How to Avoid Panic Selling

Post on: 15 Июль, 2015 No Comment

One of the biggest temptations when you see the Dow drop 500 or 600 points in a day is to become involved in panic selling. Everything seems to be crashing, and it seems like the time to sell, SELL, SELLLLL! However, you need to keep a handle on your emotions, and stop and think. Once you sell at this point, youre essentially locking in your losses.

Rather than letting panic dictate your investing plan, you should take a deep breath, a step back, and re-evaluate your gut reaction to sell. Here are some things to think about in order to prevent panic selling as the stock market drops:

Focus on the Fundamentals

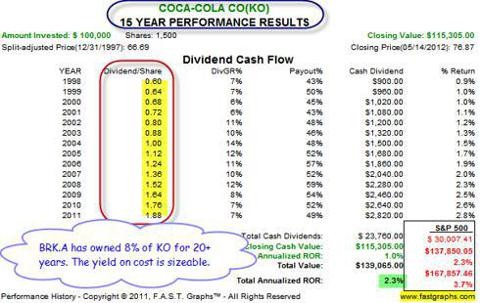

Before you sell your investment on a market drop, it can be a good idea to review the fundamentals. Has anything changed? Does the company still have the same profit potential? Is the management still competent? If there havent been any major changes to the fundamentals of the investment, you might consider hanging on to it; if it has been a solid performer, and has solid prospects for the future, selling just because the market drops can be disastrous. A good investment is likely to recover in time.

Do a Little Bargain Hunting

Instead of thinking of the stock market drop as a catastrophe, you can think of it as an opportunity. Many stocks are on sale during times like these, and you can make a profit if you buy low now, and sell high later. Some people think that the stock market might even go lower and theyre excited at the prospect. One way to keep from knee-jerk selling is to change your thinking so that you see opportunities, rather than focusing on only the down side.

What if Selling is a Good Idea?

In some cases, selling might be a good idea. You want to be careful about it, though. Consider your reasons for selling. Are you concerned that the investment wont recover from the crash? If so, you might sell. You might also want to sell at a loss in order to offset some of your capital gains for tax purposes. In some cases, you might even still be ahead on the investment, and you might need the money for some other purpose. Selling for a gain, before the market drops further, might be prudent in such a case. Just be aware of the difference between long-term capital gains and short-term capital gains, and the tax implications.

There might be some legitimate reasons to sell right now. However, selling just because the market is dropping, and youre in a panicked state of mind, is rarely a good idea. Instead, it is important to really ask yourself why you want to sell. If you are selling because everyone else is, or because of the current volatility, it might be a good idea to re-examine your decision. Once you go into your brokerage account and sell, there is no taking that back. Consider your investment plan. and make sure that you are making the wisest decision before you lock in those losses.