How Sector Cycles Drive the Market Cycles

Post on: 29 Июнь, 2015 No Comment

Adam O’Dell | Monday, October 29, 2012 >>

If there is a single word I’m forbidden to utter when I’m at a party with my fiancée, that word is “cycle.” I tried it once…

“Do you want to sound like a physics professor?” she asked, with one eyebrow cocked.

“It’s finance.” I rebutted. “And some people actually enjoy talking about the markets.”

“It sounds like physics.” she repeated, unimpressed.

Like a good husband-to-be, I swallowed my pride, nodded my head with that obligatory “yes dear, you’re right” and have not shared my passion for all things cyclical with another unsuspecting party-goer again.

But you, dear reader, signed up to receive these Survive & Prosper emails. That means you’re neither unsuspecting nor a party-goer at this precise moment. You’re reading your emails right now and that makes you fair game. So let me tell you: cycles drive the markets.

Of course, you’ve probably heard this before. Market analysts have studied cycles for hundreds of years. The interesting thing is, the more we look for cyclical activity in the market – the more cycles we find. In fact, that’s part of the challenge in using cycles to understand the market’s moves – which one do you follow.

There is the business cycle and the investment cycle.

The earnings cycle and the commodities cycle.

The four-year presidential cycle and the “supercycle” Kondratiev Wave.

In fact, a slew of investment tenets and theories are based on the cyclical nature of the markets – even those that don’t include the word “cycle” in their name. The popular investing idiom “Sell in May and go away,” is based on the idea of seasonal cycles in the calendar year.

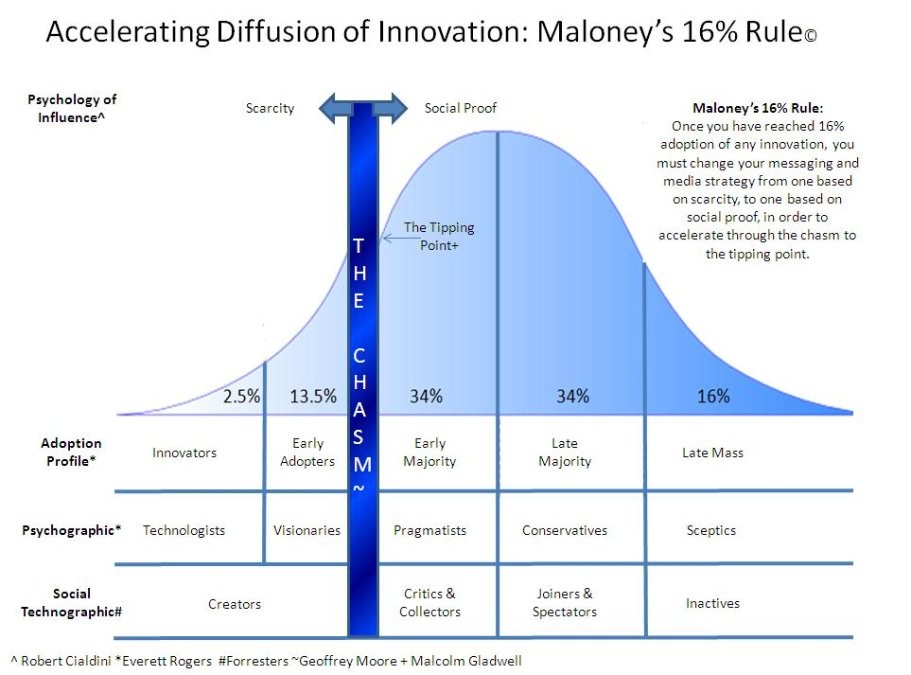

Sector rotation is another investment strategy based on cycles. The theory behind this is, at any point in time, some sectors are cycling into favor while other sectors are cycling out of favor. A graphic helps with explaining how this works.

Sector Rotation and Stock Market Cycles

The market is broken down into nine sectors. Popular sector-specific ETFs allow investors to buy and sell entire sectors, just as they would buy or sell individual stocks.

The graphic above shows one complete market cycle – a trough (or “valley”) on the left, a peak in the middle and another trough on the right.

The basis of a sector rotation strategy is this: some sectors perform best heading into market peaks, other sectors perform best heading into market troughs.

After the stock market peaks, the Consumer Staples (XLP), Health Care (XLV) and Utilities (XLU) sectors typically outperform the market. Once the market has bottomed, typically it’s the Technology (XLK), Financial (XLF) and Consumer Discretionary (XLY) sectors that lead the recovery. Likewise, in a strong bull market the Industrial (XLI), Materials (XLB) and Energy (XLE) sectors are usually the strongest performers.

Knowing just two things – where we are in the current cycle and which sectors perform best during that stage – can give you a significant edge in the market.

But I’ll admit, turning cycle analysis into profitable investing isn’t as simple as the chart above makes it seem. With investing, timing is everything…

I’ll Show You My Timeframe If You Show Me Yours

The challenge in turning the market cycles into cash is one of timing.

Get this – the Kondratiev Wave measures a cycle that spans 45 to 60 years from one peak to the next. That’s useless for the likes of day-traders.

Even the four-year presidential cycle can be difficult to trade if your investment horizon is shorter, or longer, than four years.

Now don’t get me wrong here. I have said the varying periods of the different cycles presents a challenge to successful investing… but I actually see it as an advantage. That’s because, if you know what to look for, you can find cycles in the stock market that match your individual style.

If you like buying stock and selling a year later, you’ll focus on cycles that match your desired holding period of one year. If you prefer being out of the market at the close of each day, like a day-trader, you’ll focus on intraday cycles.

Personally, I focus on “swing trading” – meaning I usually hold investments for a couple of months. I’ve found this is the sweet spot timeframe. It’s long enough for market moves to develop. And it’s short enough so I’m not at the mercy of an earnings report that’s several quarters into the future.

So with my goal of holding investments for a two- to three-month window in mind, I simply focus on the market cycles that match that duration.

The sector rotation model takes several years to play out. But these same sectors rotate in and out of favor over shorter timeframes, too. Analyzing these shorter cycles allows me to be nimble. I can hop on a hot Energy sector for a couple months in the summer, and be out by September. Then, I can invest in the Consumer Discretionary sector heading into the holiday shopping season, and be out by January.

Over the years I’ve fine-tuned the tools I use to determine which sectors are hot and which are not. Now, during the next few months I’ll work with a group of Beta Testers – I’m asking 25 Boom & Bust subscribers to volunteer – to put the final touches on these tools so that people like you could use this strategy to bulk up your investment portfolio.

Of course, I’ll never speak about this at cocktail parties!

Adam

P.S. I’ll send updates on our beta testing regularly, so stay tuned.