How Risky Is Your Investment Portfolio

Post on: 30 Май, 2015 No Comment

April 23, 2010

In investment circles you may hear words like “risk” and “diversification.” It relates to how well your investments can do or not do. If you have an investment portfolio or are getting into investing, how you build your portfolio is very important.

Everyone can benefit from investing. It is a proven way to make your money work for you in the long-term. You have earned it; why let it sit and basically gather dust? It could be working just as hard as you did to get it. That is where investing comes in.

A portfolio refers to the investment vehicles that you have. It can be stocks, bonds, CDs, money market funds, retirement accounts, savings accounts, etc. Whatever you put your money into can become a part of your portfolio.

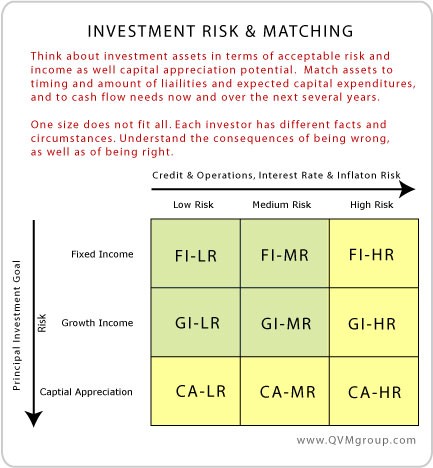

An aspect of a portfolio that concerns you need to be aware of is risk. Risk involves looking at the investments you want to make and seeing how they are viewed compared to the rest of the market. Usually, aiming for a higher risk also has the potential to yield greater monetary rewards, but it does come at a price. On the other hand, assuming no risk means no appreciable return on your investment.

Some investors shy away from risk, especially in the wake of economic upheaval and Ponzi schemes. You can lose your entire investment if the risk is too great. This leads us to diversification.

Diversification is one way to manage risk across your portfolio. Let’s say that you own a few CDs, maybe a money market fund, some bonds and of course some stocks. Stocks fall into different categories depending on potential risk: large cap, small cap, international, etc. Fluctuations in the stock market can increase your risk.

Having a money market fund can help reduce this risk and overall risk of your portfolio. With stocks, including some in each category can balance you out in the event of market changes. Putting all your eggs in one basket or stock is a disaster waiting to happen. The risk is too great or if you are ultra conservative by putting all your money in a money market fund, there is no risk but also no real return.

Having a diversified portfolio works on many levels. Depending on where you are in your life, you may need to assume more risk for a higher long-term return. Or, you may have many years to go before retirement and can assume some risk but will remain middle-of-the-road, tending towards long-term investments that will still get you what you need over time.

There is always some risk in your investment portfolio or there would be no reason to invest. To reap the gains you need to take a chance. Talk with a financial advisor about how much risk you need to assume in your portfolio at this time and read my article on diversification and asset allocation to get a better understanding about managing risk.