How Long to Double Your Money Use the Rule of 72

Post on: 16 Март, 2015 No Comment

Rule of 72, Is it Useful?

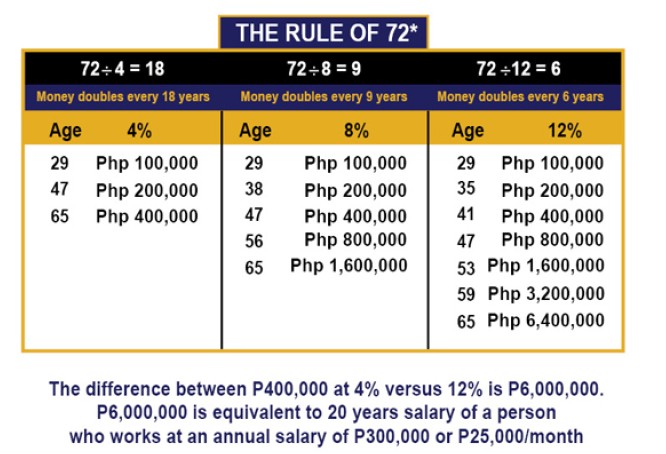

The Rule of 72 is a math rule, or formula, that can give you an approximate estimate of how long it might take to double your nest egg for any given rate of return. The Rule of 72 makes a good teaching tool to illustrate the impact of different rates of return, but it makes a poor tool to use in projecting the future value of your savings, particularly as you near retirement. Let’s look at how the Rule of 72 works, and the best way to use it.

How the Rule of 72 Works

Here is how the Rule of 72 works: take seventy-two divided by the investment return (or interest rate your money will earn) and the answer tells you the number of years it will take to double your money.

For example:

- If your money is in a savings account earning three percent a year, it will take twenty-four years to double your money (72 / 3 = 24).

- If your money is in a stock mutual fund that you expect will average eight percent a year, it will take you nine years to double your money (72 / 8 = 9).

Calculate yourself with this Rule of 72 Calculator .

The Rule of 72 as a Teaching Tool

The Rule of 72 can be useful as a teaching tool to illustrate the different needs and risks associated with short term investing verses long-term investing. The example uses the Rule of 72 to explain why it doesn’t make sense to take unnecessary investment risk for short term investment needs.

If you are taking a trip a mile up the road to the corner store, it doesn’t much matter if you’re driving at ten miles an hour, or twenty miles an hour. You’re not traveling that far, so the extra speed won’t make much of a difference in how quickly you get there. If you’re traveling across the country, however, extra speed will significantly reduce the amount of time you spend driving.

When it comes to investing, if your money will be used to reach a short term financial destination, it doesn’t much matter if you earn a three percent rate of return, or an eight percent rate of return. Since your destination is not that far off, the extra return won’t make much of a difference in how quickly you accumulate money.

It helps to look at this in real dollars. Using the Rule of 72 you saw that an investment earning three percent doubles your money in twenty-four years; one earning eight percent in nine years. A big difference, but how big is the difference after just one year?

Suppose you have ten thousand dollars. After just one year, in the savings account earning three percent, you have $10,300. In the mutual fund earning eight percent, you have $10,800. Not a big difference.

Stretch that out to year nine. In the savings account you have about $13,050. In the stock index mutual fund according to the Rule of 72 your money has doubled to $20,000. A much bigger difference. Give it another nine years and you have about $17,000 in savings, but about $40,000 in your stock index fund.

Over shorter time frames, earning a higher rate of return does not have much of an impact. Over longer time frames, it does.

Is the Rule of 72 Useful as you Near Retirement?

The Rule of 72 can be misleading as you near retirement. Suppose you are 55, with $500,000 and expect your savings to earn about 7% and double over the next ten years. You plan on having $1,000,000 at age 65. Will you? Maybe, maybe not. Over the next ten years the markets could deliver a higher or a lower return that what averages lead you to expect.

By counting on something that may or may not happen, you may save less, or neglect other important planning steps like annual tax planning .

Instead of the Rule of 72

The Rule of 72 is a fun math rule, and a good teaching tool, but that’s it. Don’t rely on it to calculate your future savings. Instead, make a list of all the things you can control, and the things you can’t. Can you control the rate of return you will earn? No. But you can control the investment risk you take, how much you save, and how often you review your plan.

Rule of 72 Even Less Useful Once in Retirement

Once retired, your main concern is taking income from your investments, and figuring out how long your money will last depending on how much you take. The Rule of 72 doesn’t help with this task. You need to look at strategies like:

- Time Segmentation — Income For Life

- Withdrawal Rate Rules

- 7 Ways to Build a Floor of Guaranteed Income