How to make 7% income with lower risks using closed end funds

Post on: 2 Июнь, 2015 No Comment

A version of this post has been submitted to Seeking Alpha.

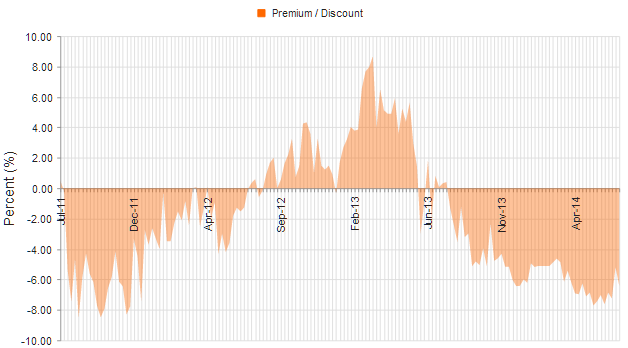

seekingalpha.com/article/1566992-a-high-income-lower-risk-cef-portfolio-for-retirees ) on how to construct a high income, lower risk portfolio using Closed End Funds (CEFs). Since the article was written, the S&P 500 has been in a phenomenal bull market. In addition, the likelihood of the Fed tapering in the near term has been reduced because of the gridlock in Washington. This article takes a fresh look at the portfolio that I recommended and assesses if the risks versus rewards profile has significantly changed.

Selection Criteria

The portfolio is primarily focused on equities although there are some allocations to bonds within some of the funds. The CEFs in the portfolio satisfy the following criteria:

- I wanted to analyze CEFs over a complete bear and bull market cycle, so I chose CEFs that had a history going back to 12 October 2007 (the start of the 2008 bear market).

- The CEFs had to be liquid, with an average trading volume of at least 50,000 shares per day

- The distribution had to be at least 6%

- The Market Capitalization had to be at least $100 million

- Return of Capital (ROC), if any, had to be non-destructive

Return of Capital

Return of Capital (ROC) is an important concept when investing in Closed End Funds and deserves some additional discussion. One of the key things to realize that the definition of ROC is not the common sense definition but is instead based on accounting rules. For a CEF, the cash available for distribution comes from interest, dividends, and realized capital gains made in the current period. If a fund distributes more than this cash, it is labeled as return of capital by the accountants.

However, not all ROC is considered “bad”. For example, if fund assets have appreciated but have not been sold, then the Net Asset Value (NAV) has increased by what is called “unrealized capital gains”. When it comes time for a distribution, the fund manager may decide not to sell some of his best performing assets because he believes they will appreciate even more. If he had sold the asset, he would have had plenty of cash for the distribution. However, since he decided not to sell, he may not enough “immediate” cash flow to pay the distribution. He therefore has to delve into savings, which results in an accounting event that is termed “return of capital”. This type of ROC is not destructive. This non-destructive ROC often happens in a bull market when equity holdings are appreciating.

Non-destructive ROC is also common when dealing with master limited partnerships (MLPs). Many MLPs are in the energy sector and manage oil and gas pipelines. The tax laws allow MLPs to depreciate these pipelines and this “artificially reduces taxable income. So for MLPs, the cash available to distribute is usually much larger than taxable income. Because of this, CEFs that own MLPs almost always have large amounts of “good” ROC.

So to summarize, ROC is considered “good” or constructive if the ROC comes from pass-through events like MLPs or from unrealized capital gains. ROC is bad or destructive when investors literally receive back their own capital as part of the distribution. Sometimes it is difficult to determine if ROC is good or bad. The best way is to use total return instead of the distribution rate to evaluate CEFs.

CEF Portfolio

The portfolio reviewed last July consisted of the following CEFs:

- Dow 30 Enhanced Premium & Income (DPO). This CEF sells at a 5.8% discount, which is close to its average discount over the past year. The fund consists of the 30 stocks within the Dow Jones Industrial Average. In order to enhance income, the fund sells covered calls and other options (on roughly 50% of the holdings). The distribution is 6.8% with a substantial non-destructive ROC. The fund utilizes 23% leverage to increase returns and has an expense ratio of 1%. Since July, the price of DPO has had some ups and downs but it has now appreciated to a new high for the year.

- Gabelli Equity Trust (GAB): This CEF sells at a small 0.3% discount which is unusual since over the past year, the fund has sold at an average premium of 2.1%. This fund utilizes a strict value methodology and has been managed by the founder, Mario Gabelli, since its inception in 1986. Mr. Gabelli also owns, directly or indirectly, about 1.6 million shares of the fund. The fund holds 384 holdings, with about 81% invested in US firms and 14% invested in Europe. It uses 22% leverage and has an expense ratio of 1.5%. The distribution rate is 7.8%, which has a large ROC component. The ROC is not surprising or destructive since most of the ROC comes from unrealized capital gains. Since July GAB has trended higher and is now at a new high for the year.

- Clough Global Equity (GLQ): This CEF sells at a 13.7% discount, which is slightly lower than its average discount of 12.6%. The managers of this fund have a flexible mandate and can invest worldwide in equities, corporate bonds, and sovereign debt. It can also use an option strategy to increase income. Currently, 80% the portfolio is invested in U.S companies. It has a total of 227 holdings invested primarily in the consumer, financial, technology, and healthcare sectors. The fund employs 33% leverage and has a relatively high expense ratio of 3.2%. The distribution rate is 7.8% with no ROC. The price of GLQ is about the same as it was in July.

