How to identify undervalued stocks or overvalued stocks

Post on: 21 Июнь, 2015 No Comment

As for the criteria/methodology for undervalued stock. the general rule is to discern the intrinsic value of the

Company and compare it to its enterprise value. For enterprise value, it’s the sum of the market value of equity plus

the market value of the debt less surplus cash. You want to buy the stock when it’s current market value is trading

at a deep discount to the intrinsic value. As for intrinsic value, you might need to perform a discount cash flow (DCF)

Analysis, a replacement value analysis (how much money it would take creates the current company today), etc.

As for the things we need to look at to evaluate, you need to understand how the firm makes money, how it generates free cash flow, what it’s return on invested capital is, etc. In order to understand the firm, you need to understand the industry, how the company fits in within the industry, where is the industry and company going in the future, etc.

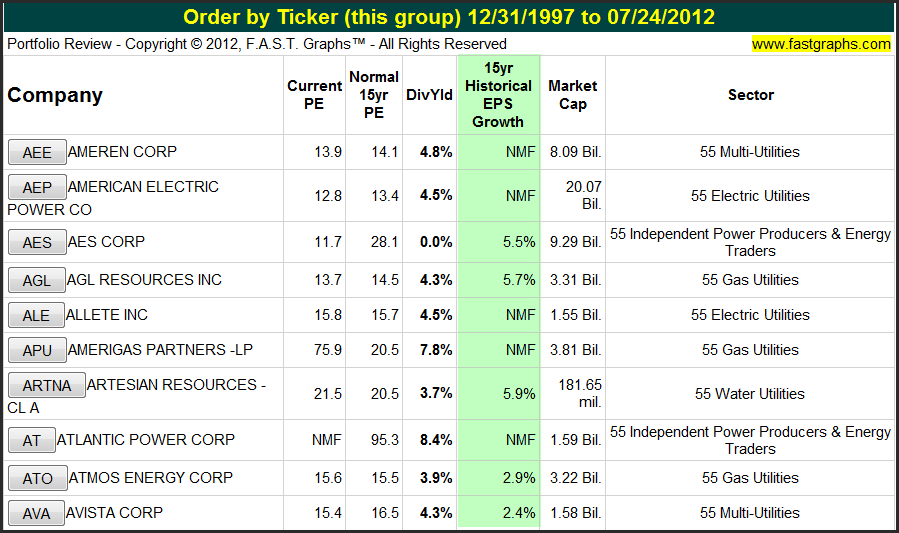

To simplify the task of identifying undervalued stocks. there are several simplified criteria that can be used and are

readily available on the internet. These are PE ratio, PEG ratio, ROE, PS ratio, DE ratio, dividend, and historic data. Generally speaking stocks with lower PE ratios (price divided by earnings ratio) are more likely to be undervalued than those with higher PE ratios. The cut off is somewhere in the range to 12 to 16. That does not mean that a stock with a PE ratio of 20 is necessarily overvalued but it does mean that it might be. Also a stock with a PE ratio of 10 may not be undervalued. That is where the PEG ratio comes into play. This is the PE ratio divided by the expected growth rate. A PEG ratio of less than 1.00 is considered likely undervalued. A PEG ratio of more than 2.00 is most like overvalued. The problem with the PEG ratio is ascertaining the projected growth rate. You can find published PEG ratios on the internet for many companies, but unfortunately the projected growth rates upon which they are figured are normally concocted by overly optimistic security analysts, so taking them with a pound of salt is called for. DE ratio (debt to equity ratio) is also a helpful indicator.

The higher this ratio the more leveraged the company is and the higher the interest payments are. A high DE ratio many

times is correlated with a low PE ratio because the quality of the earnings is less and the ability of the company to

weather a downturn is less. The airlines were good examples of this. They were all highly leveraged and they all went

bankrupt as a result when they could not meet their interest payments.

ROE (return on equity) is an indicator of how profitable the company is. More profitable companies are generally valued more highly than less profitable companies. Historical comparisons can also be a significant indicator of the value of a company. All other things being equal if the company in the past sold at a PE ratio of 17 and it is now selling at a PE ratio of 13, it might be undervalued. It also might be the result of lower future expectations for the company such as we are seeing in the market today.

Please keep in mind that stocks can remain undervalued and overvalued for long periods of time, so invest wisely.

Check out related topics at our Article Directory

TO Know About our Packages Click here