How to do your homework on ETFs

Post on: 16 Март, 2015 No Comment

Get social

Article utilities

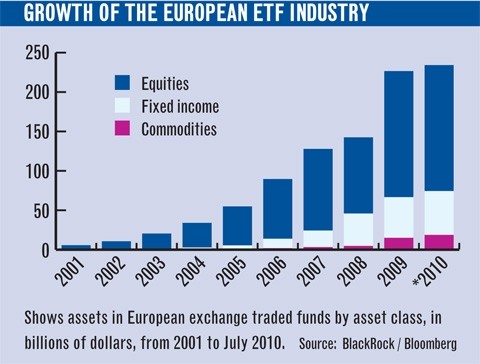

Exchange traded funds, or ETFs, are one of the biggest growth stories in international markets over the past decade or so. More recently, growth in Australia has been equally impressive, with ETFs increasing their funds under management by about 33 per cent compounded since 2004 to around $5.5 billion today. We believe the growth in ETFs has generally been a positive force for investors, increasing both competition and choice.

In fact, we were one of the early adopters of ETFs in Australia, including investing in an ETF that owns physical gold in 2007 prior to the onset of the global financial crisis.

We like ETFs for a number of reasons. They provide broad-based exposure to markets in the form of a single stock. Subject to a few points of caution which Ill outline below, they are generally easy to trade, they trade at, or near, net tangible assets and they have good liquidity. They are low cost, transparent, and provide quite a diversity of offerings. The ETF model is now well-established, having been in existence internationally for some 20 years.

False sense of security

However, all the factors that make ETFs attractive may also lull investors, many of whom are self-directed investors, into a false sense of security. They may feel investing in an ETF doesnt require the same level of due diligence as buying a single stock and may be tempted to gloss over the homework phase of the investment decision. After all, buying a basket of stocks is always safer than buying a single stock, is it not? In this regard, its important to note that not all ETFs are created equal.

When considering investing in an ETF, find out who the ETF sponsor is, and do some research on their track record with ETFs as well as their commitment to supporting their product. With the explosive growth in ETFs, there have also been an ever-increasing number of ETF closures and liquidations, mainly due to an inability to gain critical mass.

Unwanted risk and hassles

While the failure of an ETF does not necessarily result in losses for investors, it can result in significant administrative hassles. In addition, investors are exposed to unwanted market risk.

Once an ETF stops trading, it can take up to a couple weeks for the underlying holdings to be liquidated and the proceeds returned to investors. While most ETFs will provide a brief notice period before they stop trading, that may not help longer term investors who are not actively monitoring and trading their portfolios.

It is also important to understand exactly what the underlying holdings of the ETF are. If you dont, you may not be investing in what you think you are. For example, lets say you are a believer in the long-term Asian domestic consumption and growth theme. You do a quick search, find an Asian index ETF, and make your investment.

Dig a little deeper

If thats the extent of your research, you might be a bit disappointed in the fund youre buying because the typical Asian index comprises around 60 per cent global cyclicals (and 25 per cent large financials) and not much domestic consumption exposure.

In fact, if you add up all the Chinese consumer-oriented names on the Hong Kong Stock Exchange, the market cap will add up to somewhere around $200 billion less than the market cap of the Industrial and Commercial Bank of China alone. Hence your actual exposure to the domestic consumption theme will be significantly lower than you might have thought.

Along the same lines, its also important that you understand the liquidity of the underlying holdings in the ETF. An ETF is only as liquid as the underlying securities it holds, and if those underlying holdings suddenly become less liquid, so will your ETF.

A good example of this was the flash crash of May 6, 2010, when US stockmarkets broke down and the Dow plunged nearly 1000 points before recovering. While many stocks suffered a temporary loss of liquidity, ETFs were disproportionately represented.

For example, of the US listed securities that fell at least 60 per cent during the flash crash and ultimately had their trades cancelled, about 70 per cent were from ETFs. Many of the high-speed traders and market makers who normally keep ETFs trading smoothly pulled out of the market, causing ETFs to hit a major air pocket. The flash crash didnt uncover a fatal flaw in ETFs, it just highlighted the fact that ETFs are only as liquid as their underlying holdings.

Exotic dangers

Finally, while they havent yet come to the Australian market, I would caution against more exotic ETFs such as leverage ETFs or short ETFs for all but the most sophisticated and aggressive investors.

As I said at the beginning, we are supporters of ETFs. But like all investments, you must do your homework.

Alex MacLachlan is managing director, funds management for Dixon Advisory.