How To Find Great Stocks Use The IBD 50 CMG UA SHW

Post on: 1 Июнь, 2015 No Comment

D o you know how to harness the power of the IBD 50? If you have been reading Investor’s Business Daily for a while, you know how important it is to find an edge in the battle for superior investment returns. The IBD 50 supplies that edge.

Consider these stock plays that the computer-generated proprietary list of premier growth stocks presented at key junctures of the U.S. market.

• Chipotle Mexican Grill (NYSE:CMG ). The burrito and taco restaurant chain was ranked No. 17 in the Aug. 30, 2010, edition of the IBD 100 (the list became the IBD 50 on Jan. 3, 2011). Two days later, on Sept. 1, the market turned higher on a powerful follow-through by the Nasdaq composite and the S&P 500. (Both rallied 3%.)

That day, Chipotle throttled out of a perfect cup-with-handle base with a 154.53 buy point. A little more than a year later, the stock had risen 124% to a high of 346.78. Today the stock is near 665, up about 330%.

• Under Armour (NYSE:UA ). The athletic apparel maker ranked No. 37 in the Sept. 7, 2010, IBD 100. By week’s end, the Baltimore-based company leapt out of a five-week, flat-base structure at 40.10. By April 2011, Under Armour catapulted 100% before beginning a new, significant correction.

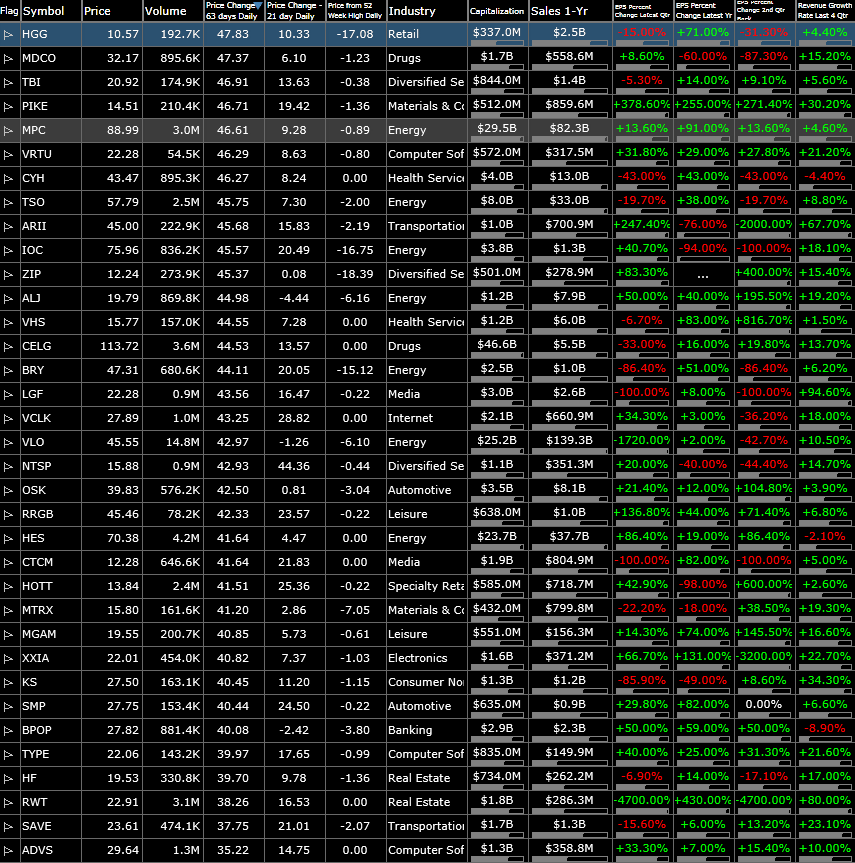

• Qihoo 360 (NYSE:QIHU ), Sherwin-Williams (NYSE:SHW ), Celgene (NASDAQ:CELG ). The three stocks ranked No. 10, No. 28 and No. 46, respectively, in the Nov. 19, 2012, IBD 50. A few days later, the market followed through again. All three stocks bolted to big gains.

The IBD 50 is in effect a leading benchmark of the most dynamic growth companies within the economy. here in the U.S. and abroad.

The above chart shows how top growth companies outperform the general market indexes by more than a country mile.

Why does the IBD 50 do so well?

The typical IBD 50 firm has outstanding profit growth, big sales increases, wide profit margins and high return on equity. IBD has one of the world’s most robust databases for searching growth stocks.

These firms tend to see heavy accumulation by institutional money managers. The savvy ones excel by finding the fastest-growing companies in their respective industries, then buy their shares over months, even years, at a time. They provide the rocket fuel for major stock advances.

The list does not hold a bias toward any industry. Nor does the index heavily favor any group of stocks for subjective or emotional reasons. Rather, the IBD 50 is a cold, hard look at what’s truly leading the stock market.

The index conducts a dispassionate process of holding true leaders and weeding out the laggards. When a stock shows sudden price weakness and volume rushes higher, or its fundamentals wither, it simply gets kicked out. A promising new leader replaces the former big winner.

The IBD 50’s ability to refresh itself with emerging market leaders also gives the reader an edge.

IBD readers see the IBD 50 updated in the Monday and Wednesday editions of the newspaper and eIBD. But IBD Leaderboard subscribers can see the list updated daily after the market’s close.