How Does Interest Rate Affect Market Value of Liabilities

Post on: 27 Май, 2015 No Comment

Basics

Companies issue bonds to finance operations. Bonds are recorded in the liabilities section of the company’s balance sheet. A bond may trade at a premium (above) or discount (below) to its par or face value. The trading value depends on interest rates, the coupon rate (percentage of face value paid as interest per year) and other conditions such as the financial health of the issuer.

Maturity Dates

On the maturity date, a bond’s par value is repaid and interest payments stop. Although a bond may trade at a premium or a discount, the prices generally converge to par as the maturity date approaches. Prices change with interest rates more for longer-term bonds (i.e. bonds with maturity dates farther out than shorter-term bonds) because of the longer stream of interest payments that might be above or below current market rates. This makes the bonds more or less appealing to investors. According to a Charles Schwab analysis of Bloomberg-supplied government bond data, in a six-month period of falling interest rates in the second half of 2008, a 30-year bond’s market value rose more than twice as much as a 10-year bond. Similarly, in a six-month period of rising interest rates in the first half of 2009, a 30-year Treasury bond’s market value fell almost three times as much as a 10-year bond.

Risk Management

References

Resources

More Like This

Practical Use of a CAPM

The Average Interest Rate for Small Business Loans

You May Also Like

Investment decisions require the analysis of many interdependent considerations. Prior to a decision to buy stocks, most investors should consider whether investment.

Interest rates have a big effect on how much a business or individual can borrow. People or companies that borrow money are.

A bond is a common way for large corporations and governments to raise capital. Unlike stock, a bond is a debt instrument.

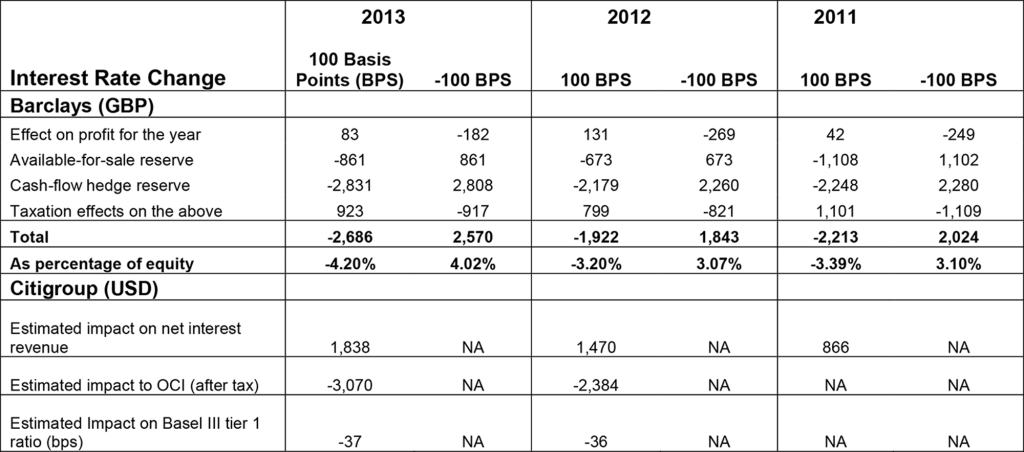

Sources of Interest Rate Risk. Interest rate risk is the chance that the value of interest-bearing assets or liabilities will change in.

When a unit of currency is able to purchase less than it could in the past, the value of the currency is.

Mortgages are home loans that individuals and businesses use to buy property. The mortgage rates are one of the most important parts.

The stock market has a major influence on our economy, from how well our corporations are doing to the extent of consumer.

Bonds are fixed-income debt securities issued by businesses, governments, and governmental organizations to fund operations, large-scale projects and for other.

The main risk for Treasury Bonds is interest rate changes. Since Treasury bonds are loans to the federal government, the risk of.

The market value of bond securities changes with changing interest rates. Bonds are issued with fixed coupon yields, and the market adjusts.

A bond's par value equals its nominal value at maturity. A U.S. Treasury bond, for example, comes in denominations of $1,000, and.

Interest rates represent the cost of borrowing, or the cost of obtaining money. Though central banks can influence interest rates by adjusting.

The prevailing rate of interest at which lenders are willing to loan borrowers money depends on a number of factors. For example.