How to beat The Little Book That Beats The Market Redux

Post on: 6 Июнь, 2015 No Comment

Deep value, contrarian, and Grahamite investment

How to beat The Little Book That Beats The Market: Redux

Wes and I put the Magic Formula under the microscope in our book Quantitative Value. We are huge fans of Greenblatt and the Magic Formula, writing in the book that Greenblatt is Benjamin Graham’s heir in the application of systematic methods to value investment .

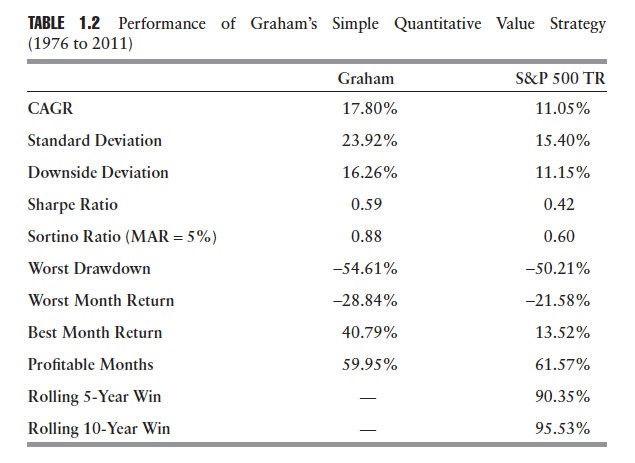

The Magic Formula follows the same broad principles as the simple Graham model that I discussed a few weeks back in Examining Benjamin Graham’s Record: Skill Or Luck?. The Magic Formula diverges from Graham’s strategy by exchanging for Graham’s absolute price and quality measures (i.e. price-to-earnings ratio below 10, and debt-to-equity ratio below 50 percent) a ranking system that seeks those stocks with the best combination of price and quality more akin to Buffett’s value investing philosophy .

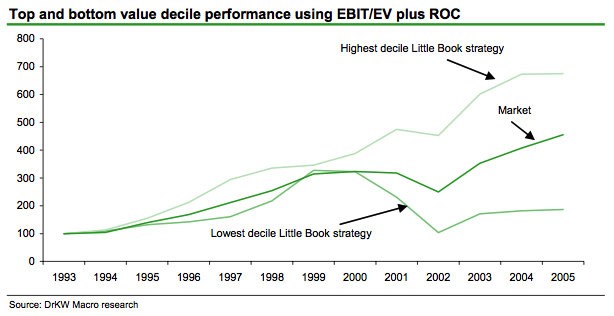

The Magic Formula was born of an experiment Greenblatt conducted in 2002. He wanted to know if Warren Buffett’s investment strategy could be quantified. Greenblatt read Buffett’s public pronouncements, most of which are contained in his investment vehicle Berkshire Hathaway, Inc.’s Chairman’s Letters. Buffett has written to the shareholders of Berkshire Hathaway every year since 1978, after he first took control of the company, laying out his investment strategy in some detail. Those letters describe the rationale for Buffett’s dictum, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Greenblatt understood that Buffett’s “wonderful-company-at-a-fair-price” strategy required Buffett’s delicate qualitative judgment. Still, he wondered what would happen if he mechanically bought shares in good businesses available at bargain prices. Greenblatt discovered the answer after he tested the strategy: mechanical Buffett made a lot of money.

Wes and I tested the strategy and outlined the results in Quantitative Value. We found that Greenblatt’s Magic Formula has consistently outperformed the market, and with lower relative risk than the market . Naturally, having found something not broke, we set out to fix it. and wondered if we could improve on the Magic Formulas outstanding performance. Are there other simple, logical strategies that can do better? Tune in soon for Part 2.