How I Value Financial Companies

Post on: 13 Май, 2015 No Comment

Valuing financial companies (think insurance companies and banks) has always been a bit of a sore point for me because they don’t generate revenues. That may not sound so bad, but along with profits and dividends, revenues are a key part of how my stock screen decides which stocks are likely to be good value and which aren’t.

It’s pretty simple really; the screen checks each company’s 10 year track record of revenues, profits and dividends. It then makes a trade-off between how quickly they’ve grown and how consistently they’ve grown on the one hand, with how high the share price is relative to cyclically adjusted earnings and dividends on the other hand.

Financial companies don’t generate revenues, so they don’t fit that model.

Years ago I used to exclude finance companies, but then I introduced a workaround, which was to ignore the missing revenues. This in turn meant that valuations were based on earnings and dividends alone. It wasn’t perfect, but it wasn’t reckless either as the valuation was still based on 10 years of earnings and dividend data which is more than most investors look at.

But I always felt that something was missing.

On and off I’d search for a replacement or proxy for revenues, but didn’t find anything suitable. And then a few months ago I read something which seemed too obvious at first but, after some extensive data digging, seems to work well.

The idea is almost painfully simple, and to be honest most other investors do this already; it’s to use book value as a proxy for revenue.

Why book value makes a reasonable proxy for revenue for financial companies

If you look at most analyses of insurance companies and banks, you’ll see book value mentioned somewhere. Although book value is mentioned occasionally for non-financial companies it’s a much less important metric.

So why is book value more relevant for financial companies than non-financials? It all comes down to how they generate profits.

In very simple terms, banks make money on the difference between the interest they charge on money they’ve lent out versus the interest they have to pay on money they’ve borrowed.

The more money a bank borrows at lower interest rates (e.g. deposits or loans from other banks or the government) the more it can lend out at higher interest rates (e.g. overdrafts, mortgages or business loans), which means more profit made on the spread between those interest rates.

So book value, which is assets (loans) minus liabilities (deposits etc.) is generally proportional to the earnings of the bank, in much the same way that revenues are proportional to earnings for non-financial companies (although the ratio differs widely between one industry and another).

It’s a similar story for insurance companies.

In their case (again very simply) they make some money directly by taking a percentage of premiums paid, but they also make money by investing those premiums.

When you pay your car insurance the premium (minus commissions and fees) ends up in a pool along with millions of other premium payments which is known as the float. The float is needed in order to pay out any claims promptly; it’s essentially the buffer that smooths out the financial risks associated with crashing your car into nice and simple monthly or yearly premium payments.

So as with banks the insurance company’s book value, which is somewhat simplistically the difference between assets (the float) and liabilities (expected claims), is a good indicator of the earnings power of that insurance company.

Looking for consistent growth of book value, earnings and dividends

Okay so book value can be a proxy for revenues, but how does that help when you’re trying to value a financial company?

With non-financial companies I look for a long history of revenue growth, and the steadier that growth has been the better. So given that book value can be used as a proxy for revenue, what I’m looking for in financial companies is a long history of steady book value growth.

Think of book value as the top line in the income statement. It’s the source that everything else flows from. After costs are deducted you’re left, more or less, with earnings, and once reinvested earnings are deducted you’re left, more or less, with dividends.

And so just as with non-financial companies where I look for a long history of consistently growing revenues, earnings and dividends, for financial companies I now look for a long history of steadily growing book value, earnings and dividends.

Seeing a history of growing book value gives me some indication that any growth of earnings and dividends is sustainable, or at least more sustainable than if book value wasn’t growing and keeping pace with earnings and dividends.

Admiral — A shining example of consistent book value growth

To show you what this looks like I’ll use Admiral Group PLC (OTCPK:AMIGY ) as an example of how this works.

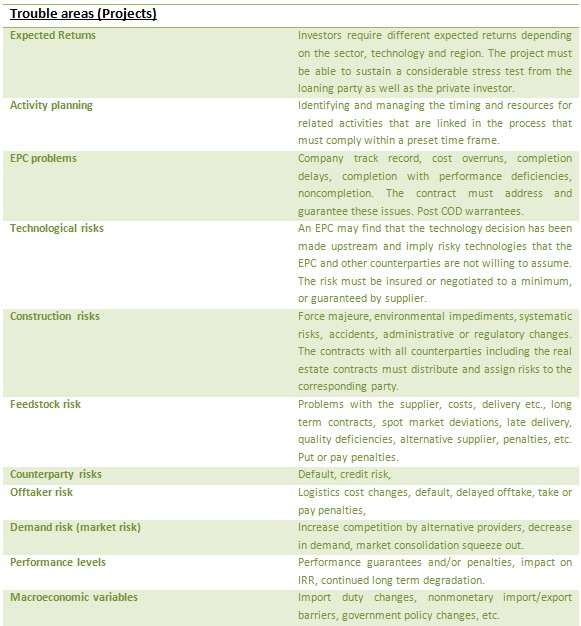

Admiral has, quite frankly, an astonishing track record. The chart below shows how the company’s book value, earnings and dividends have grown over the last decade and there are quite literally no other financial companies listed in the UK with a better record of consistent growth.

This chart demonstrates that at least for some financial companies there is a clear link between book value and earnings, and eventually dividends. It isn’t always the case, and the link is almost never as obvious as it is for Admiral, but I think the link is strong enough in most cases to make long-term book value growth a very useful tool when valuing financial companies.

Having resolved the no revenue problem, the rest of my valuation model is then exactly the same for financial companies as it is for non-financials (check out these worksheets and spreadsheets if you’re not familiar with it).

Disclosure: I own shares in Admiral and it’s also part of the UKVI model portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.