How to Analyze Mutual Funds

Post on: 12 Апрель, 2015 No Comment

More Articles

When using mutual funds as an investment vehicle to build your net worth, it is important that you are able to review and analyze your mutual fund choices correctly to minimize risk and maximize your potential investment gains. Choosing a fund that performs better consistently by even a percentage point or two could make the difference between a comfortable retirement and barely getting by. With all of the fund choices that are available, consistent analysis will also help you compare different mutual funds on a more level playing field.

Step 1

Review the prospectus for the mutual fund that you are analyzing. The prospectus will show the fund’s overall investment philosophy, as well as an explanation of the fund’s overall risks. The fund’s manager will be listed in the prospectus, and the past performance of the mutual fund should also be detailed by listing investment returns over certain time periods.

Step 2

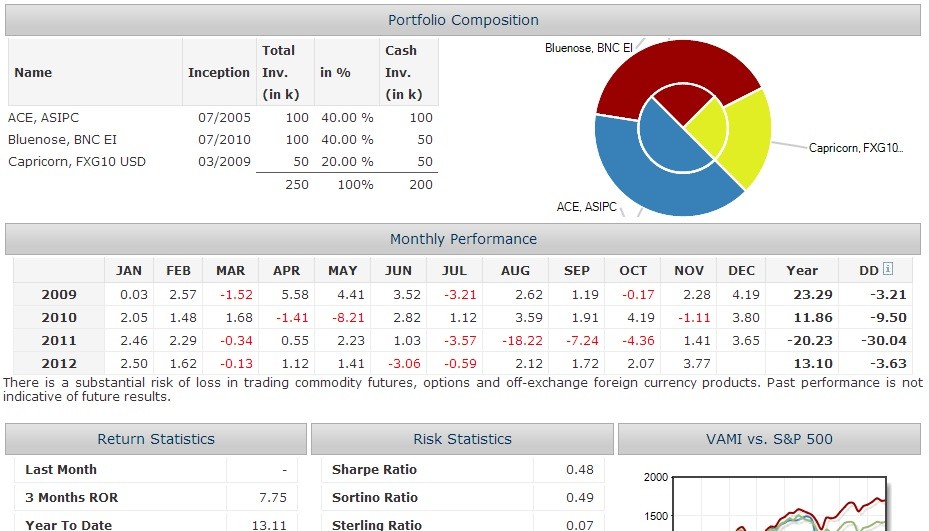

Locate the Sharpe ratio for the mutual fund. This is a ratio that compares the fund’s return, after subtracting what an investor would have received by investing in a guaranteed investment like a treasury bill, with the standard deviation of the mutual fund. The standard deviation is a measure of how far the fund strays from its average performance. A higher Sharpe ratio generally means that the fund has less risk for the investment return that it is producing

Evaluate the mutual fund’s expenses. These are listed in the fund’s prospectus, but are also listed with mutual fund rating services. Funds that trade investments more often will usually have higher expense ratios, as will funds with larger management teams. Funds also will be either load or no-load funds. A load fund pays a percentage of your initial investment, or of shares that you sell, to the broker who sold the fund. While this is an extra expense, the mutual fund advice you receive from the broker selling you a loaded fund is an added value that you receive for this fee.

List the top stocks that the fund owns, which will often be listed in the prospectus or with a mutual fund rating service. If you have any philosophical issues with any of these companies, or how they do business, factor that in when making your final investment decision. An example would be if you were fundamentally opposed to cigarette sales, you may want to pass on a fund that had a tobacco company as one of its top investments.