How Much Company Stock Should You Own in Your Retirement Account

Post on: 29 Май, 2015 No Comment

D o you work for a company that is public traded and also offers that stock in your retirement plan? If so, what percentage does that stock represent of your retirement portfolio? 10%? 25%? 75%? To my complete discomfort, I came across one gentleman whos entire retirement portfolio was in one stock. Prior to 2008, it was a great dividend payer and had appreciated greatly over the years. Unfortunately, that stock saw a significant drop in value. That gentleman helplessly watched 75% of his entire portfolio vanish.

This stock was just one of many examples over the years. The collapse of Lehman Brothers and several other major financial institutions in 2008 should have served as a wake-up call to the millions of American workers who have access to company stock as an investment within their employer-sponsored retirement plan.

Familiarize Yourself With Your Plan

Too many times I see investors sign up for their retirement plan without doing any research. You retirement is one of the most important aspects of your life. Take some time to find out exactly how your plan works.

Does your employer make matching contributions in the form of company stock? Are there rules governing management of the stock within your account? You can request a Summary Plan Description, which details the rules. Get with your HR department and to make sure you understand how your plan affects you. If they cant help (which Ive seen many of times), make an appointment with a financial advisor who is versed on company retirement plans.

Do You Own Too Much Company Stock?

Could your company be the next Lehman Brothers? What percentage of your total assets does it represent? There are no fixed guidelines but I would recommend a maximum of 10% to 15%. Owning more could expose you to financial risk if the stock suddenly declined in value. The ideal allocation for you will depend on your goals, risk tolerance, and time horizon, factors you may want to review with a financial professional.

Review Your Entire Strategy.

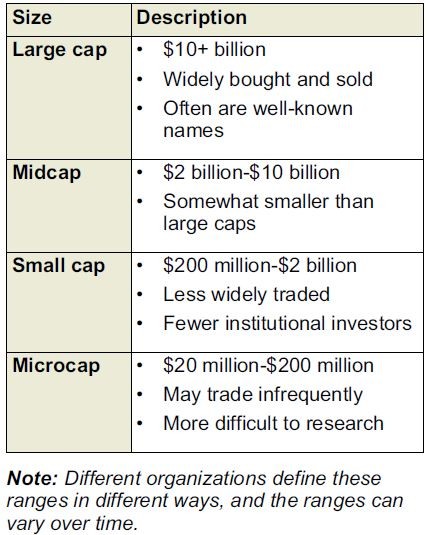

Sometimes employees cannot fully control the allocation of company stock within their account. Some employers require matching contributions to be invested in company stock or they may limit employees ability to sell the stock prior to a certain age. If you determine that company stock represents too much of your portfolio, there are things you can do to manage the risk. You may want to consider allocating a portion of your assets to different types of investments. If your employer is a retail company, for example, you may be able to diversify and consider other types of stocks.

Dont Forget Your IRAs

If youre not completely satisfied or comfortable with the investment options in your 401k, then you can always open an IRA. Youll be limited in how much you can contribute, $5,000 under 50 and $6,000 over 50- but at least youll have more control in what your money is going in to. Plus, if you have a spouse (even if shes not working), you can open a spousal IRA and be allowed to contribute just as much for him/her.

As much as you despise your companys retirement plan, dont give up the match. Contribute as much to at least get the match (if they offer one) and the rest could then go into the IRA (traditional or Roth).