How to determine undervalued stocks

Post on: 16 Март, 2015 No Comment

What is undervalued stocks?

This is definition of a stocks that are selling at a price lower than what is assumed to be its value. Lets say a stocks price is 10$, but actually you think the real value of that stocks is 20$, so this means that you have found an undervalued stock. One of the most important things to be successful in stock trading is that you have to find undervalued companies. Combined with value investing will give you an advantage that no other analysis can give you. So make sure when you invest in companies to be sure that you dont buy something that everybody will sell soon and you will lost a lot of money.

You have to know that if you find undervalued stocks this does not mean that you have to buy it. After that you have to find if that company has durable competitive advantage to buy it, because you do not want buy a stock company for 3$ and then this company to announce bankruptcy.

So how can you determine undervalued stocks?

Well first find companies that you think that have a potential to have a durable competitive advantage (if you want to understand how you can see if company has a durable competitive advantage with wbstocks you can click here or to see Warren Buffetts methods to find durable competitive advantage click here ).

Then make a list of them. When you have a list of companies you have to start looking for a undervalues stocks in that list.

Internet made it easy for you, because there are a lot of tool that can help see if company has undervalued stocks, so you dont have to put a lot of effort in that research.

So what to look for?

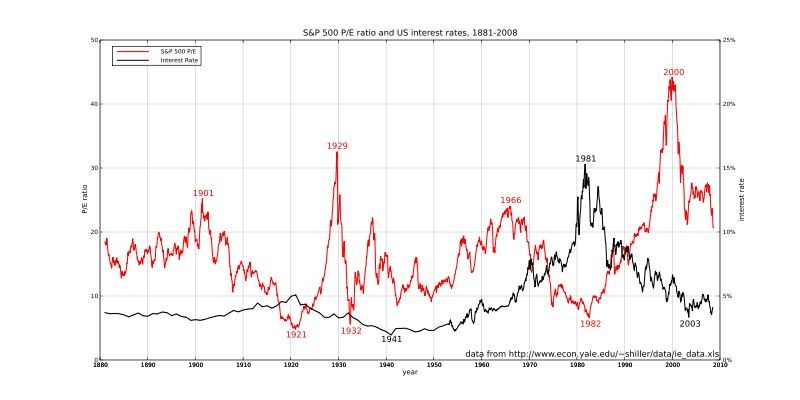

1. Look for P/E ratio. It is very popular indicator, which can help you see undervalued stocks. You have to see if this indicator is over 20 then this means that this company is overvalued and it is best to stay away from it. It is better for this ratio to be only one digit, something like 8-9. As I say this is very popular indicator, so in most financial websites you can see this ratio already calculated. For example in google finance you can see this ratio at the top of the company information.

2. Other thing too look at is earnings yield. This is inverse of P/E ratio. This indicator shows the percentage of each dollar invested in the stock that was earned by the company. What we have to look here is high earnings yield. If this ratio is high this means that company stocks are able to generate a large amount of earnings relative to the share price.

3. Another method to determine undervalued stocks is charts. What we have to look here is the trend and how long it is downside. So here is an example of a downside trend.

Here we can see that this stock is in a down trend, and if we wait to be in an up trend and buy when this happens, we can expect a return of 61%. Not bad for one stocks, right? Of course this is a prediction we can expect 61%, but we cant be sure that this can be the real scenario. Here we have two benefits. First we have long way to previous point of the stock (61%) and second if we buy this low we can have bigger margin of safety.

What is margin of safety?

I am gonna explain it with an example. Let say if you think that one stocks is worth 20$ and you buy it at 10$ this will give you a margin of safety if your analysis is wrong and the stock goes only to 15$. There is no universal way to calculate margin of safety, so you have to figure it for yourself