How To Find PE And PEG Ratios

Post on: 4 Июнь, 2015 No Comment

The p/e ratio is a well-known financial indicator that is commonly used in the stock market. For many years, this has been the standard in evaluating stocks. However, the PEG ratio is another financial indicator that is similar but offers a different insight into stock valuation. Here are the basics of the p/e ratio and how it compares to the PEG ratio.

P/E Ratio

The p/e ratio is calculated by taking the market value per share and dividing it by the earnings per share. A company that has a high ratio is considered one that is poised for growth. This has long been an accepted way to determine whether a stock was valued correctly. This method puts a strong emphasis on the earnings of a company. Since an increase in earnings is what every company strives to achieve, it only makes sense to make this part of the equation. With this method, you are assuming that the earnings tell you much more about the company. For example, if a company is not handling things as they should, their earnings will decrease. However, if a company is doing things correctly, their profit and earnings will rise.

While the p/e ratio is a popular method for valuing stock, it is by no means a perfect solution. This equation has a few inherent flaws associated with it. First of all, this ratio is using past earnings in order to make predictions about the future. When you are looking at past data, it is difficult to ascertain a true rate of growth for the future.

In addition to basing its assumptions on past data, you will also want to keep in mind that many other things besides earnings can influence the price of the stock. Things like human capital are much more difficult to put into a formula. The brand of the particular company also plays a role in growth for the future. Therefore, looking simply at the earnings of the company gives you a very limited snapshot of the company’s potential.

PEG Ratio

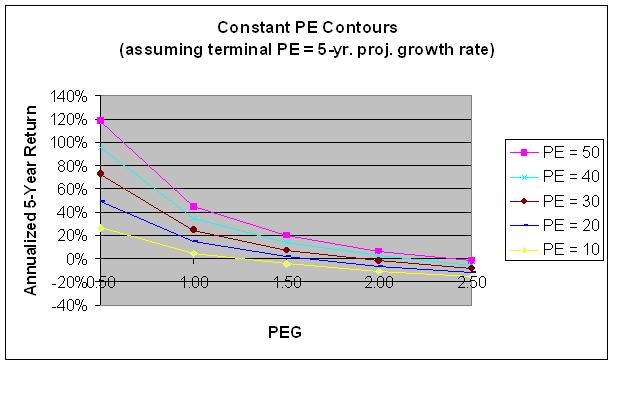

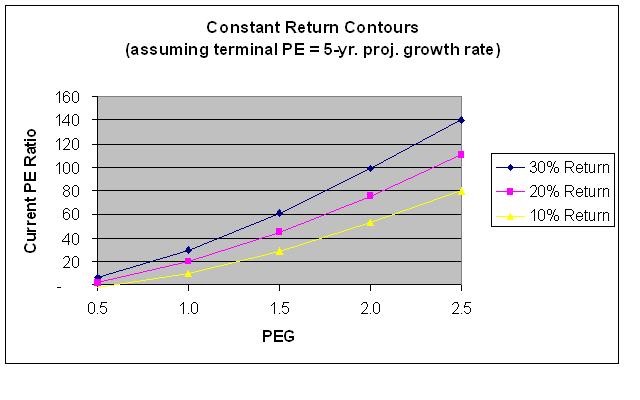

Another similar indicator is known as the PEG ratio. Most people consider this to be a more accurate way to access the potential of a stock. The PEG ratio is calculated by taking the p/e ratio and dividing it by the annual growth of a company. With this method, if a company has a low PEG ratio, you could say that they are undervalued in the market.

The reason that the PEG ratio is considered to be more effective is because it provides you with a forward look into the valuation of a stock. With the p/e ratio, you are basically looking backwards in order to determine if a stock is undervalued. However, with the PEG ratio, you are basing your assertions on what the company is currently doing and what it is poised to do in the future. Therefore, instead of relying completely on the p/e ratio, you should consider implementing the PEG ratio into your stock valuation methods.

$7 Online Trading. Fast executions. Only at Scottrade