How to get higher interest rates on your savings

Post on: 3 Июнь, 2015 No Comment

You see a bank ad trumpeting a 3% interest rate and think, Hallelujah! Finally, a certificate of deposit that will earn a decent return! On closer inspection, though, you discover that the rate is for a home equity line of credit.

By Jay Directo, AFP/Getty Images

Generating income in a low-interest environment can be difficult.

There’s a reason most banks don’t promote their CD rates: They’re horrible. The average rate for a one-year CD last week was 0.44%, according to Bankrate.com. Most big banks are paying less than 1% on their savings accounts.

The low-interest environment is leading retirees and other income-dependent investors to try all sorts of maneuvers to eke out extra interest income. Here’s a look at some of the alternatives, along with the drawbacks:

MORE: Compare CD rates; get more information

COLUMN: How to avoid rising bank fees

COLUMN: Prepaid cards are getting cheaper, but still flawed

Long-term CDs

The average rate for a five-year certificate of deposit is 1.64%, according to Bankrate.com. and some banks are paying up to 2.36%. That’s an improvement over the decrepit rates for short-term CDs, but there’s a good chance rates will rise before the CD matures.

Some seniors are buying long-term CDs anyway, figuring that they can cash them out early, pay the early withdrawal penalty and still come out ahead. But before you try this strategy, read the terms of your CD contract carefully, says Greg McBride, senior financial analyst for Bankrate.com. In some cases, the bank’s early withdrawal penalties could wipe out all of the interest you’ve earned.

About 13% of banks charge investors one year’s interest if they cash out a five-year CD before maturity, according to Bankrate.com.’s 2010 CD survey. In addition, some CD contracts give banks the right to increase penalties before your CD matures. McBride predicts that more banks will increase their early withdrawal penalties to discourage early cash-outs.

A hefty early withdrawal penalty could vaporize your interest, and some of your principal, too. Suppose, for example, that you buy a five-year CD with a one-year early withdrawal penalty and cash it out after nine months. If the amount of interest you’ve earned doesn’t cover the penalty, the majority of banks will dip into your principal to make up the difference, McBride says.

Bump-up CDs

These long-term CDs allow you to increase your rate before the CD matures if overall rates rise. Last week, for example, Ally Bank introduced a four-year Raise Your Rate CD that allows investors to increase their rate twice during the term if interest rates rise.

In many cases, though, CDs with a bump-up option have a lower initial rate than comparable CDs that don’t offer that feature, McBride says. Because you have some flexibility on the back end, you’re going to trade away some return on the front end, he says.

I Bonds

Investors who purchase an inflation-adjusted Savings Bond, or I Bond, between now and Oct. 31 will earn a combined rate of 4.6% for six months. That’s bound to get a lot of investors’ attention, but this great rate could be ephemeral.

I Bonds consist of two components: a fixed rate that stays the same for the life of the bond, and an inflation rate that’s adjusted every six months. The I Bond issued in May has a 4.6% inflation rate, reflecting the spike in gas prices between September 2010 and March 2011, and a 0% fixed rate.

The headline return is only in effect for six months, he says. What you’re marrying yourself to is a return that will only keep pace with inflation.

Rewards checking accounts

The average interest rate for a rewards checking account is 2.56%, according to a survey released last week by Bankrate.com. That’s down from the 3.3% average a year ago, but considerably higher than the average rate for a five-year CD. And unlike a long-term CD, you can withdraw your money at any time without paying a penalty.

But to earn these rates, you must meet rigorous requirements. Most banks and credit unions that offer these accounts require you to use your debit card at least 10 times a month. Use your debit card just nine times, and your interest rate will plummet.

Another downside: Most of these accounts limit the amount of money eligible for their rewards rates. The caps typically range from $10,000 to $25,000. For example, Atlantic Coast Bank offers a rate of 3.01% for balances up to $15,000; after that, the rate drops to 0.50%.

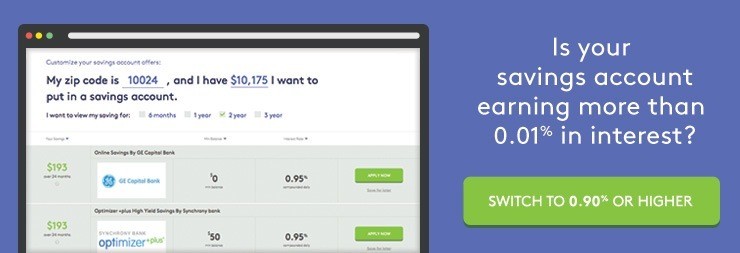

Online savings accounts

Investors who are unable to jump through the hoops required by rewards checking accounts can still boost their interest rate by banking online. Average rates for online savings accounts are five times higher than rates at traditional brick-and-mortar banks, according to MoneyRates.com. On a $10,000 balance, online banks offered an average of 0.87%, vs. 0.15% for a traditional offline savings account, according to the survey.

As long as your deposit is insured by the Federal Deposit Insurance Corp. you won’t take on any additional risk by banking online, says Richard Barrington, personal finance expert for MoneyRates. You can link your online savings account to a checking account at a traditional bank and use the latter for routine transactions, such as ATM withdrawals, he says.

It’s a sad state of affairs when an investment offering a 1% rate is considered a good deal. Investors who depend on income from their investments may want to consider other alternatives, such as short-term bond funds and dividend-paying stocks, says Laura Thurow, co-director of Baird Wealth Private Wealth Management Research. But that means giving up the ironclad guarantee you get with an FDIC-insured CD or savings account.

In this interest-rate environment, Thurow says, You either have to take on a little more volatility or accept a lower return.

Sandra Block covers personal finance for USA TODAY. Her Your Money column appears Tuesdays. E-mail her at: sblock@usatoday.com. Follow on Twitter: www.twitter.com/sandyblock. See an index of Block’s columns.

For more information about reprints & permissions. visit our FAQ’s. To report corrections and clarifications, contact Standards Editor Brent Jones. For publication consideration in the newspaper, send comments to letters@usatoday.com. Include name, phone number, city and state for verification. To view our corrections, go to corrections.usatoday.com .