelity funds? Will the performance take a hit after the sale?

Experts have mostly played down these concerns, while conceding that investors need to keep a closer eye on the performance of the funds for a while. The same advice is also offered when a fund manager exits and a new one takes over the reins.

Investors are asked to monitor the fund performance for some time before taking a call whether to exit or stay with the fund. But, how do you monitor a mutual fund’s performance? What changes do you need to watch out for? How will these influence your perception of the fund under its new parentage or stewardship?

How long do you need to monitor the fund?

While keeping an eye on your fund, do not get influenced by performance figures over a short period. Give the new fund manager or asset management company ( AMC ) some time to prove his/its worth.

Experts advise that investors should stick around for at least six months to get an idea about how their scheme is shaping up after the change in management. A couple of months or a quarter’s performance will not paint a true picture of the fund’s performance or allow the fund manager to do justice to his role.

How have fund houses performed after a takeover?

Here’s a look at the returns delivered by the schemes for various time periods immediately before and after the change in ownership.

Vivek Rege of VR Wealth Advisors, takes a firm stand. Do not get influenced by short-term performance of the scheme, which could lead you to a wrong conclusion. Investors should only take a call after considering the consistent performance of the fund over several quarters, he says.

At the same time, staying invested for a longer duration might defeat the purpose of monitoring the fund since things could have already turned sour and you would unnecessarily be stuck with a lemon in your portfolio, despite keeping a watchful eye over proceedings. So, a 6-8 months period should be sufficient to help you appraise the performance.

Now that you know how long you need to keep your fund under surveillance, below are some factors you need to watch out for during this time of monitoring your fund. You can easily access the information available on mutual fund portals as well as fund factsheets.

Weak relative performance

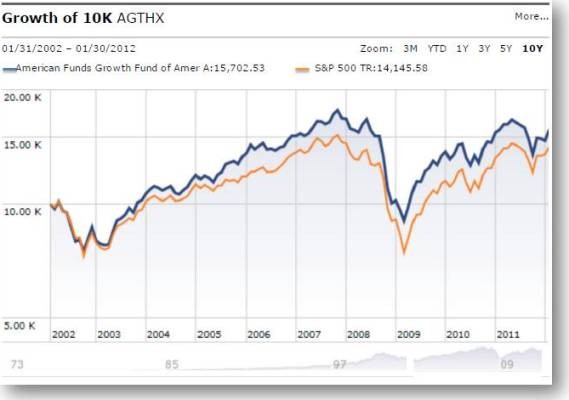

A fund’s performance cannot be judged in isolation. If you really want to check how your fund is performing over a certain period of time, compare its performance with others in its category each month or quarter.

If its performance remains sub-standard, that is, the returns are below category average or benchmark index consistently, but most of its peers are doing well, it is a strong reason for you to consider switching to another well-established fund in the same category.

Rege cautions that investors must make an appropriate comparison and not compare apples to oranges. The first step in comparing performance lies in choosing peers properly within the appropriate category, he adds.

You can see how your fund is faring compared to others using online portals such as Value Research and Morningstar. Both portals provide a monthly and 3-monthly break-up of a fund’s performance, comparing it with its category return as well as ranking the performance in that category.

Shift in investment style

Performance (in terms of returns) is not the only yardstick by which to gauge the viability of the fund. It is equally important that the investor track the changes in the fund’s portfolio after the change in management. For instance, check which stocks are flowing in and out of the portfolio during the monitoring phase to ascertain that the new fund manager has not shifted the fund’s investment focus in a way that alters the fund’s risk profile. Has the fund become more aggressive compared to your comfort zone?