How LowVolatility ETFs Can Enhance Your Success

Post on: 29 Май, 2015 No Comment

One of the advantages of investing in the modern era is that there are many new tools and strategies that have been made possible by enhanced data management techniques. With the ability of computers to rapidly parse mountains of mathematical data in search of hidden relationships, new investing ideas can emerge and be tracked. Looking at the overall picture, a number of new paradigms have emerged that manage to challenge the traditional investment outlook. Among the other revelations is the one that shows how low-volatility ETFs can enhance your success.

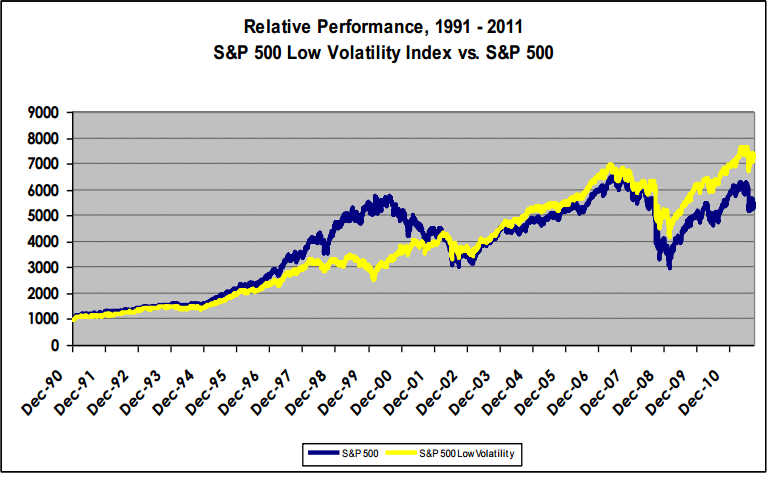

Conventional wisdom says that higher risk warrants a higher reward. In other words, a high risk investment should yield more than a safer, low risk investment. Among the ways in which risk is apportioned between the various classes is through an examination of the volatility of the asset in question. Therefore, a high volatility investment should carry both a greater reward as well as a larger potential for incurring loss, yet this is not necessarily correct as an ironclad rule would assume it to be.

What makes a low volatility ETF an attractive investment is the limited downside risk inherent in any low volatility asset. Because they do not move much and are not subject to wild swings in value, low volatility stocks are already trading reasonably close to the downside of their trading range, yet retain the ability to hitch onto any general uptick in market conditions. Of course low volatility means that it does not rise as far or as fast as its high volatility rivals. Over time, however, the ratio between the low volatility floor and the rising tide effect produces greater returns over time in comparison to the extreme up and down swings of other, more spectacular movers.

In addition to their surprising advantage in the risk/reward ratio, many low volatility ETFs are also built around the desirability of having dividend payments as icing on the cake. Not surprisingly, many steady-state stocks are also the ones that are most likely to offer significant dividend payments. Combining dividends and the limited possibility of significant price drops makes for an attractive package even without any upside movement in price, but the combination has proven to be quite unexpectedly profitable to those who have been conditioned by institutional tradition to assume things about the risk/reward ratio that have now been proven to be incorrect.

For those investors who have an interest in beating the general average market return without losing sleep about the extended risks they are exposing themselves to, low volatility ETFs and dividend-intensive low volatility funds offer a real chance for them to achieve their goals without worrying too much about the consequences of failure. Understanding how low-volatility ETFs can enhance your success is the first step in getting off the high risk investment treadmill and moving over into calmer, more profitable avenues.

How Low-Volatility ETFs Can Enhance Your Success