How Market Conditions Affect Interest Rates

Post on: 28 Май, 2015 No Comment

How Market Conditions Affect Interest Rates

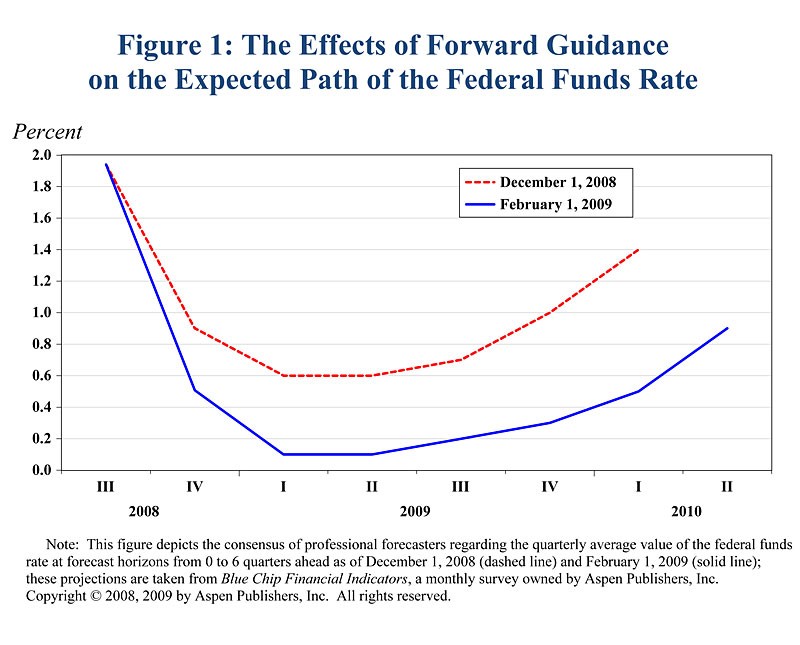

When the Chairman of the Federal Reserve lowers rates, he lowers the Federal Funds rate. Its the interest rate at which large banks lend funds to one another and is a short-term rate. Mortgage interest rates are long-term, up to 30 years. Longer-term interest rates are sensitive to expectations about inflation. When short-term rates fall, like the ones the Federal Reserve controls, borrowing and spending usually increase, which can actually cause inflation. Longer-term rates, like mortgage interest rates, can rise when concerns about inflation increase.

Markets are often ahead of the Federal Reserve. Mortgage interest rates are determined every day in active public markets. If those markets believe the economy is slowing, interest rates may fall as markets anticipate that the Federal Reserve might lower short-term rates. This happened in the last half of 2000 when mortgage rates began steadily dropping, even though the Federal Reserve left their short-term rates unchanged. The opposite can happen as well. Mortgage rates can rise well ahead of the Federal Reserve increasing short-term interest rates.

It’s almost impossible to accurately predict the future of something as complex as the U.S. economy. However, it is important that we, as mortgage consumers, understand some of these market dynamics. Sometimes, a lack of understanding can cost us a lot of money.

Bond prices and bond yields have a direct effect on long term interest rates. Bond prices and bond yields always move in opposite directions (if one pays more for a bond, the yield decrease, and vise versa). Bond prices, hence their yields, are affected by many economic indicators. Some of the monthly economic indicators the bond market pays close attention to are Non-Farm Payrolls, Unemployment Rate, and Gross Domestic Products, Consumer Price Index, Producer Price Index, and Retail Sales. As a rule of thumb, when these economic indicators forcast a strong or inflationary economy, bond prices fall and bond yields increases, interest rate will go up. If a weak economy or low inflation is expected, bond prices rise, bond yields falls and rate will fall.

It is important to note that Adjustable Rate Mortgages (ARMs) and Fixed Rate Mortgages are affected differently by an increase made by the FED or Federal Reserve. The FED makes adjustments to the short term rates which in turn affects things like the bond market, a key determining factor in the 30 year fixed rate. The 30 year rates work in the opposite direction to the 10 year note. If the price of the 10-yr note falls, the rates rise.

Adjustble rates are comprised of two things an Index, and a Margin. The margin is set by the banks so when the FED adjusts the rates, banks in turn make adjustments. The Index is a regularly published rate that is independent of the lender and generally used as a market indicator. Examples of and Index would be: PRIME, LOBOR, MTA, COSI, etc.

Because Adjustable Rate Mortgages and Fixed Rate Mortgages are affected differently it is very important to find a mortgage professional who understands the market conditions and the relation between the bond markets and interest rates. Your mortgage broker can help you make the decision on when to lock a rate which can save you thousands of dollars over the life time of your loan. He can also help you choose the right program!

This is why it is important to shop for your mortgage with lenders on the very same day. Key factors can see mortgage rates changed several times in a given week, sometimes in the same day. The lender that you get a rate from on Monday may not be able to give you the same rate on Wednesday.

One aspect of the economy that can cause interest rates to rise is inflation. One of the reasons interest rates were so high back in the 1980’s was that the market felt that inflation was out of control. Investors demand high rates of return when there is inflation because they are investing or loaning with today’s dollars and being repaid with tommorrow’s money. If the market senses inflationary trends, interest rates will usually rise.

Many domestic and international investors, particularly those investing in the country’s stock and currency markets, will respond to a hike in interest rates by moving money out of the country. This is due to a belief that the increased cost of borrowing will weaken balance sheets and devalue equities, thereby creating a ripple effect which weaken’s the country’s currency.

When the Stock Market is in a Bull trend (Up Trend) it is indicative of monies flowing into the market. Historically, The stronger the up trend in stocks, the weaker the realestate market will be durring the same period. Weak realestate markets (lack of demand) will result in declining prices in home values, which usually correlate to a rise in mortgage interest rates.

This is why you must rate lock if you like the rate available to you.