How to Choose an Employee Stock Plan for Your Company

Post on: 11 Апрель, 2015 No Comment

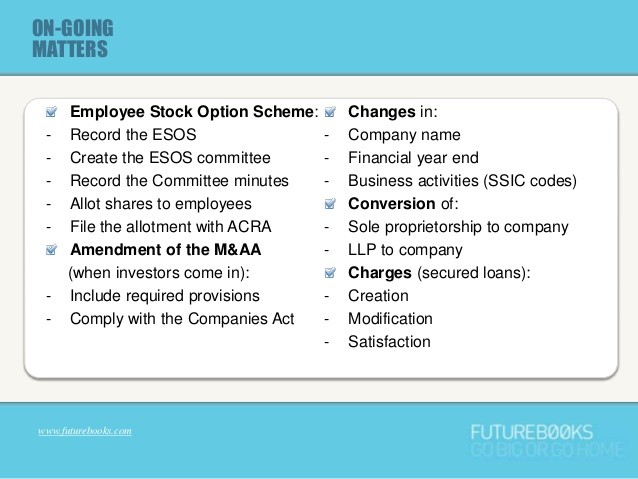

ESOPs Are Not Options

People who are familiar with stock options and encounter the word ESOP sometimes think it means Employee Stock Option Plan, but it means nothing of the sort, as explained above. ESOPs and options are totally different. Neither is ESOP a generic term for an employee stock plan; it has a very specific legal definition. (Outside the U.S. ESOP means various things, ranging from U.S. ESOP-like plans to stock option plans.)

Incentive Stock Option Is Not a Generic Term

Another common misconception is that incentive stock option is a general term for stock options given as an incentive to employees, etc. Actually, the incentive stock option is one of two types of compensatory stock options (the other type is the nonqualified stock option), and it has very specific legal requirements.

Typical Situations

Having covered the plans you might use, let us see where they fit into typical corporate situations:

Private (Closely Held) Companies

- Companies that plan to go public or be acquired (high-tech startups, etc.): Despite all the stock market and accounting rule changes that have occurred over the last decade, options are still the currency of choice when it comes to attracting and retaining good employees; many high-tech workers won’t take a job without options. As the company is going public, it is common to put a stock purchase plan in place as well. There is growing interest, however, in stock appreciation rights and restricted stock as well.

- Closely held companies with owners looking to sell some or all of their stock: An ESOP is usually the best choice. In most cases, the ESOP will borrow money to buy out the shares, but the company may just put in cash for several years in a gradual sale. Companies can use pre-tax dollars to buy an owner outthere is no other way to do this than an ESOP. If the company is a C corporation (rather than S), the owner, if certain conditions are met, will be able to avoid paying any taxes on the sale proceeds provided they are rolled over into stocks and bonds of U.S. operating companies. Stock options would not work at all.

- Traditional closely held companies that will stay private but do not have a selling owner: If your company is not going to experience a liquidity event (going public or being acquired), then you have multiple choices. An ESOP provides by far the most tax benefits to employees and the company, but it requires that allocations of stock be made based on relative compensation or a more level formula, subject to vesting and service requirements to enter the plan. Stock appreciation rights or phantom stock are usually the best choice if you want to provide rewards to employees based on merit or some other discretionary basis. With stock options or a stock purchase plan, your company would have to create a market for the stock, which could create costly and cumbersome securities law issues. Options or purchase plans are thus generally used only as management compensation in such companies.

Public Companies

In some ways, public companies have more flexibility when choosing a stock plan, since (1) there is a market for the stock, thus meaning the company doesn’t have to buy it back from employees; (2) there are no securities issues since the stock is already registered, and (3) they typically have larger budgets than private companies, some of which, for example, balk at paying the hefty sums associated with setting up an ESOP. Thus, the selection process has less to do with eliminating the plans that simply won’t work well and more to do with weighing their pluses and minuses.

Stock options restricted stock, stock appreciation rights, and phantom stock (and to a lesser extent stock purchase plans) are especially useful when you are hiring the kinds of employees who expect them as a condition of employment. And having employees buy stock through options and purchase plans can be a source of revenue for the company. However, don’t forget ESOPs; as a long-term, tax-advantaged plan, the ESOP can help both a company and its employees develop a true ownership culture.

Using a 401(k) plan for employer stock in a public company is more controversial. In the wake of accounting scandals at Enron and other companies, dozens of lawsuits were filed against employers and plan fiduciaries for not removing employer stock as an investment option in a 401(k) plan and/or continuing to contribute company stock as a match. The same process started all over in the wake of the stock market crash of 2008 and 2009. Employees started to move more assets out of employer stock (down from 19% at the start of the decade to about 10% at the end), and companies became more wary about overloading company stock in the plans. For more companies, this course is the prudent one.

In many cases, you will want to have at least two kinds of plans: for example a broad-based stock option plan plus an ESOP, or an executive option plan plus a broad-based Section 423 purchase plan, etc. What you do will depend on the desires and needs of your company and your employees.

Very Small Private Companies on a Budget

What if your company is very small (maybe 7 or 10 employees), plans to stay that way, and the cost of setting up an ESOP or even a 401(k) plan seems prohibitive? There is no easy answer for you; perhaps a yearly cash bonus based on company performance would be better than a stock plan. You might read our Conceptual Guide to Employee Ownership for Very Small Businesses for more ideas and a general grounding in the issues.

Synthetic Equity

Synthetic equity refers to plans such as phantom stock or stock appreciation rights (SARs) that provide employees with a payout, usually in cash, based on the increase in the company’s stock value. Employees may receive stock instead of cash; in the case of phantom stock settled in shares, this is usually referred to as a restricted stock unit plan.

Synthetic equity plans are relatively easy to create and maintain, and they are generally not subject to securities laws. The underlying stock still must be valued in some reasonable way (not just a guess by the board of directors or a simple formula) and grants are treated as compensation for accounting purposes. If the plans are designed to pay out at retirement or some date well into the future, they could be considered retirement plans and thus be subject to the complex rules of the Employee Retirement Income Security Act (ERISA) if not limited to a small number of employees. Plans with typical payouts of three to five years are not a problem.

Where to Go from Here

An article like this can only scratch the surface of a complicated subject. The suggestions made here are only suggestions, and may not fit your particular situationthat’s why the heading above reads Typical Situations. It is essential that you educate yourself further and, if you set up a plan, hire the right people to help you.