How Taxes Can Affect ETF Performance

Post on: 25 Июнь, 2015 No Comment

In our recent white paper, After-Tax Returns. Justin Bender and I introduced a methodology for measuring the effect of income taxes on ETF returns. Justin also created a downloadable spreadsheet you can use to estimate the after-tax returns of funds in your own portfolio.

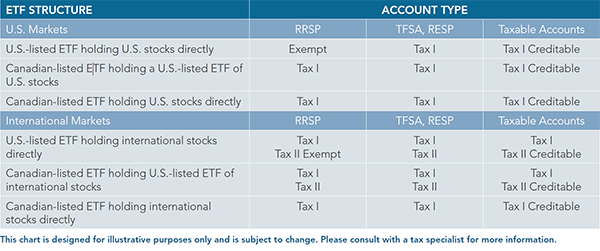

As we explain in the paper, funds with similar pre-tax returns can look quite different when you compare their performance after the CRA has taken its cut. Remember that on a pre-tax basis investment gains are reported in the same way whether they’re Canadian dividends, fully taxable income or capital gains. If you’re investing in a tax-sheltered account, its all the same. But in a non-registered account, distributions are taxed in different ways. and this can dramatically affect the amount of money you actually keep.

Here’s a real-world example that illustrates how large the difference can be. Justin collected the distribution and price data for the iShares Core S&P/TSX Capped Composite (XIC) and the DFA Canadian Core Equity Fund (DFA256) over the nine years ending in 2013. Both funds track the broad Canadian stock market, so you would expect similar returns. And indeed, during that period XIC’s annualized before-tax return was 7.32%, while the DFA fund returned 7.25%. The difference is so small that we’ll call it a draw. However, the calculator revealed a significant difference in after-tax performance:

Sources: BlackRock Canada, Dimensional Fund Advisors Canada ULC, Justin Bender, PWL Capital Inc.

Despite lagging XIC slightly before taxes, the DFA fund outperformed by 0.41% annually on an after-tax basis. Over the full nine-year period, the DFA fund’s tax cost ratio (which estimates the amount of a fund’s distributions lost to taxes) was 0.61%, compared with 1.06% for XIC.

Why the difference?

Before you make an investment decision based on an analysis like this, however, it’s worth digging a little deeper to find the reason for the large difference in after-tax returns.

One of the factors—explained in detail in the white paper —is that funds with higher MERs tend to have lower tax cost ratios. That’s because funds typically deduct their management fees before passing along distributions to their investors. This can make a higher-cost fund appear more tax-efficient, though of course the investor is simply losing money to fees rather than taxes. In our comparison above, the DFA Canadian Core Equity Fund (DFA256) had a relatively high MER of 0.59% in 2005, though that has since come down to 0.38%. Meanwhile, XIC had a management expense ratio of 0.18% back in 2005, and while that later increased to 0.25% the ETF has always been cheaper than the DFA fund.

But the biggest culprit was likely the index changes XIC underwent in the mid-2000s. When it was first launched, XIC tracked the S&P/TSX 60 Capped Index. which includes only large-cap stocks. It changed its mandate in November 2005 and began tracking the broader S&P/TSX Capped Composite Index. The buying and selling of stocks during that transition resulted in some large capital gains distributions, and investors would have been handed a tax bill for these gains even if they never sold units in the ETF. But to be fair, unless XIC changes its underlying index again, that’s not likely to be a problem going forward.

This is a reminder that the most tax-efficient index funds and ETFs are likely to be the ones that cover the broadest swath of the market. An index of large-cap stocks will likely see new companies moving in and out, which will force index fund managers to sell their holdings and replace them. As we’ve seen, that can trigger capital gains that get passed along to the investor. This is also the case with ETFs that screen for stocks with specific characteristics, such as the iShares S&P/TSX Canadian Dividend Aristocrats (CDZ). which distributed very large capital gains in 2010, 2011 and 2012 as it kicked out companies that failed to raise their dividends.

Total-market funds that hold large, mid and small-cap stocks are likely to distribute less in capital gains: they typically have much lower turnover, since their makeup rarely changes. DFA equity funds enjoy a unique tax benefit in this respect. They generally attempt to hold the entire asset class—the DFA Canadian Core Equity Fund (DFA256) holds more than 500 companies, for example, or about twice as many as XIC —but they do not track a specific index, so they are not forced to add or remove holdings just to avoid tracking error.

Subscribe

Subscribe to our e-mail newsletter to receive updates.