How interest rates can drastically affect real estate prices

Post on: 28 Май, 2015 No Comment

How interest rates can drastically affect real estate prices

Posted: June 8th, 2005 Comments: 1

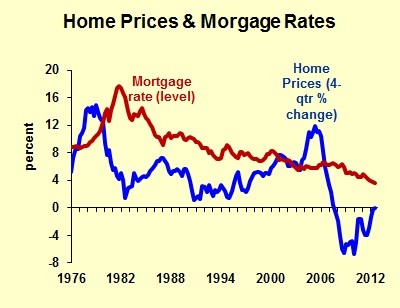

Do you know the power interest rates have over real estate prices? Well, they can drastically affect real estate prices and the profits you make on your properties, probably more than you realize. If you look at the graph just above, you will see that the total amount of mortgage that you can afford changes significantly (assuming you want to keep the same monthly payment) as interest rates fluctuate.

As an example, lets take a mortgage payment of $1000 at an interest rate of 5% amortized over 30 years. With these numbers, you can pay a mortgage principal of $186,281.62. Now lets increase the interest rate by 1% to 6%. If you want to maintain the same monthly payment of $1000, then you cannot sustain a mortgage of more than $166,791.61, making the mortgage principal amount 10.97% less than before. Lets take a higher, more realistic interest rate, of around 8%, what difference does this make? Well you can now only afford $136,283.49 of mortgage principal, a significant drop of 26.8%.

Many people believe that what has driven the real estate market to todays high prices is the investment value of properties, plain and simple, just like stocks in the dot com boom. However, if you ask someone walking down the street what started the boom, as in what exactly is the investment value, most wont be able to answer you. Put fairly simple, housing got affordable really quick because interest rates dropped like a rock, to their lowest in decades! The reality is that for each 1% interest rates dropped, a person could afford a lot more mortgage with the same monthly payments, especially when the interest rates are on the lower side. That is what initially fueled the real estate market, however as the flames burned high, the market has taken a fire all of its own because people forget why the market started to get hot.

From the first graph we can extrapolate the data to create the graph just above.The good news is that we can see the mortgage principal drop to be more significant at first, so if you can ride it out for the first little while, youll probably be able to make some real money, pennies on the dollars. All those unfortunate souls that have been buying up real estate without really doing the research or working the numbers, or that are on the edge, will most likely get squeezed out and cause some over zealous fire sales, much like the dot com bubble and bust of 2000. For the smart investor, the next few years may become really fertile lands for making profits.

For your interest, Ive added below the table used to compute these graphs (for a monthly payment of $1000):