How Long Will Your Nest Egg Last

Post on: 16 Август, 2015 No Comment

Aug 1, 2013 by Kurt

Len Penzo is running a series on his blog called How I Live on Less than $40,000 Annually. He finds people from different geographic areas and circumstances and lets them explain how they live while spending less than $40k per year.

Could You Live on $40,000 a Year in Retirement?

Lens series made me think about whether some people could live on $40,000 or less in retirement. Many arent going to have a choice, so it seems. Then I wondered how large a nest egg one would need to withdraw $40,000 a year and run little risk of running out of money. The answer depends on many future variables, but I isolated two important ones—future inflation and the return earned on savings—and created this graph (which I like to do):

The three lines show three different starting nest egg sizes: $1 million, $500,000, and $250,000. Then to take into account both inflation and return on the invested nest egg, I plotted real return on investment across the bottom and years until the nest egg is gone on the vertical axis (or y axis for you engineers). Real simply means after inflation. Example:

Inflation during your retirement years: 2%

Return you earn on your savings: 5%

Real return on investment = 5% − 2% = 3%

So plug in your own expectations. Note that real returns can be negative if you expect inflation to outpace your investment returns.

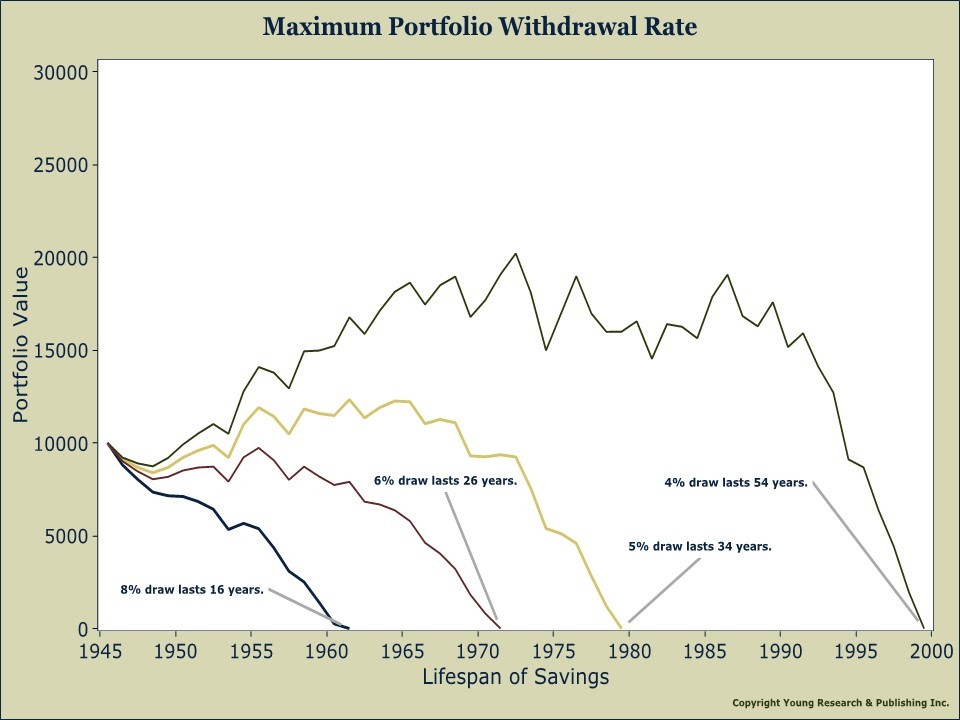

How Much Can You Withdraw to Make Your Nest Egg Last 30 Years?

Now lets ask the same question a bit differently. Given a $1 million, $500k, or $250k nest egg, how much can you withdraw annually to make your savings last 30 years? Here you go.

Again based on your assumptions for a real rate of return on your savings, this graph shows the most you can withdraw each year to make the nest egg last 30 years. In the example, you could withdraw $28,400 annually from a $500,000 nest egg that earned a 4% annual real rate of return over the 30 years.

How to Use the Graphs in the Real World

You can of course retire from your full-time career whenever you want, but information like this will give you a sense of how much extra income youll need to supplement withdrawals from your nest egg to meet your living expenses. whatever they may be. Youll be getting Social Security (or the equivalent if you live outside of the U.S.) we hope, but if theres still a deficit in your household budget, youll have to keep earning to fill the gap, change your lifestyle to spend less, or both.

A BIG Caveat

As you may have noticed, stocks have become quite crash-prone over the past 15 years. The problem with an analysis like the above is it implicitly assumes everything happens smoothly and regularly. In particular, the average annual real investment return is assumed to happen each and every year of the graphs time horizon. We know thats not how things work in the real world.

Lets say for you year 1 in the first graph was 2007. (For millions of people, it was.) You may have seen your $1,000,000 nest egg Wall Streeted to $600,000 by early 2009. Would you have then had the nerve to continue withdrawing, say, $50,000 annually? I wouldnt have. Stocks have recovered, but if they hadnt you would have jumped lines so to speak on the first graph, suddenly finding yourself on a trajectory that would exhaust your badly cracked nest egg long before the age to which you hope to live.

You may draw your own lesson from the past five years, but for me its aim to build a nest egg about double the size I think I might need if stocks will comprise a significant portion of my investments after Im within a decade of my target retirement date.