How Smart Savers Choose Between a 401(k) or Roth IRA

Post on: 1 Август, 2015 No Comment

How Smart Savers Choose Between a 401(k) or Roth IRA

Why Americans Keep Treating Their 401(k)s Like Piggy Banks

The Right Way to Tap Your IRA in Retirement

5 Simple Steps to the Perfect Portfolio

Q: My husband and I are in our middle 30s and both have good jobs in a professional field. We each make $60,000 a year. Should we be saving in our 401(k) plans, or contributing to a Roth IRA?

A: The answer, of course, is that you should be doing bothbut not necessarily in equal amounts, and much depends on your expenses and how much you are able to sock away. Lets look at some of the variables.

The first consideration is making certain both of you get the full amount of your employers matching 401(k) plan contributions. Fill up the 401(k) bucket first, says IRA expert Ed Slott, founder of IRAhelp.com. That is free money and you shouldnt leave any of it on the table. In many 401(k) plans, companies kick in 50 cents for every $1 you save up to 6% of pay. If both of you are in such plans, you should each contribute $7,200 per year to your 401(k) plans to collect the $3,600 your employers will match. But dont contribute more than that, and if you get no match, skip it entirelyfor now. Its time to move on to a Roth IRA.

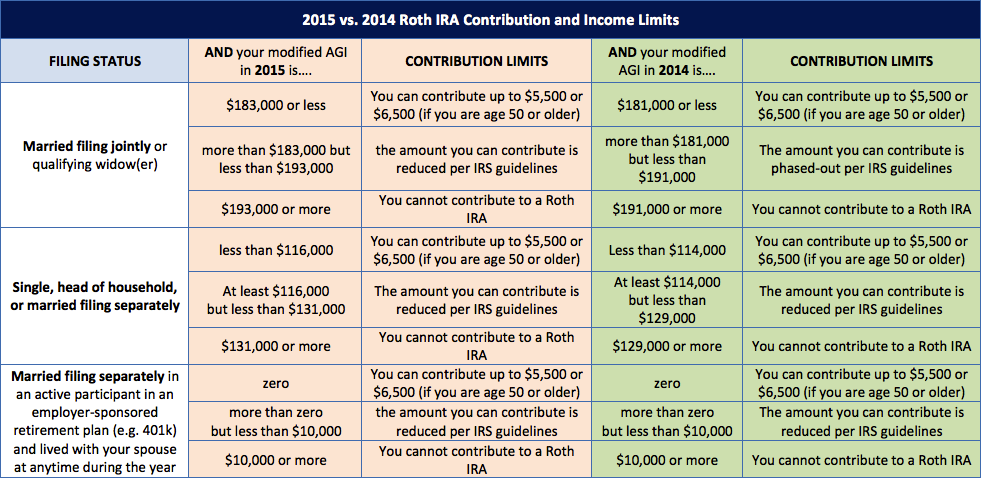

A Roth IRA is a far different savings vehicle than a 401(k) plan. Having one will give you more flexibility in retirement. Your 401(k) plan is funded with pre-tax dollars that grow tax-deferred. You pay tax when you start taking distributions no later than your 71 st year. A Roth IRA is funded with after-tax dollars that grow tax-free for the rest of your life and that of your spouse, and they have tax advantages for your heirs as well. You can also take early distributions of the principal that you contribute, without penalty or tax, should you run into a cash crunch. So after you have each maxed out your 401(k) match, shift to a Roth IRA. Each of you can save up to the $5,500 annual limit.

The downside of a Roth IRA is that you lose the immediate tax deduction that you get with a 401(k) contribution. Still, you eliminate the uncertainty of what future tax rates may do to your retirement income plan, says Slott. If tax rates go up, as many believe they must in the years ahead, your 401(k) savings will become a little less valuable. But your Roth IRA savings will be unaffected.

Once you have each saved $7,200 to get the company match of $3,600, and have also fully funded a Roth IRA to the tune of $5,500congratulate one another. That comes to $16,300 each of annual savings, or a Herculean savings rate of 27%. Most experts advise saving at a 15% rate, and even higher when possible. If you still have more free cash to sock away, you can begin to put more in your 401(k) to get the additional tax deferral. But you should first consider opening a taxable brokerage account where you invest in stocks and stock mutual funds. After a one-year holding period these get taxed as a capital gain, currently a lower rate (15% to 20%) than the ordinary income rate that applies to your 401(k) distributions.

Do you have a personal finance question for our experts? Write to AskTheExpert@moneymail.com .