How to Diversify with the Best Asset Allocation for You

Post on: 12 Август, 2015 No Comment

At the beginning of the New Year, we are all filled with good intentions for a productive year ahead. Now is the time to act on one of the most important of these good intentions – making smart asset allocation decisions. Here are some tips for making the right decisions around an asset mix best suited to your own return objectives and investment risk tolerance .

Strategic and Tactical Decisions

Asset allocation has both a strategic and a tactical component. Strategic allocation should be aligned with long-term goals and asset mix weightings should shift only periodically as you progress towards major lifestyle events, like college tuitions, starting a new business, or retirement. Generally speaking, the farther you are away from these liquidity events, the more you will want to orient your portfolio towards low-income assets with higher growth potential over long-term cycles. Small cap and emerging markets stocks fit this description, as do commodities futures. Many market experts consider it a default scenario that markets like China and Brazil will continue to grow strongly compared to the US and Western Europe, while prices for a wide range of commodities from oil to soybeans and copper will keep going up as far ahead as the eye can see. If your time horizon to a major liquidity event is fifteen years or more, you will probably want to be positioned accordingly.

Tactical allocation decisions are more closely aligned with near-term capital markets expectations. Tactical asset allocation is not for everyone – it requires more attention and action from investors on a more regular basis. Ultimately, it may not be worth the effort if you don’t have the time or the inclination to make that commitment.

A Core / Satellite Approach

If you are game to try your hand at tactical allocation, then one approach I find to be worthwhile is the core / satellite structure. What this means is that you designate some percentage of the portfolio as core, which should stay unchanged – apart from strategic evolution as discussed above. The remaining “satellite” or “periphery” component will be reserved for shorter-term tactical decisions. The satellite tends to run from around an aggressive 30% to a conservative 10% (implying a core range of 70% 90%).

Since the majority of shorter-term activity will take place inside the satellite component, it is a good idea to consider ETFs as the primary asset vehicle for taking on different asset class exposures. Since ETFs trade like common stocks and typically do not have cumbersome restrictions (like redemption fees or lockout provisions), they are well-suited to making fluid tactical decisions. Be mindful, as always, of the trading commissions and other expenses that can detract from performance if used excessively.

Putting it All Together

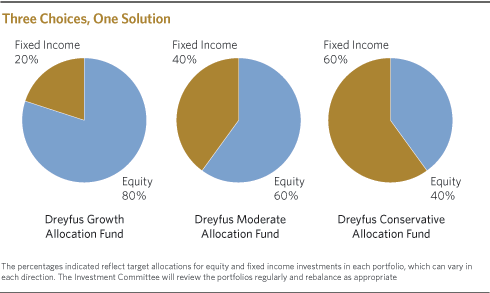

Once you have settled on your investment goals, risk tolerance, and strategic / tactical approach, it is time to establish a model portfolio with target weights. Let’s start by dividing the universe into the two basic risk categories of equities and fixed income. For an investor with an appropriately long-term horizon, a logical weighting might be 70% equities and 30% fixed income. Apply that weighting to both the core and the satellite components. For example, if your core / satellite split is going to be 80 / 20, then in the core you would have a 56% target allocation to equities and 24% to fixed income (56+24=80). And the corresponding weights in the satellite would be 14% and 6%. All the core and satellite allocations should add up to 100%. This may seem unnecessarily cumbersome, but remember that the core and satellite assets are going to be performing different roles and will probably involve different funds, ETFs, or other assets. So, it is important to account for the core and satellite weights separately. Visually it looks as follows: