How to invest in water stocks

Post on: 16 Март, 2015 No Comment

Finance and Stock Trading News

How to invest in water stocks

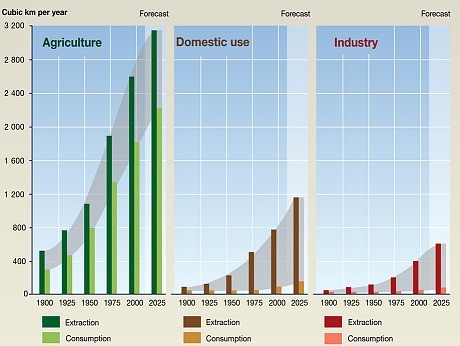

Often overlooked as a commodity, water supplies could become increasingly critical as emerging economies around the world improve their diets and demand more agricultural resources for the production of meat.

For many years (water) has been treated as a free good and supplies have been taken for granted, Hugo Rogers, manager of the Thames River Water & Agriculture fund in London, tells The Telegraph. As a result, aquifers are falling and reservoirs are running dry.

The implications could be felt around the world. Indeed, two of the largest aquifers in the U.S. are already at risk. The Ogallala, which runs from Wyoming to Texas and does not replenish, is expected to be depleted in the next 25 years, The Telegraph reports. Lake Mead also among the largest aquifers in the country has fallen more than 100 feet in the past seven years alone.

Even as water supplies dwindle, demand is gradually increasing around the world with some analysts calling for global water usage to be 40 percent greater in 2050 than it was in 2000. Depleted aquifers and an aging and inefficient water infrastructure present opportunities for water investors particularly in the water conservation and purification sectors. Heres a handful of water stocks to research further if you expect prices to climb in the coming years:

Water ETFs

PowerShares Global Water Portfolio ETF (NYSE:PIO) PIO mirrors the the Palisades Global Water Index and features a good mix of value and growth stocks. Weightings follow: Large-Cap Value (26.09%), Mid-Cap Growth (28.74%), Mid-Cap Value (11.31%), Small-Cap Growth (26.49%), and Small-Cap Value (7.38%). As of March 7, the funds largest holding was agricultural irrigation and fabricated metals manufacturer Valmont Industries, Inc. (NYSE:VMI). Think of PIO as PowerShares Water Resources ETF (PHO) with slightly more international exposure. 12-month return: +12.2 percent

PowerShares Water Resources ETF (NYSE:PHO) Like PIO, PHO also mirrors the Palisades Water Index. PHO, which is older and more established, has significantly out-performed PIO since PIOs inception in the summer of 2007. It also trades at roughly twice the volume of PIO. PHO seeks to identify a group of companies that focus on potable water, water treatment, and water consumption-related technology and services, and its slightly more focused on U.S.-based water companies than PIO. 12-month return: +14 percent

First Trust ISE Water Index Fund ETF (NYSE:FIW) FIW mirrors the ISE Water Index, which is comprised of 36 stocks focused on potable and wastewater industries. FIW is the most thinly-traded of all the major water ETFs. Currently, its heavily weighted toward industrial water stocks (which comprise 59 percent of the funds holdings). 12-month return: +17 percent

Individual water stocks and tickers

AECOM Technology Corporation (NYSE:ACM) A commercial and government consultant for water-related projects including the planning and develpment of highways, airports, bridges, mass transit systems and more. 12-month return: -1.6 percent

Aqua America, Inc. (NYSE:WTR) A holding company for water utilities that provide water or wastewater services for three million people in 14 Southern and East Coast states. 12-month return: +35 percent

Ashland Inc. (NYSE:ASH) A global chemical company with more than 100 years in the industry, Ashland serves a number of chemical-related markets from oil to papermaking chemicals. 12-month return: +11.2 percent

Companhia de Saneamento Basico ADR (NYSE:SBS) Majority-owned by the State of Sao Paulo in Brazil, SBS offers water and sewage services in 365 of the 645 municipalities in Sao Paulo. 12-month return: +46.7 percent

Danaher Corporation (NYSE:DHR) A sprawling company with dozens of divisions, Danahers environmental segment provides water-related services including ultraviolet disinfection systems and industrial water treatment solutions. 12-month return: +34.4 percent

Flow International Corporation (NASDAQ:FLOW) Harnessing ultrahigh-pressure (UHP) waterjet technology, Flows equipment can be used for manufacturing and industrial cleaning. 12-month return: +37.2 percent

Flowserve Corporation (NYSE:FLS) As a provider of flow control systems, FLS manufacturers pumps, valves, seals, automation and aftermarket services to improve delivery and conservation of everything from water to oil and gas. 12-month return: +17 percent

Itron, Inc. (NASDAQ:ITRI) Itron helps water utilities collect data and improve metering of water usage. The company also services the electric and gas utilities. 12-month return: -23 percent

ITT Corporation (NYSE:ITT) ITTs three core businesses will soon be spunoff into three independent publicly traded companies, one of which will serve as a water technology company focused on industrial water pumps, water analytical instruments, irrigation systems, wastewater treatment and more. 12-month return: +7.2 percent

Lindsay Corporation (NYSE:LNN) By marrying advanced electronics with irrigation, Lindsay Corporation promises to conserve water, energy and labor for the agricultural industry. 12-month return: +78.1 percent

Nalco Holding Company (NYSE:NLC) A holding company focused on industrial water, energy and air applications, Nalcos water treatment services are used by a wide range of clients, from petrochemical companies to paper manufacturers. 12-month return: +9.7 percent

Pentair, Inc. (NYSE:PNR) Pentair offers a wide range of water services from drinking water, fire protection and pool and spa solutions for the hospitality industry to manufacturing spray nozzles, tanks, crop and drip irrigation systems for the agricultural industry. 12-month return: +9 percent

Roper Industries, Inc. (NYSE:ROP) Roper designs and manufacturers water meter and automatic meter reading (AMR) products and systems for water utilities as well as pumps for irrigation, agriculture and wastewater applications. 12-month return: +51.2 percent

Tetra Tech, Inc. (NASDAQ:TTEK) Tetra Tech helps clients optimize businesses for energy performance and water usage. The company also designes and executes renewable energy plans for industrial and governmental organizations. 12-month return: +11.6 percent

URS Corporation (NYSE:URS) URS works with governments and organizations to develop water, wastewater and hydropower projects. 12-month return: -6.7 percent

Valmont Industries, Inc. (NYSE:VMI) Valley Irrigation, a division within Valmont, has been building precision irrigation equipment for more than 55 years. 12-month return: +22.3 percent

Veolia Environnement (NYSE:VE) A French environmental services company, Veolias water services segment specializes in the outsourced management of water and wastewater services. 12-month return: -4.1 percent

Watts Water Technologies, Inc. (NYSE:WTS) Watts water quality, water conservation, water safety and water flow control products serve residential and commercial markets from Europe to China. 12-month return: +28.6 percent