How Quantitative Easing Affects the Labor Market

Post on: 29 Май, 2015 No Comment

After several years of negative and sluggish growth, the United States has begun to slowly emerge from the Great Recession. One of the most prominent tools the Federal Reserve Bank used to combat the economic downturn is quantitative easing. Also called QE, quantitative easing is when the government purchases debt in the open market to increase demand for those assets, thereby causing their prices to increase.

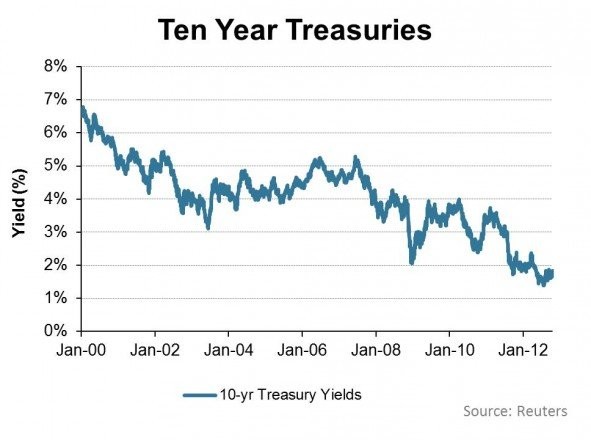

Given the inverse relationship between bond prices and interest rates, mortgage and interest rates have since plummeted to unprecedented levels. First-time homebuyers and those who want to refinance their homes have clearly benefited from the low rates. Investors with stocks are also reaping rewards, watching their portfolios double from the depths of the most recent bear market. Stocks are a more attractive investment in this economic climate because a certificate of deposit or money market account gets near zero percent return.

As a result of the slow but steady economic recovery, the Federal Reserve recently decided to end its quantitative easing program. While the policy’s effect on interest rates and the like is well documented, its impact on the labor market is less evident. Employment is a lagging economic indicator typically, so it’s usually the last to recover after a significant recession. This is an examination of the relationship between quantitative easing and the labor market and the pros and cons of the Fed’s quantitative easing policy. (For more, see the tutorial: The Federal Reserve .)

Pros of Quantitative Easing

Most businesses, whether small or large, will need to borrow money to expand and grow. During periods of government-supported bond buying, money becomes a very inexpensive asset. Interest rates during the Great Recession were near zero percent and still remain historically low. These low rates allow corporations to borrow money cheaply and expand their businesses, promoting, in theory, risk taking and expansion. As a result of increased investment – and a presumably good return on that investment – these corporations will need to hire and expand their workforce.

Supporters of quantitative easing will also point to the appreciation of riskier assets as a rising tide that lifts all boats. This increase in riskier assets (for example, stocks) is likely to result in an expanded labor force as greater wealth from capital gains and investment income spur spending on goods and services. As this money is spent, it works its way through the economy and has a multiplier effect. resulting in positive gross domestic product. or GDP, growth. Eventually the higher spending and investment lead businesses to create more jobs in an attempt to keep up with the demand for their offerings. (For more, see: Quantitative Easing: Does It Work? )

Loading the player.

Cons of Quantitative Easing

Quantitative easing skeptics suggest that the Federal Reserve’s actions have interfered with the normal marketplace pricing of bonds and other assets. Consequentially, any perceived gains in the labor market or other everyday indicators will be short-lived and will only last until another financial bubble. Furthermore, despite extremely low rates, the recovery from this recession has taken longer than any prior recession in U.S. history. Skeptics would also suggest that the recovery that has resulted from QE really benefits those who caused the economic crisis and need it the least: Wall Street and high net worth individuals.

Rising stocks prices typically reward high-income Americans as they have more investable assets and disposable income. According to recent reports. most Americans are earning less than they were in 1980 in today’s dollars while facing exorbitant increases in health care, food and higher education. Quantitative easing isn’t going to cause these costs to decrease any time soon.

Skeptics will also question the quality of jobs created during this extended period of quantitative easing. More people are underemployed during this recovery than prior recessions: they’re working below their skill level due to lack of availability of higher paying jobs. Additionally, employment and labor gains are based upon the ability of individuals with adequate skills to meet the demands of today’s workplace. According to a US Census study. Americans without higher education may earn up to 70 percent less that those with at least a college degree throughout a 40-year work career.

Additionally, the suggestion that quantitative easing will cause a structural shift in the employment landscape is unproven. Critics also worry about inflation expectations as a result of the amount of money in circulation. At some point, this additional float of money will lead to inflation or “too many dollars chasing too few goods.” This will likely hurt those at the lower end of the economic spectrum, reduce the purchasing power of the US dollar, and lead to another hit in wages in real terms.

The Bottom Line

There are pros and cons when it comes to the impact of quantitative easing on the labor market. Many people and many corporations have enjoyed robust recoveries in wealth and profits, perhaps as a result of quantitative easing; and the highest earners and highest net worth individuals are doing exceedingly well. This spills over into Americans’ economic confidence and spending habits and will eventually impact labor market in a positive way.

Quantitative easing skeptics suggest that the Fed program, albeit timely and probably necessary, won’t have a lasting impact on the labor market. Critics point to Japan and European countries as examples of nations that have tried the same policies to no avail. They also point to looming inflation as an inevitable reaction to an excessive money supply. Ultimately, the relationship between quantitative easing appears to be a classic case of causation versus correlation. Many economic historians will look back and judge the impact of quantitative easing on the labor markets.