How to calculate a PEG ratio (4 Steps)

Post on: 10 Июнь, 2015 No Comment

Instructions

Before you are able to find the PEG ratio, you must first know what the price to earnings ratio, or p/e ratio of your stock is.

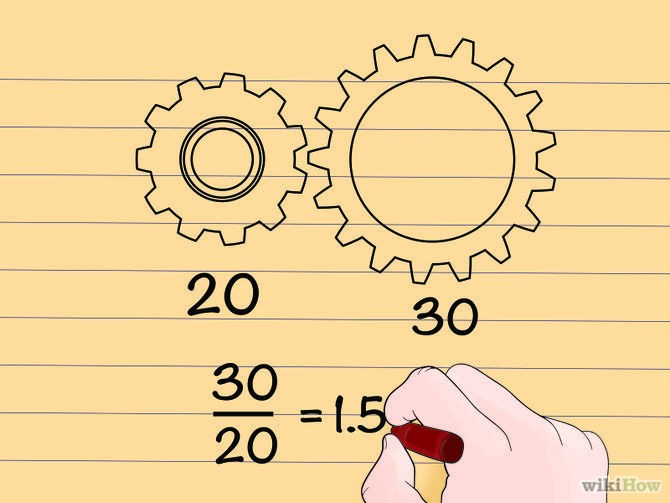

In order to find the PEG ratio, which is the Price to Earnings Growth ratio, we need to use the price to earnings ratio that we just found. Using the example from step 2 we start out with our p/e of 15. To find the peg ratio the p/e of 15 is then divided by the expected annual growth of the company. Let’s say that the expected growth of this company is 10% per year. We then take 15/10 to get a PEG ratio of 1.5.

Tips & Warnings

More Like This

How to Calculate EPS Growth Rate

You May Also Like

How to calculate a PEG ratio. A look at how to find the PEG ratio for individual stocks. Related Ads. View Photos.

How to Calculate Tube Feeding. A tube feeding refers to the nutrients delivered to the gastrointestinal tract through a tube. Peg.

If you want to work out what the partition ratio is on your disk drive, you can do so using the built-in.

The Sharpe Ratio, created in 1966 by Nobel laureate William F. Sharpe, is an equation to calculate risk-adjusted performance of a stock.

Calculate the year-ahead PEG (YPEG). This calculation is especially useful for valuing older, more established companies. The YPEG is not based on.

If you are, maybe you're using the PEG ratio. What's PEG? Well it's the measure of price earnings multiple to growth and.

Bolus is a term associated with diabetes patients that refers to the insulin-to-carbohydrate ratio. Diabetes patients have to take insulin to counteract.

A 3-to-1 reduction ratio gear case would thus convert 3,000 rpm to 1,000 rpm. Calculator; Torque wrenches (optional). In this.

A good idea for finding undervalued growth stock is to first conduct a price/earnings growth ratio on the stock. The PEG ratio.

How to Evaluate Financial Strength Using Ratio Formulas. Financial ratio formulas can be used to determine a companies stability, long term growth.

When calculating ratios, think of it as finding out how much of a total is in one place and how much of.

Calculator; Show More. Instructions. 1. Add the money paid out in claims for a certain period of time. For instance, a company.

The term v/v, or volume/volume, describes the concentration of a solution. Students learn this concept in high school and lower-level college chemistry.

Finance, Google or MSN Money. Assume the share price for XYZ company is $10. 2. Obtain the firm's annual report. Among.