How to Hedge Your Investment Portfolio (4 Steps)

Post on: 15 Апрель, 2015 No Comment

Things You’ll Need

Instructions

Buy put options. Put options gives you the right to sell at the agreed upon price at a later date. So if the market falls, you can sell your options or stock for a profit and offset your loss. Simply put, this is your insurance against loss. The rationale is very simple. You wouldn’t risk not taking car or home insurance policy, why should your investment be any different?

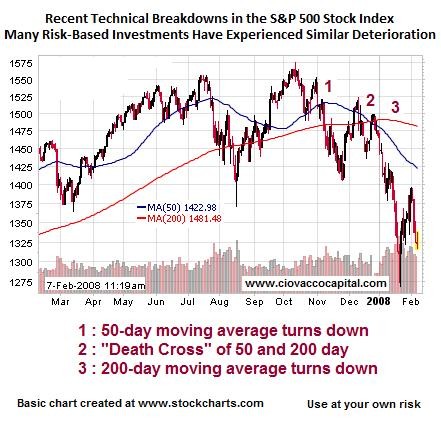

Put option can be against the individual stock that you own or against an index which your portfolio models after or a major index, such as S&P 500, for general down side protection.

So depending on the worth of your portfolio and the premium you are willing to pay for put options, you should calculate the number of put contracts you need to buy. Note that each put contract gives you the right to sell 100 underlying security, so your total cost is (option premium * 100) + commission.

Shorting stocks. This is opposite to buying stocks. The idea is that you would be borrowing the stock and selling the right to acquire it at a future date for today’s price. You are betting that the stock would fall such that you can buy at a cheaper rate in the future and repay your obligation while pocketing the proceeds from short sale. In a bear market, this is a great way to hedge your loss or make money. That said, keep in mind that speculation is dangerous.

To illustrate, suppose you believe that SPY is over-valued at $90 and expect it to take a beating in the near future. To sell short, you would borrow 100 SPY and sell a contract to buy at $90/share, say 3 months into the future. If the contract sells for $5, your proceeds would be $500 (ignoring commissions). So if SPY falls below $85, you stand to pocket $500. If SPY rises above $95, you stand to lose on your bet.