How To Do Cost Averaging Passive Stock Market Investing Part 1

Post on: 3 Апрель, 2015 No Comment

There are two basic ways to invest in the stock market.

The first one is active trading which involves timing the market and doing fundamental and technical analysis .

The second one is passive investing or cost averaging which involves doing steady investments through time.

If you want to invest in the stock market but you dont have the time to monitor and study the daily, weekly and monthly movements of stock prices; then I highly recommend doing cost averaging.

What is Cost Averaging?

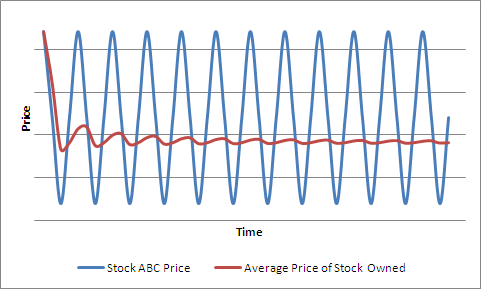

Cost averaging is an investment strategy which requires systematically purchasing securities at predetermined intervals and set limits over a long period of time.

Too hard to understand? Then let me clarify things through an example.

Consider the table below and focus on the first two columns which shows the quarterly prices of Stock ABC from January 2008 until January 2011.

Cost average investing means buying the same value of stocks regularly. In this case, its buying P6,000 worth of stock ABC every quarter as indicated by the third column.

Meanwhile, the fourth column shows the number of stocks that was bought every time. Notice that when the price of Stock ABC is high, you bought less number of shares; and when it is low, you bought more shares .

The fifth and sixth columns shows the cumulative amount you have already invested and the total number of stocks you already own.

The seventh column (Stock Value) shows the value of the stocks you own based on the current price. This was computed by multiplying Total ABC Stocks with Stock ABC Price.

And the last column shows how much is your profit or loss IF YOU SOLD all your shares during that time. Notice how it fluctuates from being negative to positive over time.

Also note that as time went by, the amount of loss and gain increases.

Finally, the last row shows that if you sold all your stocks last January 2011, then you would have gained an extra P54,000 in your pocket that despite the price of Stock ABC going sideways over the past three years.

To summarize, heres how to do cost averaging. step by step:

- Determine the amount you can invest every time.

- This was P6,000 in our example above.

- It can be any amount which you can afford, however at least P5,000 is recommended for the Philippine Stock Market.

- Determine how often you will invest.

- This is quarterly in our example above

- It can be weekly, twice a month, monthly, every two months, etc. you can even do it just annually.

- The right investment frequency really depends on your situation. Do what is most comfortable for you.

- Invest the set amount, regularly, for a period of time.

- For the stock market, its recommended that you have an investment horizon of at least 3 years.

- Try your best to follow the schedule. But its okay to miss one if you have other financial priorities.

- Again, do whats comfortable for you. You can choose to just do this for one year then stop buying and let your money sleep for the next two years or more.

- When you have achieved your investment objective, then its time to sell your stocks and enjoy the profits.

Hopefully, this post has helped you understand how to do cost averaging in the stock market. In the next part, I shall explain WHY this strategy works and HOW TO PICK the best stocks for cost averaging.

Make sure you dont miss that because its really important. If you havent subscribed to Ready To Be Rich yet, then just enter your email address below and youll know when Part 2 is already posted.

Enter your email address for your free subscription to Ready To Be Rich:

Dont know anything about the stock market?

Easy Series Reference:

Disclaimer: The information above should not be taken as financial advise from an expert. This article is merely for educational purposes. Please consult a wealth manager or a certified financial planner before making any major investment decision.