How to Invest in WTI

Post on: 14 Июнь, 2015 No Comment

How to Invest in WTI

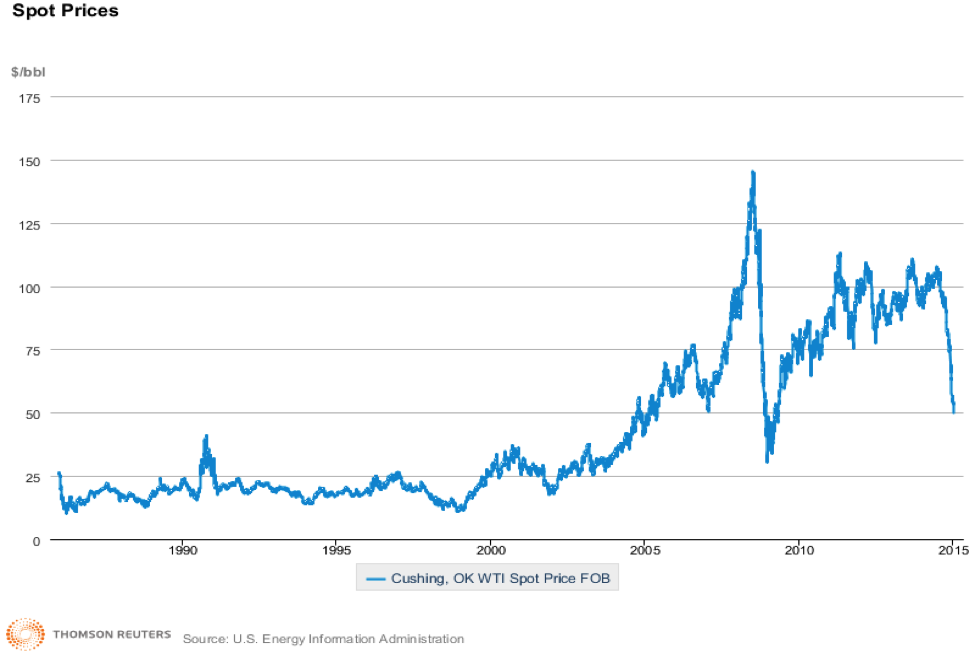

WTI Crude Oil is the benchmark for oil prices in the United States, the worlds top consumer of oil. WTI crude is a sweet crude oil that is more sweet than its European counterpart Brent and a result, generally trades at a premium. Due to this lower sulfur content, WTI is often processed into gasoline on the American east coast and is then piped across the country for consumption.

Crude oil is used in a variety of products that are crucial to everyday modern life. However, crude oil is unprocessed and generally comes right out of the ground/ocean and has minimal uses until it is processed into a finished product such as gasoline.

Investors looking to invest directly in WTI crude have a limited number of options. While there are heavily traded futures contracts available for the product there are currently no pure play stocks or equity ETFs that invest in companies that exclusively produce WTI crude and do not then refine it themselves into finished products. With that being said, smaller U.S. oil firms that arent integrated may offer direct exposure to the price of WTI crude although they are likely to be very volatile when compared to the overall energy industry. There are, however, a number of ETP products that offer exposure to the commoditys futures contracts either in a basket or pure-play form.

Ways to Invest in WTI

There are 3 ways to invest in WTI: ETFs, Futures, and Stocks. Click on the tabs below to learn more about each alternative.

What are WTI ETFs?

There are a number of ETFs offering exposure to light sweet crude oil, also known as West Texas Intermediate ( WTI ). The most popular is the United States Oil Fund ( USO ), which invests primarily in front month contracts. As such, USO will maintain a high sensitivity to spot prices but may be subject to adverse impact of contango over the long term.

Oil ETFs are primarily distinguished by the types of futures contracts held. The United States 12 Month Oil Fund ( USL ) spreads exposure evenly across 12 separate futures contracts, minimizing the impact of the roll yield on returns. Teucrium’s Crude Oil Fund ( CRUD ) spreads exposure across three unique maturities, a strategy that was designed to more closely replicate movements in spot prices. PowerShares offers an oil ETF ( DBO ) that may change its roll process depending on current market situations; the methodology is designed to minimize the impact of contango and maximize and positive effects of backwardation.

There are also several ETFs that focus on equities of companies engaged in the production of crude oil. The most popular choice, the Energy SPDR ( XLE ) includes exposure to mega cap companies such as Exxon Mobil and Chevron. The iShares S&P Global Energy Sector Fund ( IXC ) delivers more global exposure, investing in international companies as well as domestic energy producers. Another interesting option is the Global X Oil Equities ETF ; that fund offers exposure to companies whose stock prices have exhibited a strong correlation with spot oil historically.

What are WTI Futures?

WTI futures are the world’s most actively traded energy product. WTI futures and options trade on the NYMEX. and contracts for several months often exhibit significant liquidity. Futures contracts, traded under the symbol CL, represent 1,000 barrels of oil for delivery at any pipeline or storage facility in Cushing, Oklahoma with pipeline access to TEPPCO. Cushing storage or Equilon Pipeline Company LLC Cushing storage. WTI underlying futures contracts must meet certain minimum grade and quality standards.

WTI contracts are listed nine years forward using the following listing schedule: consecutive months are listed for the current year and the next five years; in addition, the June and December contract months are listed beyond the sixth year. Additional months will be added on an annual basis after the December contract expires, so that an additional June and December contract would be added nine years forward, and the consecutive months in the sixth calendar year will be filled in.

How to Buy WTI Stocks

For investors seeking exposure to crude oil but looking to avoid investing in futures contracts, the stocks of oil producing companies may present an interesting opportunity to establish indirect exposure. Because the profitability of oil companies tends to move along with changes in the spot price of oil, these securities often serve as effective trades on the related commodity.

There are dozens of options for investing in oil producing companies. Many of the oil giants are household names, including ExxonMobil ( XOM ), Chevron ( CVX ), and ConocoPhillips ( COP ). There are also international equity options, such as BR, Total, and PetroChina. For more complete lists of oil stocks that can offer exposure to WTI. consider taking a look at the holdings of any of the following ETFs: