How to Calculate the RiskFree Rate of Return

Post on: 30 Май, 2015 No Comment

Things You’ll Need

Calculate Risk-Free Rates

Determine the length of time that is under evaluation. If the length of time is one year or less, then the most comparable government securities are Treasury bills. Go to the Treasury Direct website and look for the Treasury bill quote that is most current. For example, if it is 0.204, then the risk free rate is 0.2 percent.

References

More Like This

How to Calculate CAPM in Excel

You May Also Like

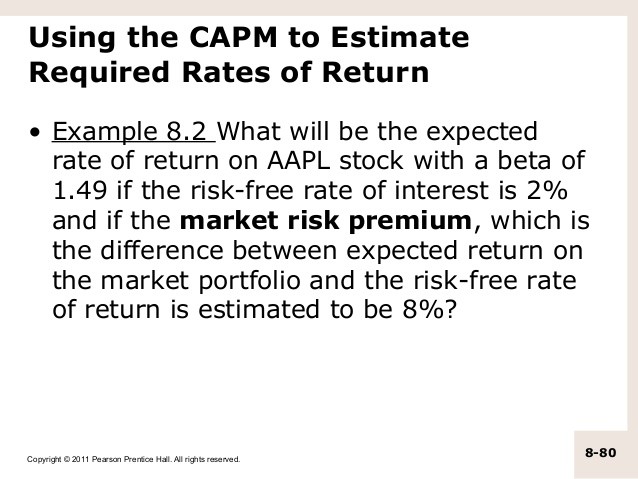

In this formula, r is the expected rate of return, Rf is the risk-free rate and RM is the expected market rate.

Identify the risk-free return for an investment. Generally speaking, a high-grade bond of some sort is used to represent the risk-free rate.

How to Calculate Risk-Free Rate. The risk-free rate of return is used in many financial calculations. How to Calculate the Risk-Free.

Risk in finance is the difference between actual and expected returns. The expected return on a risky asset or project is the.

How to Find the Risk Free Interest Rate With a YTM. Yield-to-Maturity (YTM) represents the yield on an investment from now until.

Most investment managers settle for achieving gains above the risk-free rate. AVERAGE RETURN ON STOCKS IN CONJUNCTION WITH THE CURRENT RETURN.

How to Calculate CAPM in Excel. Enter the alternative risk free investment in cell A1. Compare the CAPM with the.

How to Calculate the Risk-Free Rate of Return. How to Calculate Risk-Free Rate. The risk-free rate of return is used in.

The market risk premium is the rate of return of the market for investments that is in excess of the risk-free rate.

Subtract the risk-free rate of return from the expected return of the overall stock market to calculate the risk premium. For example.

As discussed in Stephen Kellisons The Theory of Interest, investment interest completely free of risk doesnt exist. All investments have some risk.

The risk-free rate is usually based on United States Treasury bills, notes and bonds, because it is assumed that the U.S. government.

The actual CAPM formula states that a security's expected return (ER) is equal to the risk-free rate (RF). How to Calculate.

Ks = the required rate of return Krf = the risk-free return rate, usually that of U.S. Treasury bonds B = Beta.