How equalweight ETFs have lost their balance

Post on: 21 Июль, 2015 No Comment

JonathanBurton

SAN FRANCISCO (MarketWatch) — Equal-weight indexing has been getting more attention lately. But perhaps it’s time investors scaled back their enthusiasm: This niche strategy may not deserve equal billing with traditional index strategies.

Buffett: Berkshires 2012 return was subpar

In his highly anticipated annual shareholder letter, Warren Buffett said Berkshire Hathaways 2012 weren’t good enough. MarketWatchs Laura Mandaro explains why. (Photo: Getty Images)

Stock index funds typically weight holdings by market capitalization—or the total value of a company’s shares outstanding. Thus, the biggest, most-popular stocks sway returns more than their plain-Jane classmates.

Equal weighting doesn’t play such favorites. The equal-weight version of the Standard & Poor’s 500-stock index SPX, -0.61% , for instance, gives International Flavors & Fragrances Inc. IFF, -1.22% almost exactly the same clout as International Business Machines Corp. IBM, -2.34% — even though the cosmetics and food-industry giant sports a $5.8 billion market cap compared with Big Blue’s $222 billion value.

Proponents of equal weighting say it limits the harm a single tumbling stock can do. Apple Inc. AAPL, -0.69% makes up 3.1% of the capitalization of the S&P 500, so its recent steep slide drags on the index as much as its large weight helped on the upside. At only about 0.2% of the equal-weight S&P 500 index, though, Apple’s impact is softened, for better or worse.

Supporters of equal-weight indexing also fault the market-cap approach for buying high and selling low, since investors get a larger stake in stocks that have been on a roll and smaller positions in stocks that have tumbled.

“The market has a nasty tendency of over-relying on the good companies and paying too large a premium [for them] on the tacit assumption that recent success portends long-term future success,” says Rob Arnott, CEO of investment firm Research Affiliates LLC. The firm’s RAFI indexes are tracked by several exchange-traded funds from provider Invesco PowerShares that rate stocks based on financial strength and other fundamental corporate measures.

Equal-weight proponents are encouraged by the recent run of the $4 billion exchange-traded Guggenheim S&P 500 Equal Weight, RSP, -0.69% the largest such offering, whose returns have outperformed the SPDR S&P 500 SPY, -0.61% by a percentage point or so annualized over the past three years, and by more than two points over five years. On a year-by-year matchup, the equal-weight ETF wins in five of the past nine years.

Then again.

But don’t dump your mainstream index funds and ETFs just yet. While cap-weighting has limitations, equal weighting has its own challenges. Switching to equal weighting can upset a portfolio allocation. Equal-weight funds rebalance all positions quarterly, selling winners and buying laggards. That tilts the portfolio slightly toward value stocks, an approach that has produced above-average returns over time but demands a bargain-hunting mind-set that not every investor shares.

Also, the S&P 500 cap-weighted index is biased to large-company stocks, while the equal-weight S&P 500 leans toward mid- and small-caps, which are given to wider performance swings than their bigger brethren.

The equal-weighted S&P 500 index, for instance, fared worse in the 2008 market meltdown than its cap-weighted counterpart, losing 40% versus 37%. Equal-weight bounced back strongly in 2009, gaining 45% versus a 26% advance for the traditional index.

“You may be reducing your exposure to giant megacaps, especially when they reach bubble territory, but you’re also dramatically increasing your exposure to small and midcap stocks, which tend to be more volatile,” says Samuel Lee, an ETF analyst at investment researcher Morningstar Inc. “There’s no free lunch.”

An equal-weighted index can also have very different sector exposure. The largest sector by cap weight in the S&P 500 is technology, recently making up 18.3% of the index. For equal-weight, the biggest sector is financials, at 16.6%, with tech running third at 14%.

Moreover, there have been periods when the equal-weighted S&P 500 has trailed far behind the standard benchmark. In the late 1990s, equal-weight’s small-cap and midcap stalwarts couldn’t compete with the returns from large tech and telecommunications stocks.

Some laggards

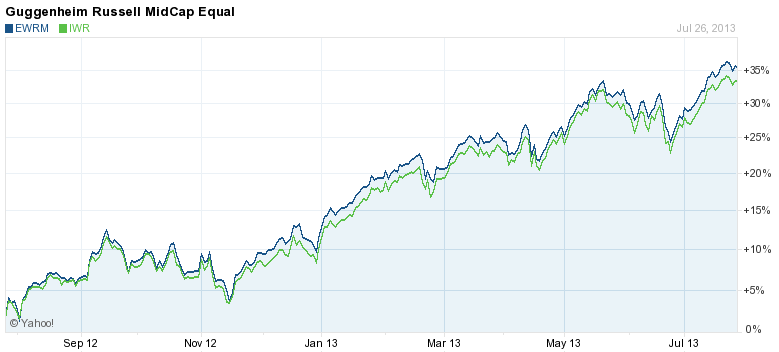

And while equal weighting has been a winner lately with both the S&P 500 and the Nasdaq 100, that hasn’t been so with some other equal-weight offerings. Guggenheim Russell 1000 Equal Weight EWRI, -0.70% and Guggenheim Russell 2000 Equal Weight, EWRS, -0.58% for example, haven’t kept up with non-equal-weight cousins over the past 12 months. Guggenheim recently announced it would close three equal-weight ETFs that never gained traction: MSCI EAFE Equal Weight US:EWEF ; S&P MidCap 400 Equal Weight US:EWMD , and S&P SmallCap 600 Equal Weight US:EWSM .

If these caveats aren’t caution enough, equal-weighting isn’t cheap. The Guggenheim S&P 500 fund charges 0.40% versus 0.09% for SPDR S&P 500 and 0.10% for Vanguard Mid-Cap VO, -0.58% — an ETF that Morningstar’s Lee says the Guggenheim fund closely mirrors in performance. Other equal-weight ETFs also lose the price battle to cap-weighted index funds.

Says Lee: “There might be something to equal weighting, but I feel there are better products out there that can achieve much of the same with lower cost.”