How To Compound Your Wealth Through Stocks And Properties And Other Financial Knowledge

Post on: 16 Март, 2015 No Comment

Monday, October 18, 2010

How I Lost $100,000 Without Even Trying

Once upon a time, I bought a house.

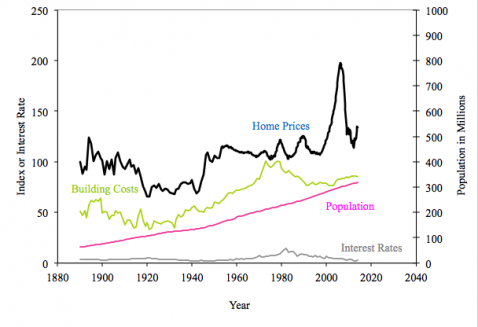

At the time, I thought I had overpaid. but the time was 2001 — much nearer the start of the housing boom (that’s recently turned bust) than its end. Fast forward a few years, and I sat down to my trusty computer, pulled up Zillow.com for a Zestimate, and was informed that my little brick box was worth more than $500,000. Amazing news? Sure. Gratifying? You bet. Zillow was telling me that my house had more than doubled in value in just five short years.

Sadly, Zillow was on crack.

Welcome to the other side of the looking glass

About a year after receiving the good news from Zillow, I sold the house for far less than the site had told me it was worth. A 25% drop — $100,000 — from the top, in fact. Or, if you’re a glass-half-full kind of a Fool, a 60% profit beyond what I paid for it.

The real truth, though, is that the house was worth neither what I paid for it, nor what I could have sold it for in 2006 — nor even what I ultimately pocketed from the whole transaction. The real worth of the house was something unknowable, something that could only be guessed at: its intrinsic value.

Price is what you pay. Value is what you get.

Leave it to Warren Buffett to sum up the dilemma in a single pithy dichotomy. The world’s greatest investor reminds us that the value of an asset — whether a car, a house, or a stock — does not necessarily have any relation to the price we pay to own it. Far be it from me to criticize the Oracle’s wisdom, but Buffett’s observation still leaves us with one crucial question: How exactly do we know the value of the asset?

Benjamin Graham’s classic non-answer stated that an asset is worth at least its book value, so you’re safe if you pay less than that. There’s also a logically impeccable but not very helpful adage that an asset is worth whatever someone will pay for it. And Professor Aswath Damodaran offers this math-intensive solution: The value of equity is obtained by discounting expected [residual] cash flows.

A more honest answer, though, is that we simply never know how much anything is worth. Not exactly, at least.

Hunting stocks with an axe

Yet in real life, we don’t allow the lack of an exact answer to stop us from buying. Humans need shelter, so we buy a house when the price seems fair. We need cars, so we work from sticker prices and the Kelly Blue Book to pick an acceptable price for those, too.

The same goes for stocks. We shouldn’t measure with a micrometer, mark it off with chalk, then cut it with an axe. We make our best guess at a fair price. We try to buy for significantly less than our estimation. If we guess right more often than wrong, we make money. But where do we start?

Start with common sense

Look in places where you’re more likely than not to find bargains:

Low prices: Stocks hitting the new 52-week-lows list may be down for a reason. Still, a stock selling cheaper today than it’s sold any time for the past year is more likely a good bargain than a stock selling for more than it’s ever fetched before. Last month, I noted five stocks that had fallen to their 52-week lows. While the S&P trades 12% higher today, all five of those stocks have risen anywhere from 22% (Marvel Entertainment (NYSE: MVL )) to 184% (Republic Airways).

Read the paper: Newspaper headlines offer another superb place to seek bargains. Remember how oil was selling for $150 a barrel last July? Remember how a few months later, it sold for less than $40? How much do you want to bet that the intrinsic values of oil majors such as ExxonMobil (NYSE: XOM ) or Chevron (NYSE: CVX ) tracked those movements exactly? (Hint: They didn’t.) Somewhere between $40 and $150, there was value to be had in the oil majors.

Cheap valuations: Another great way to scan for bargains is to run a stock screener every once in a while. I like to look for stocks that trade for low price-to-free cash flow multiples, exhibit strong growth, and have low debt. In recent weeks, this method has yielded me such unexpected bargains as NetEase.com (Nasdaq: NTES ), priceline.com (Nasdaq: PCLN ), and eBay (Nasdaq: EBAY ).

Foolish takeaway

The key point I want you to take away from all this is simple: Trust your instincts. When Zillow tells you your house has doubled in value, treat that Zestimate with some skepticism. When Suntech Power (NYSE: STP ) doubles in price on announcements of industry subsidies from China, be wary. On the other hand, when stocks that have little to do with the financial crisis drop 50% in the space of a year, when stock prices don’t match the news they’re supposed to reflect, or when you stumble across a stock with a price that looks cheap, you might just have found a bargain.