How To Invest In The Nikkei 225 Yahoo Maktoob News

Post on: 5 Июнь, 2015 No Comment

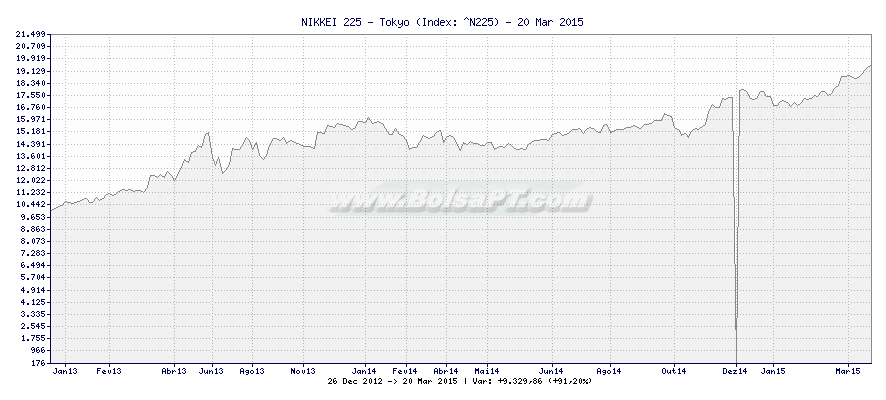

The Nikkei 225 Stock Average is Japan’s premier stock index and a barometer of the Japanese economy and stock market. In fact it is considered Japan’s equivalent to the Dow Jones Industrial Average. It includes the top 225 blue-chip companies listed on the Tokyo Stock Exchange.

You cannot invest directly in an index. But if you are looking to gain exposure to the stocks the Nikkei 225 includes the best way is via an exchange-traded fund (ETF) that tracks the yen-denominated index. (For more, see: A Guide to Japan’s Nikkei 225 Index .)

Some Background

Like the Dow Jones Industrial Average, the Nikkei 225 Stock Average is a price-weighted equity index. Ranking of companies is determined by stock price, which differs from other major indexes where market capitalization is used in calculations. Calculated since September of 1950 (retroactively to May of 1949), it is Asia’s oldest index and also commonly referred to as the Nikkei 225, Nikkei Index and the Nikkei.

The index is reviewed annually in September and if changes are made they are instituted in October.

Some of the most well-known brands in the world are companies included in the Nikkei 225. Canon Inc. (CAJ ), Panasonic Corp. (PCRFY ), Pioneer Corp. Sony Corp. (SNE ), Nissan Motor Co. (NSANY ), Toyota Motor Corp. (TM ), Mazda Motor Corp. (MZDAY ) and Honda Motor Co. (HMC ) are among them.

Stocks in the index fall under the following sectors: technology, financials, consumer goods, materials, capital goods/others and transportation and utilities. In all, the index includes 36 different industries. Companies in the technology sector accounted for 43.28% of the index, financials (3.77%), consumer goods (21.52%), materials (15.46%), capital goods/others (12.8%) and transportation and utilities (3.17%) at the end of 2013.

Buying and managing each individual stock in the Nikkei 225 is not practical, not to mention the cost and tax implications. As an individual investor, you can gain exposure through exchanged-traded funds whose underlying assets correlate to the Nikkei 225. ETFs are essentially a basket of stocks that represent an underlying index. (For more, see: Japan ETFs .)

Unlike mutual funds, which are priced at the end of the day, ETFs trade throughout the day. Their prices fluctuate like a stock’s, essentially trading like a stock. Like mutual funds, ETFs offer diversification through one investment. They have lower expenses than actively managed funds.

Dollar Denominated ETF

The least complicated and most direct way to invest in the Nikkei 225 is via the MAXIS Nikkei 225 Index ETF (NKY ). Introduced in July 2011, it’s the only U.S.-listed, dollar denominated ETF so far that tracks the Nikkei 225. It has more than $87 million in assets under management, trades on the New York Stock Exchange’s electronic trading platform Arca and an expense ratio of 50 basis points.

The MAXIS Nikkei 225’s price has ranged between 16.25 -18.53 in the last year as of Oct. 15, 2014.

Japanese ETFs

Several ETFs tracking the Nikkei 225 trade on the Tokyo Stock Exchange. They include Blackrock Japan’s iShares Nikkei 225 ETF, Nomura Asset Management’s Nikkei 225 Exchange Traded Fund (NTETF ) and Daiwa Asset Management’s Daiwa ETF Nikkei 225. (For more, see: 5 ETFs to Cash in on Japan’s Rise .)

In order to trade these ETFs you’d need to open an account with a brokerage that enables you to buy and sell investments not listed on a U.S. exchange. Fidelity Investments and E*Trade Financial Corp. (ETFC ) are among the discount brokers that offer international trading accounts. (For related reading, see: How to Invest in Samsung .)

Keep in mind that trading ETFs in their local markets has its complications. Tokyo Stock Exchange-listed ETFs are denominated in yen. In addition to monitoring the performance of the Nikkei 225 you will also have to consider exchange rate fluctuations between the yen and dollar. (For more, see: The Benefits of ETF Investing .)

The United Kingdom, France, Germany, Switzerland, Italy and Singapore also offer ETFs that track the Nikkei 225, some of which are cross-listed on the Tokyo Stock Exchange.

The Bottom Line

If you’re looking to gain broad exposure to the Japanese stock market through investments whose underlying assets track the Nikkei 225, ETFs are the way to go, in particular the U.S.-listed, dollar-denominated MAXIS Nikkei 225 Index ETF. (For more, see: Spanning the Globe in Search of Intriguing ETFs .)

More From Investopedia