How ETF Investors May Profit From Currency Devaluation

Post on: 14 Июль, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

NEW YORK ( ETF Expert ) — ETF enthusiasts can make profitable investing decisions based upon government/central bank currency manipulation.

For example, a little more than a month ago, I wrote A Foreign Stock ETF for a Rapidly Declining Currency.

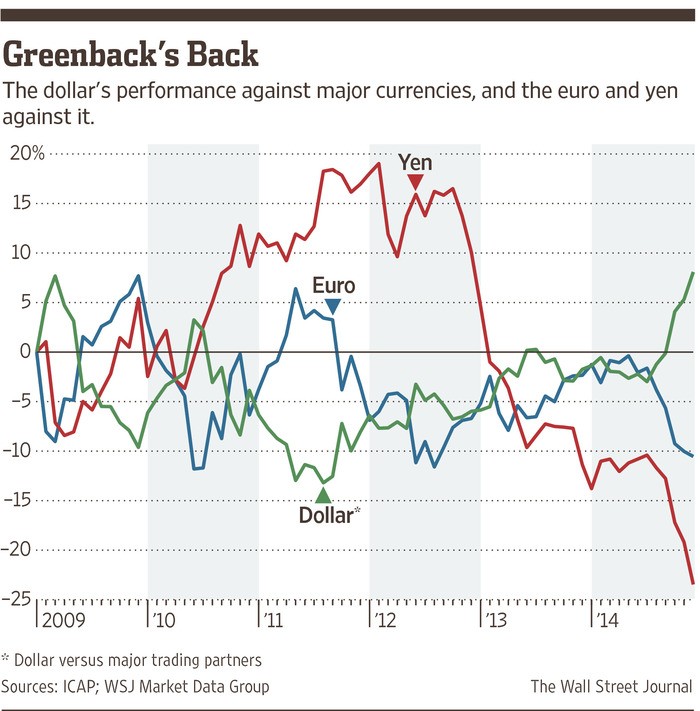

In the article, I discussed Shinzo Abe’s determination to devalue the yen substantially through aggressive monetary intervention so that Japan’s exports would be more competitive on the world stage.

The beneficial trade? An investor who chose WisdomTree Japan Hedged Equity (DXJ ) has seen month-over-month gains of 7.9%. In contrast, unhedged iShares MSCI Japan (EWJ ) is up a mere 0.5% month-over-month; in spite of Japanese equities performing well, the rapid decline in the yen is killing the unhedged iShares vehicle.

Obviously, one key to success in the current marketplace is being on the right side of a currency’s trend. This isn’t always easy to do.

Readers and show listeners know that I highlighted WisdomTree’s Europe Hedged Equity (HEDJ ) for many months, believing it to be a better choice than an unhedged Vanguard Europe (VGK ).

Yet, the euro that I believed was destined to remain in a downtrend in November recovered quickly in December due to the U.S. cliff debate; month-over-month, the unhedged VGK has picked up 4% whereas the hedged HEDJ has garnered 3%.

In essence, one is unlikely to know a currency’s near-term trend with precision. On the other hand, a 100-day intermediate-term trendline may prove beneficial for identifying the direction of a currency or group of currencies.

Consider the circumstances associated with WisdomTree Emerging Market Currency Fund (CEW ) — an ETF that offers exposure to a basket of 15 emerging-market currencies. Nearly six months ago to the day, CEW rose above an intermediate-term 100-day trendline. Moreover, the trend higher has remained intact.

Not so surprisingly, this has favored unhedged emerging market equities over the same time period. Vanguard Emerging Markets (VWO ) has picked up 19% over the past six months whereas the S&P 500 SPDR Trust (SPY ) has gained 12%.

While currencies alone cannot determine where stock markets will go, ETF investors may need to think carefully about the selection of a dollar-hedged or unhedged equity fund going forward.

For instance, CurrencyShares Canadian Dollar (FXC ) is below its 100-day as well as sitting near a three-month low.