How to Invest in ETFs Using a Simple Rotation Strategy

Post on: 10 Май, 2015 No Comment

My focus for the past year has been backtesting ETF rotation strategies. At this point, Ive published the backtesting on Amazon, recorded training videos, created a portfolio rotation simulator. and established a live account for forward testing. In this article, I want to give you a summary of how to invest in Exchange Traded Funds (ETFs) using a rotation strategy.

Individual investors, particularly with a self-directed IRA, can take advantage of rotation strategies without putting in 10,000 hours to become a professional trader. Professional money-managers can apply these principals too if theyve let go of the assumption that they need to spent a 40-hour work week on the market.

How to Invest

The key to investment success is: Buy Low and Sell High. Easier said than done, of course. What trips many investors up is the notion that they need to buy at the extreme low and sell at the extreme high. Not so. It is really only necessary to buy lower than one sells most of the time, and control losses the rest of the time, to come out with a profit.

Therefore the most important thing is to identify a good investment as it is moving up, because it is the upward movement that produces the profits. Relative strength is one proven metric for finding investments moving up. A simple way to quantify relative strength is Rate of Change (RoC) which is just the percentage gain over a certain time period.

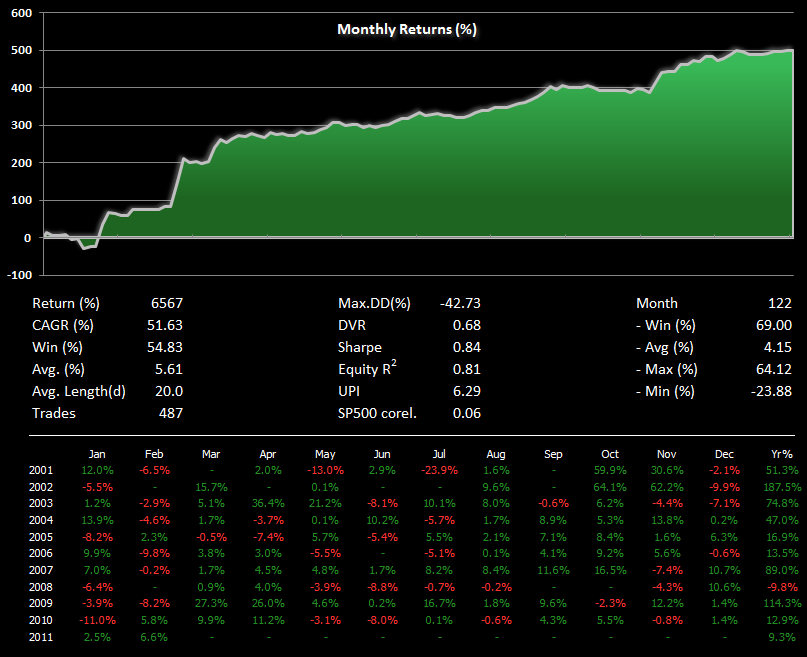

Investors should expect difficulty so it is considered wise to diversify their holdings. Being ready to switch to better prospects also increases an investors chance of coming up with profits, as demonstrated by the backtesting results for ETF rotation compared to buy-and-hold of a diversified portfolio.

What is an ETF

An Exchange Traded Fund or ETF is similar to a mutual fund in that the ETF holds a variety of stocks and the ETFs value changes as the underlying stock prices fluctuate. ETFs may invest in stocks, bonds, commodities and futures. Most ETFs go up when their holdings go up. Some ETFs, called inverse funds, are designed to increase in price when their underlying index goes down. This gives investors a straightforward means to hedge their bets and short the market.

ETFs tend to be passive investment vehicles like index funds. An index fund is an ETF or mutual fund that tracks an index, such as the S&P 500, by investing in the component stocks in the index. It turns out that this approach of following an index often comes out ahead of active management strategies that attempt to pick winning stocks.

ETFs also exist that invest in international stock indices, which is great because us individual investors have little hope of becoming global stock-picking experts.

A Simple ETF Rotation Strategy

The steps to creating a simple ETF rotation strategy come in two parts: the background work to set it up and the on-going execution of the strategy.

For set-up, one needs to decide:

- Type of account: Tax-Deferred (preferred) or Taxable.

- Broker.

- Pool of investment candidates, in this case a selection of ETFs that track various global and domestic stock and bond indices.

- Selection criteria, such as high percentage gain or RoC.

- How far back to measure the RoC to catch the trend of rising ETFs. Make it too short and the system will lose money by thrashing among funds that happened to have a good day. Make it too long and you will only rotate in after most of the profits are gone.

- Number of funds to hold at any one given time.

- How often to rotate, as in daily, weekly, monthly, annually.

- Under what conditions to stand aside.

- How often to rebalance.

For the on-going operation of an ETF Rotation strategy, the steps are:

- Wait for the rotation day and do nothing in between. This is important!

- On rotation day:

- Check the RoC (percentage gain) of all the ETFs and single out the top performers with the best percentage gain.

- If you already own the top funds, do nothing,

- If one of your investments has fallen from the top, sell it and buy into highest performer that you dont already own.

- Repeat.

More information

More information, parameter settings, and backtesting results are in my book: Truth About ETF Rotation: Fund Your Retirement By Investing In Top Exchange Traded Funds in One Hour Per Week (Volume 1) .