How To Find The Best Entry Points For Short Selling Stocks

Post on: 23 Июль, 2015 No Comment

Oct 25, 2012

23 Flares LinkedIn 9 Twitter 4 Facebook 5 Google+ 5 23 Flares

Because fear is a more powerful human emotion than greed. stocks nearly always fall much faster and more violently than they rise.

As such, there are key technical differences in our trading strategy between the way we analyze and buy stocks, compared to short selling stocks .

First, it is crucial to realize that trading in the same direction as the dominant broad market trend is the most important element of our swing trading system because approximately 80% of all stocks move in the same direction as the major indices.

This is where our objective, rule-based market timing model really shines, as it prevents us from selling short when the main stock market indexes are still trending higher (or going long when the broad market is in a confirmed downtrend).

Although it may seem counter-intuitive to new traders, we do not sell short stocks as they are breaking down below obvious levels of technical price support, as they tend to rebound and rip higher after just one to two days of weakness.

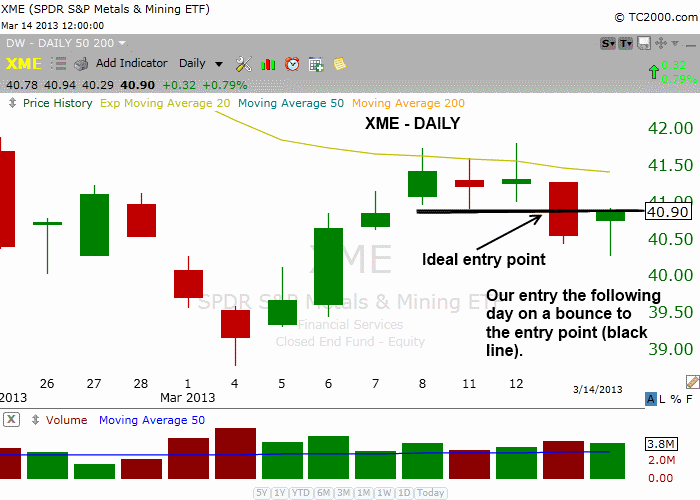

Rather, our most ideal short selling candidates are stocks and ETFs that have recently set new swing lows (or are testing prior lows), and have subsequently bounced into resistance over a period of three to ten days.

Yet, even though we prefer to wait for a bounce before entering a new short position, we also do not enter a new short position while the stock is still bouncing (trying to catch the high of the bounce).

Instead, we first wait for subsequent confirmation that the stock is about to stall again. This typically comes in the form of either a bearish reversal bar (such as a bearish engulfing or hanging man candlestick pattern) or sharp opening gap down, which signals the short-term bounce is losing steam.

Similarly, we always take the same approach on the long side when buying pullbacks of strong stocks; we wait for a pullback to form some sort of reversal pattern before buying (rather than trying to catch the bottom of the pullback).

The daily chart of OReilly Automotive ($ORLY) below is a good example of what frequently happens when attempting to sell short a stock as it breaks down below an obvious level of price support. Again, entering a new short position while a stock is breaking down below the low of a range is not something we are very comfortable doing:

%img src=http://www.morpheustrading.com/

rick/charts/2012/121024ORLY.png /%

A lower risk way of initiating a new short sale, which also provides traders with a more positive reward to risk ratio for short selling, is shown on the following chart of Check Point Software ($CHKP). This is an example of what we look for for when entering a short position (although the declines are not always as dramatic):

%img src=http://www.morpheustrading.com/

rick/charts/2012/121025CHKP.png /%

On October 17, $CHKP gapped down sharply, on huge volume, due to a negative reaction to its quarterly earnings report. This caused the stock to crash through a four-month level of price support at the $44 area (dashed horizontal line).

But over the week that followed, notice that $CHKP climbed its way back up to test new resistance of its breakdown level.

If $CHKP subsequently manages to probe above the intraday high of October 17, it would see some short covering, as most traders would not have expected the price action to climb back to that level.

Further, the 20-day exponential moving average is also just overhead, which lends a little more resistance.

It is at that point ($44.50 to $45 area) that we would look for the first bearish reversal candle OR opening gap down to initiate a very low-risk short selling entry with a positive reward-risk ratio.

By waiting for a significant bounce into new resistance of the breakdown before selling short, we can be right or be right out by keeping a relatively tight protective stop.

Finally, drill it in your head that having the patience to wait for the proper entry points is crucial when short selling stocks. as the short side of the market is less forgiving to ill-timed trade entries than the long side.

If youre looking for a simple and effective way to make sure you are nearly always on the right side of the market, sign up now for your 30-day risk-free subscription to The Wagner Daily newsletter for swing traders.