- H&Q Healthcare Investor (HQH): This price of this CEF has oscillated between a small premium and a small discount. Over the past year, the average discount has been 2% but the fund is currently selling at a 1.4% premium. It has 90 holdings focused on healthcare, including biotechnology, medical devices, and pharmaceuticals. It does not use leverage but many of holdings are smaller, emerging companies. It has an expense ratio of 1.4%. The distribution rate is 7.7% with no ROC (the recent distribution has been funded via short term gains). The price of HQH is now at a new high for the year.

- Nuveen Core Equity Alpha (JCE): This CEF sells at a discount of 8.3%, which is lower than the average discount of 6.7%. It has 322 holdings selected from the S&P 500 by using a proprietary mathematical algorithm. The formula attempts to add alpha by generating returns better than the S&P 500. It does not employ leverage and has a 1% expense ratio. It has a distribution of 6.5%, consisting primarily of non-destructive ROC. The price of JCE has continued to increase since I reported on it in July.

- Kayne Anderson MLP (KYN): This fund sells at a 9% premium, which is slightly higher than its average 8.5% premium. I typically do not like to pay high premiums for CEFs but funds that invest in Master Limited Partnerships (MLP) are exceptions. Because of the tax treatment of depreciation, NAV is often understated and most MLP funds sell at a premium. This fund has 67 holdings, all of which are Master Limited Partnerships. It employs a relatively high 33% leverage and has a very high 4.4% expense ratio (including interest payments). The distribution rate is 6.2%, which is paid from income and non-destructive ROC. The price of KYN has been relatively stable over the last few months and it is currently about the same level as it was in July.

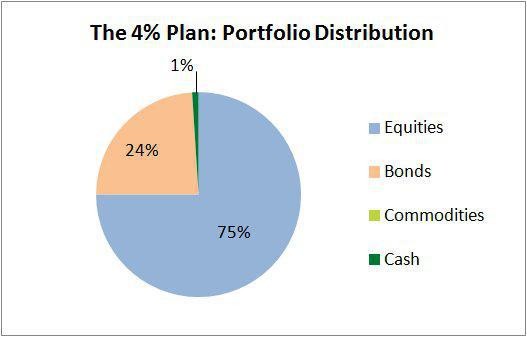

- LMP Capital & Income (SCD): This CEF sells at a 10% discount, which is lower than the average discount of 6.3%. It has 96 holdings, spread among general equity, MLPs, convertible bonds and general bonds. Typically the fund has a 75% to 25% split between equity and fixed income. It employs 20% leverage and has a 1.5% expense ratio. The distribution rate is 7.1%, which is paid from income and non-destructive ROC. The price of SCD is higher than it was in July but it has not made a new high for the year.

Risk Vs Reward Over Bear Bull Cycle

Assuming equal weight, these CEFs average over 7% annual distributions so they definitely satisfy the criteria for high income. To assess the risk-adjusted return, I used the Smartfolio 3 program (www.smartfolio.com ). Figure 1 provides the rate of return (called Excess Mu on the charts) in excess of the risk free rate. This rate of return is plotted against the historical volatility over a complete market cycle from 12 October 2007 to the present. For reference, I have also plotted the risk-adjusted return associated with the SPDR S&P 500 ETF (SPY).

Figure 1. Risk vs. Reward since 12 October 2007 (click to expand)

As is evident from the figure, the CEFs in the portfolio were more volatile than the S&P 500 but also provided greater returns. For example, KYN had a high rate of return but also had a high volatility. Was the increased return worth the increased volatility? To answer this question, I calculated the Sharpe Ratio.

Sharpe Ratio

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with SPY. If an asset is above the line, it has a higher Sharpe Ratio than SPY. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY.

Over the period of interest, all the selected CEFs had an equal or better risk-adjusted returns than the S&P 500. HQH had the best performance followed by KYN.

Portfolio Performance

I then combined these 7 CEFs into an equally weighted portfolio and assessed how the combined portfolio performed. The risk versus reward of the combined portfolio is shown as a red dot on the figure. As you can see, the combined portfolio had a volatility that was less than most of the constituent volatilities. This is an illustration of an amazing discovery made by an economist named Markowitz in 1950. He found that if you combined certain types of risky assets, you could construct a portfolio that had less risk than the components. His work was so revolutionary that he was awarded the Nobel Prize.

As illustrated by the figure, the portfolio of CEFs beat the S&P in both total return and risk and this performance was achieved over a complete market cycle that included both bear and bull markets. This is similar to the results I found when I analyzed this portfolio last July. The next step was to see if the performance was maintained over the periods where the S&P was enjoying a rip roaring bull market.

Risk Vs Reward Past 3 Years

I reduced the look back period to 3 years and re-ran the analysis. The results are shown in Figure 2. During the past 3 years, the risk-adjusted returns were not uniformly better than SPY. In fact, only HQH beat SPY and GAB turned in a performance equal to the S&P 500. The rest of the CEFs had Sharpe ratios slightly less than SPY. However, overall, the portfolio handily beat the return of the S&P and did so at lower risk. This illustrates the power of combining assets into a diversified portfolio.

Figure 2. Risk versus Reward for selected CEFs over 3 years (click to expand)

Risk Vs Reward Past Year

As a final stress test, I re-ran the analysis over the past 12 months, when the S&P experienced a truly impressive bull run. The results are shown in Figure 3. In this case, none of the CEFs were able to beat the SPY on a risk-adjusted basis but the combined portfolio did manage to perform slightly better than the S&P 500.