How does shorting the S P 500 ETF as a hedge against a stock market crash compare to precious

Post on: 25 Май, 2015 No Comment

Posted on 07 June 2014 with 1 comment from readers

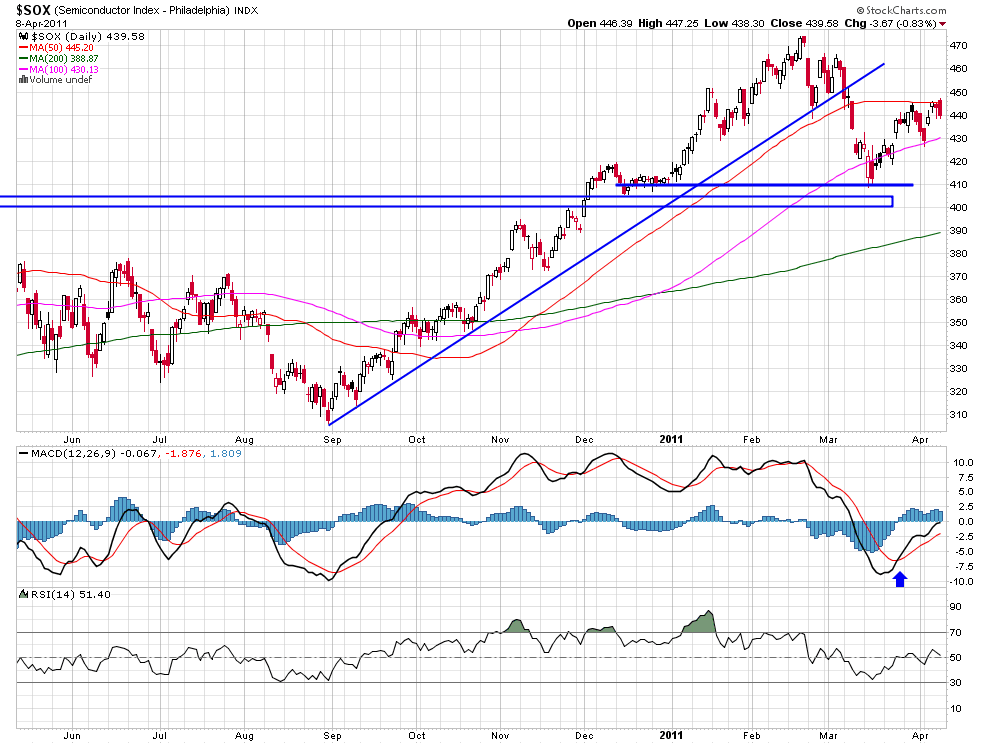

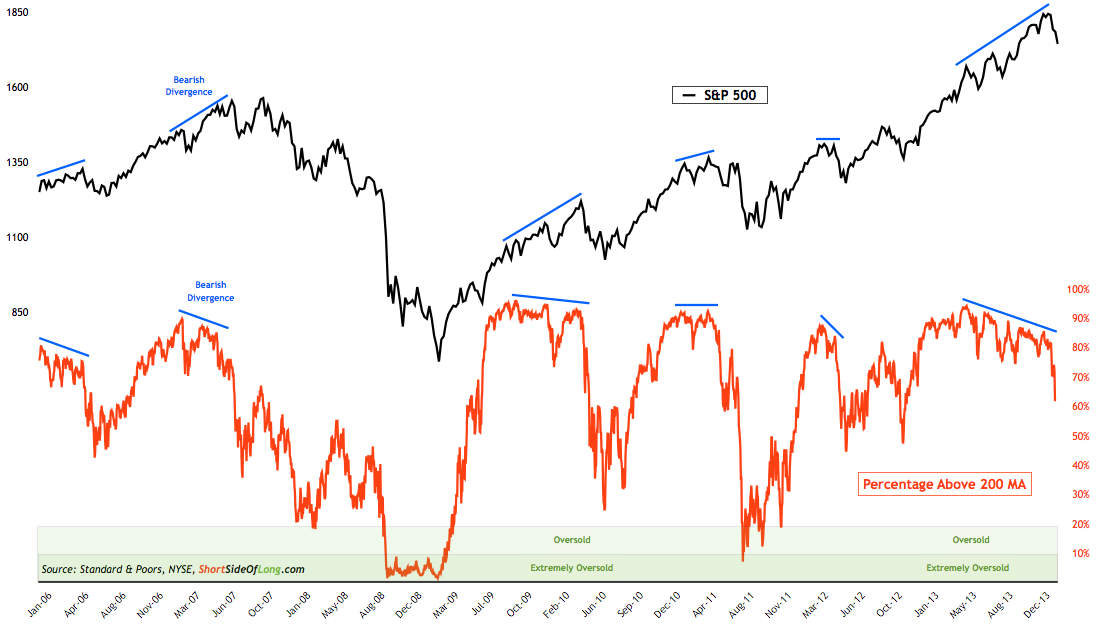

You dont need to be a professional investor to appreciate that the S&P 500 chart below has extreme danger written all over it, and yet the VIX fear index trades at close to a record low. That means it is still very cheap to buy downside insurance against a crash in the stock market from these elevated levels.

Many professional investors are starting to do that now by shorting the SPY exchange traded fund for the S&P 500 using options (click here ). This is more efficient than using one of the widely criticised inverse ETFs that reset daily and amplify losses faster than gains.

However, the downside of options is that when they expire you will lose all your money unless the market has crashed by then. Hence it is important to calculate just what you can afford as insurance with this hedging strategy. Obviously the portfolio insurance must not cost more than the value of the assets it is protecting. Its a calculation easy enough to do.

Other options

How else could you protect yourself in a stock market crash without this certain loss of money if it does not happen? As an aside we know investors who planned for a market crash in March and whose options expired worthless at the end of that month.

True the much maligned inverse ETFs simply rolled over with some losses but they are substantially intact. If the market crashed tomorrow they would still bounce upwards. That is one alternative. Another is precious metals. Your principal is not going to disappear and it has a greater liklihood of recovery than with the inverse ETFs.

Thats because precious metals are money without a counterparty and not a financial asset like an ETF which will have many counterparties involved. Golds performance in the 2008-9 financial crisis was unusual. Normally when stocks fall then gold goes up. In 2008-9 that did not happen. Gold also came off a record high.

Golds oversold

Today gold trades around $1,250 compared with its all-time high of $1,923 three years ago, so it is post-correction already. That makes the yellow metal a very different beast this time around. Gold will be far more likely to rise in value as stocks come off than fall, and silver will be gold on leverage again.

There will be a very good reason for this. The next global financial crisis will be very nasty because stocks, bonds and real estate are currently stacked at super-high valuations sustained only by artificially low interest rates. What will happen to instruments like options and ETFs as this colossus fails? Will the third parties behind them really survive to pay out?

Its when you take this sort of perspective that hedging portfolios with precious metals really begins to make sense. A crash is not a correction and you need a different sort of insurance to deal with it.