How Risky are Your Bond Investments Certified Financial Planners Bridgewater NJ Financial Pathways

Post on: 28 Июнь, 2015 No Comment

Fee Only Financial Planner

Please share:

Comparing the Relative Risk of Stocks and Bonds

How do you choose an investment for your 401k or IRA? If you are like most investors, past performance – especially RECENT past performance weighs heavily in your decision making. But be careful. There is a reason that all investment firms include a disclaimer that says something like “past performance is not predictive of future results” – because it is completely true! Over reliance on recent past performance results as an investment criteria is a critical mistake of many casual investors.

Let’s look at the past year as an example. Stocks have done very well this year. The S&P 500 has produced double digit returns. Except for a brief pullback of about 5% in June, stocks seem to only go up.

In contrast, bond investments have had a difficult road. Most bond funds are down for the year, despite bouncing back smartly after a particularly dismal time in May and June.

If I were to ask which is the safer investment, stocks or bonds, and gave you no information other than the year to date performance figures, you would be quite justified in telling me that stocks are the safer investment. But are stocks REALLY safer than bonds?

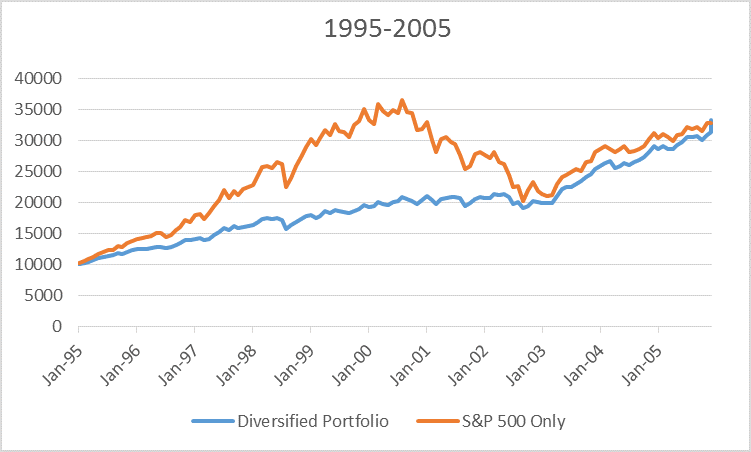

Have Stocks Become Safer Investments Based on Recent Performance? In part it depends on what you mean by safe. Most people define it as “how much money do I stand to lose if things get really bad”. Well let’s consider that 2008 and 2009 was “really bad” in most folks’ judgment. The S&P 500 lost over 50% of its value from November of 2007 to February of 2009. Could such an event happen again? You would have to be a fool to dismiss the possibility! So it is pretty clear that by most people’s definition of risk, stocks are a pretty risky place to put your money.

But those memories are quickly fading. Stocks have been going nowhere but up. Meanwhile, the media is focusing on the risks inherent in owning bonds in a rising interest rate environment. (when interest rates rise, bond prices tend to fall). Some self proclaimed experts now warn that bonds are riskier than stocks. And recent performance seems to confirm these warnings. The bond market has been having a very difficult year. But are bonds really riskier than stocks? Could your bond portfolio really lose 50% of its value in 15 months the way stocks did in 2008/09?

Estimating Downside Risk in Bonds.

History is a poor guide to estimating downside risk in bonds, because there have really been few instances in the past 30 years where interest rates have risen dramatically. Rising rates are the biggest risk faced by bondholders, since higher interest rates mean lower bond prices. Well rates have been heading down and bonds have steadily gone up for almost 30 years, with very little downside. But we will admit that today is different. The risk to bonds is perhaps greater today than in the past. So perhaps we can use another approach to quantify bond investment risk.

Fortunately bonds can be more predictable than stocks, at least as the relationship between interest rates and bond prices is concerned. We can mathematically estimate the response of bond prices to a rise in interest rates based on something called the “duration” of the bonds held in the fund. Important Factoid: The higher a bond or bond funds duration, the more sensitive it will be to changes in interest rates. While I will save you the detailed mathematical formula, it would take an astonishingly large move up in interest rates for the typical bond fund to lose as much as the 50% loss experienced by the S&P 500 from Nov 2007 to Feb 2009.

As an example, the most widely held bond mutual fund is the Pimco Total Return Fund. Using the average duration of the fund as provided by Morningstar, we can estimate that interest rates would have to increase by over 10% over a similar 15 month period in order for the Pimco fund to lose 50% percent of its value. That would imply a 10 Year US Treasury Bond yielding 12.5%, and mortgage rates at maybe 14%? While this could happen in theory, (1980 anyone?) the risk of this sort of event in the immediate future seems extremely low.

So admittedly another 50% plus decrease in stocks may also be unlikely. But a “bear market” in stocks is defined by a much more modest 20% decline in value. Such events are quite common throughout stock market history. In fact, based on past history it is probably pretty safe to assume that we will experience a bear market in stocks at some point in the next few years. So just how much would interest rates need to rise in order for the bonds in the Pimco Total Return portfolio to fall by 20%? The answer: Rates would need to rise from 2.5% (using 10 year US Treasury rates) to 6.75%. That would be an increase of 170%. Again, it is possible, but I do not think this is at all likely in the near term future for both political and economic reasons.

So although recent performance (and media chatter) make bonds seem like a risky investment, it also seems quite clear that stocks are still the investment most prone to a sudden and dramatic loss in value. This does not mean bonds are a “better” investment. This would require us to weigh the upside potential of stocks vs that of bonds as well the downside risks. But I do worry that investors who abandon bonds in favor of stocks based on recent market performance may find they have leaped out of the frying pan and into the fire.

All investments entail risk, including risk of principle. Many other factors can influence bond investment performance in addition to interest rate risk, including default and credit risks. Duration of a bond fund measures only the impact of interest rates on the value of individual bonds in a portfolio, and therefore cannot accurately predict the future price of a bond fund. Pimco Real Return is simply a convenient example, as the most widely held and well known bond fund, and this is not an endorsement or recommendation of this fund. Nothing in this article is intended to be investment advice. Speak with a Certified Financial Planner™ prior to taking any action.