How to Choose a Good ETF

Post on: 9 Май, 2015 No Comment

An exchange-traded fund, or ETF, is as basket of stocks or bonds, like a mutual fund, that trades on an exchange, like a stock. Most ETFs track stock and bond indexes, and many advisers like them because they can be more tax-efficient than mutual funds, and the expense ratio is usually significantly cheaper. Of course, investors do pay a broker’s commission for every ETF trade, and those costs can add up, which is why ETFs can be best for investors who buy in with a lump sum of money and hold the investment for a long time.

Think broad. If you’re just starting to build an investment portfolio, ETFs can help you get exposure to as much of the market as possible.

- Mind the index. There are ETFs to track almost any corner market and investment strategy you could imagine. Stick with broad-based indexes, like the S&P 500 or the MSCI World Index.

- Add up the stocks and bonds. See how many stocks or bonds are in the index tracked by the ETF. An ETF that tracks 500 stocks will be far less volatile than one that tracks 20 stocks, and will be much less vulnerable to a sudden drop if bad news hits one of the companies in the fund.

Think big. It’s not just the number of stocks or bonds in an ETF that matters. The number of shares that trade each day is important, too.

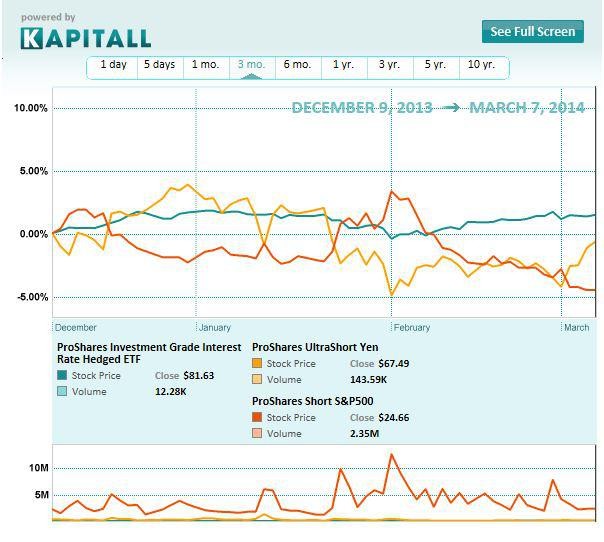

- Volume counts. An ETF that doesn’t trade much may also be prone to bigger price swings than an ETF that trades constantly. Also, ETFs that trade more regularly are also more likely to be priced fairly. You can find volume information on ETF’s ticker page on SmartMoney.com.

- Assets count, too. The total assets held by an ETF are another indicator of how regularly the ETF will trade. Having at least $100 million in assets means that enough investors have their eye on the ETF. Net assets are also available on the ETF’s ticker page on SmartMoney.com.

Think cheap. ETFs are generally cheaper than mutual funds, and some ETFs are cheaper than others.

- Expenses still matter. Check the ETF’s expense ratio, expressed as a percentage of assets. Many investment strategies or indexes have more than one ETF tracking them, often with different fee structures.

- Cheap isn’t always best. Expense ratios measure the cost of managing the ETF, but they don’t measure how well an index ETF actually tracks its index. Lower tracking error can very easily make up for a point or two in higher expenses.

What not to do when buying an ETF:

- Don’t fall for niche products. New ETFs launch every day, and some of them track very specific markets. Do you know what influences palladium prices? If not, don’t buy a palladium ETF.

- Don’t bet the farm. ETFs that say they’ll deliver 2 or 3 times the return of some index—called leveraged ETFs — are extremely volatile and designed for professional traders with a short-term or even daily focus. Most individual investors should steer clear.

- Don’t trade too often. Jumping in and out of ETFs based on short-term market movements will eat up your money with commission costs.