How to Invest and Hedge During Inflation

Post on: 22 Июль, 2015 No Comment

How to Invest in Inflationary Economic Environment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Inflation is said to be one of an investor’s worst enemies. However, it can also be said that a lack of understanding of inflation can be detrimental to an investor’s investment portfolio. Learn how to invest and hedge against inflationary economic environments.

Definition and Example of Inflation

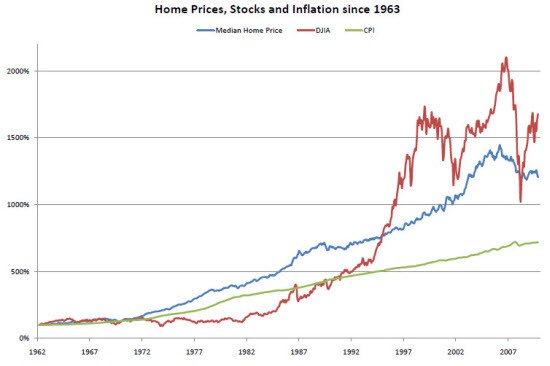

Inflation is an economic term that refers to an environment of generally rising prices of goods and services within a particular economy. As general prices rise, the purchasing power of the consumer decreases. The measure of inflation over time is referred to as the inflation rate. In common terminology, many people may refer to inflation as the cost of living.

For example, prices for many consumer goods are double that of 20 years ago. When you hear your grandparents recall, A movie and a bag of popcorn only cost $1.00 when I was your age, they are making an observation about inflation—the cost of goods and services—over time.

Investing to Outpace the Average Rate of Inflation

Without really knowing it, most people invest their savings in investment vehicles, such as mutual funds, because they want to beat inflation. If you save your money by burying it in jars in your back yard or by stuffing it under your bed mattress, you will lose to inflation because the cost of living grows while the value of your money does not (even though you may have planted it in the ground)! In fact, you may still lose to inflation even if you save your money in a bank account or Certificate of Deposit (CD).

For example, the average historical rate of inflation is roughly 3.40%. Let’s say you are feeling financially responsible and put your hard-earned cash into a CD, earning 2.00%, at the local bank. Doing some quick math, you can calculate the difference (3.40 — 2.00 = 1.40) and see that you are still losing to inflation by 1.40%. This doesn’t even factor in the effect of taxes on your savings, which would reduce your real rate of interest (after inflation and taxes) to roughly 0.10%, assuming a top federal tax rate of 25%. Therefore, in a low interest rate environment, you could save money in a CD but still value because of inflation and taxes — you are doing what I call losing money safely.

The best way for most people to beat inflation —to achieve returns averaging more than 3.40% — is to invest in some combination of stock and bond mutual funds. The question now is, What funds are best in various inflation environments?

Inflation Investment and Hedge Strategies

What most people think when they think of inflation (a gradual increase in the cost of living) is not entirely a bad thing from the perspective of the investor. Inflation can be good. Economists have referred to a healthy balance of inflation and economic growth as a Goldilocks Economy because it is balance that is just right for investment and consumer activity. This ideal balance is where the inflation rate is average to below average, say 3% or less, and economic growth is 3% or more. It is an environment where stock prices can climb and bond prices are steady because no outside stimulus (monetary or fiscal policy ) is required.

Generally, stocks are preferred to bonds in inflationary environments because bond prices fall as interest rates rise. When inflation gets above Goldilocks level (2% to 3%), the value of the US dollar may fall. Therefore. foreign stock funds can act as an automatic hedge as money invested in foreign currencies is translated into more dollars at home.

Tip and Caution

Trying to navigate market and economic conditions with investment strategies is a form of market timing that carries significant risk of losing value in an investment account. For most investors, building a diversified portfolio of mutual funds is the best strategy for all market and economic environments.

Disclaimer:

The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.