How to Increase Dividend Payments Through ETF Investing

Post on: 1 Апрель, 2015 No Comment

John Nyaradi September 2, 2014 Comments Off

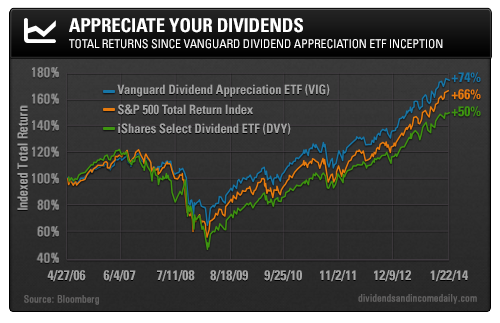

Investing for dividend growth is a favorite strategy of many individual investors and professional money managers, and ETFs can be a great vehicle if you’re seeking dividends.

Many investors are not aware of the fact that there are ETFs available, which actually pay dividends since it’s frequently assumed that dividends paid for the stocks held by ETFs are simply used by the fund managers to buy new shares, enhancing the value of the fund.

As is the case for stocks that pay dividends, the universe of dividend-paying ETFs offers the investor a wide variety of performers. A number of ETFs are available that follow the stocks known as “dividend aristocrats,” those issuers that have increased dividends every year for the past 25 years.

The ProShares S&P 500 Aristocrats ETF (NOBL) invests in the S&P 500 Dividend Aristocrats Index. and this index currently has 54 stocks in its membership.

The SPDR S&P Dividend Index ETF (SDY) tracks the S&P High Yield Dividend Aristocrats Index and this is made up of the top 50 highest dividend- yielding components of the S&P Composite 1500 Index over the last 20 years. One advantage SDY has over NOBL is its heavier trading volume (approximately 529,000 shares per day) compared with the average of 41,000 NOBL shares traded each day.

Some investors prefer to select a dividend ETF by including its year-to-date share price increase as a key focus. So far this year, one of the best advancers has been the GlobalX SuperDividend ETF (SDIV), which has seen its share price soar 11.25 percent. This ETF tracks dividend stocks from all over the world and not just U.S. issues.

Investors who seek exposure to emerging markets might be interested in the Wisdom Tree Emerging Markets High-Yielding Equity Fund (DEM).

There is a wide variety of dividend-paying ETFs available to suit any number of preferences. Whether you prefer large cap or small cap, or focus on stocks from a particular country, you can probably find a dividend-paying ETF to accommodate your particular taste. For example, some investors might seek out the Wisdom Tree Japan SmallCap Dividend Fund (DFJ).

Steady dividend growth has been a popular investment objective for years, and Dividend ETFs can offer easy entry into this strategy.

For more about dividends, including dividend ETFs, Closed-end Funds, and anything but plain high-yield dividend stocks be sure to check out Tim Plaehns new service, The Dividend Hunter .