How to Benchmark Portfolio Returns

Post on: 16 Март, 2015 No Comment

You benchmark your portfolio’s performance by comparing its return to that of an index, which is an unmanaged list of stocks, bonds or other investments. The Dow Jones Industrials and S&P 500 are two widely used indexes. To benchmark correctly, you must select an index that covers assets with characteristics similar to the ones in your portfolio. You can choose from hundreds of different indexes that cover various asset classes, such as U.S. stocks, international bonds, biotechnology stocks or precious metals.

Other People Are Reading

Finding the Right Benchmark

To find the appropriate benchmark for you, sstart by analyzing and categorizing the investments in your portfolio. Normally, an investment can belong to multiple categories. For example, you might own the stocks of small domestic telecommunication companies that belong in the high-tech, the small-cap and the U.S.-stock categories. You can find categories and indexes at the websites of index providers, including Lipper, S&P, Morgan Stanley and Morningstar. Select the benchmark that most closely resembles your portfolio.

Managed vs. Unmanaged

References

More Like This

What Is Sensex in the Stock Market?

You May Also Like

Stock market indices are used as benchmarks to measure the performance of investments. There are literally hundreds of different indices that measure.

There are two ways to earn a return on mutual funds: unit price appreciation and dividends or other disbursements. Calculating your total.

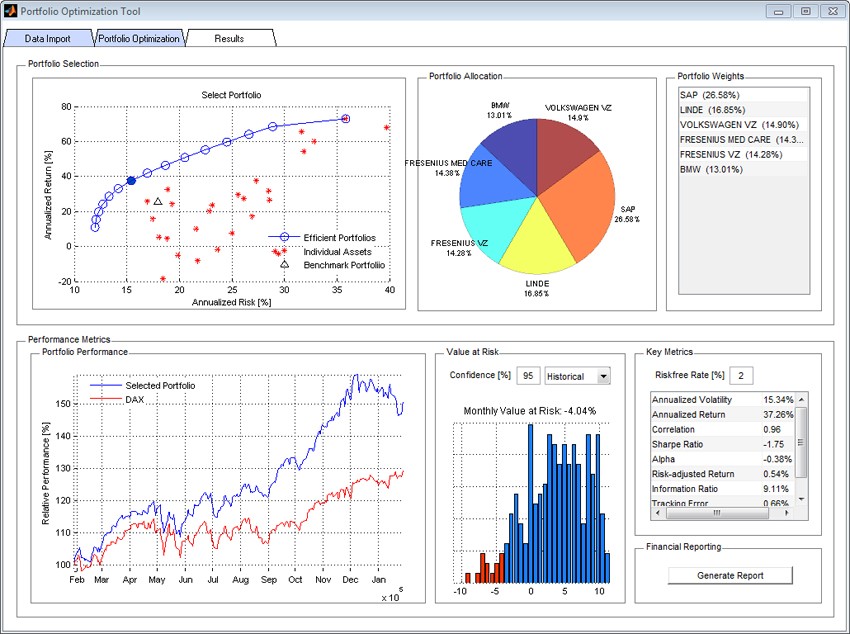

Modern portfolio statistics attempt to show how an investment's volatility and return measure against a given benchmark, such as U.S. Treasury bills.

Benchmarking is a method for judging your business by objective standards. It's a step beyond setting goals: In benchmarking you use your.

Investment analysts often suggest that investors diversify their investment portfolios. This entails buying a variety of different types of securities rather than.

Portfolio analysis is a tool investors use to measure the performance of their investments. Investors might want to measure the overall performance.

Performance attribution is aimed at identifying and quantifying the sources of returns that are significantly different from the chosen benchmark. Performance.

Once again it's time for benchmark tests at your school, and you want to do well. A good score on a benchmark.

Many investors have different stock portfolios with different investment styles, such as a portfolio of tech stocks or industrial stocks, or portfolios.

Industry benchmarks are created to record specific measurements that state the best and worst levels of performance either for a process or.

Benchmarking is the process of comparing existing practices within your own organization against best practices used elsewhere, either within the company or.

A balanced retirement fund refers to a portfolio of securities or mutual funds that invest in at least two broad asset classes.

A stock's beta theoretically measures price sensitivity compared with the market. Investors with multiple positions should consider their portfolio's beta.

Calculating investment returns can be simple using Excel. Use these steps to compute the time-weighted internal rate of return (TWIRR) of your.