How Do You Create a Diversified Portfolio

Post on: 2 Апрель, 2015 No Comment

How Do You Create a Diversified Portfolio?

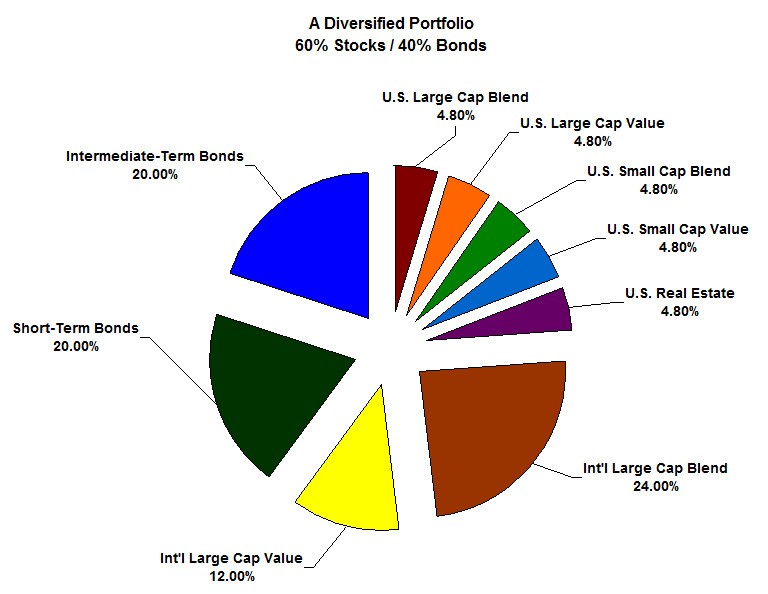

A diversified portfolio is critical to solid investing. Diversification in your portfolio will ensure that you balance and manage the investment risks involved. Financial advisers and experienced investors understand that diversifying a portfolio is one of the most important tools used to make sure investments within the portfolio have balanced risks and rewards. This can include having some high risk and high return, low risk and low return, and medium risk and return securities all bundled together in one investment portfolio. The old saying about having all of your eggs in one basket holds true here. When the basket falls, all the eggs are broke, just like you can be. A diversified portfolio can help you hedge against this risk by providing many baskets for your investment eggs.

Creating a diversified portfolio is not difficult, but it may require a little research on your part unless you use a professional to manage your investment portfolio. Diversifying means that you invest in differing securities that are in the same or similar asset classes, as well as investing in different asset classes. A diversified portfolio is one that has specific percentages for each asset class and risk allocation, and if your portfolio is diversified, then market conditions may not have such a drastic effect on the value and returns you see from it. The perfect diversified portfolio will be different for each investor, depending on what your goals and investment ideals are. Only you can decide to what extent you want your portfolio diversified.

Diversifying your portfolio should start with diversifying one asset class. There are three main asset classes. These are cash, stocks, and bonds. You may want to start with stocks and diversify these holdings first. Look at the stocks you own and determine if they are from different industries, if they are growth or value stocks, if they are small or large cap stocks, and so on. To be diversified in this area, you should own several types of stock so that you minimize the overall financial risks associated with your investment portfolio. This will protect you if one industry or company goes down because others may go up at the same time.

Once you have diversified each asset class in your portfolio, look at the overall picture of the portfolio. Is it balanced, or do you have a very large percent of one asset class and not enough investments in other areas? If you had a portfolio that was very heavy on stocks and light on other asset classes, the recent stock market tumble may have damaged your portfolio significantly. A diversified portfolio will prevent substantial losses if one sector drops and loses value because the other asset classes will usually not be affected or move in the other direction, protecting the bulk of your investments from financial ruin.

A diversified portfolio can include many different classes and types of assets. If your portfolio is large, there are other assets that can be included along with stocks, bonds, and cash. Real estate, options, foreign currency, and others can be included to ensure that your portfolio is well diversified so you are financially covered no matter what the market does and can minimize the overall risks from investing. A properly diversified portfolio will include a mix of stocks, bonds, cash, and other investing options for a well-rounded portfolio that maximizes the chance of returns in exchange for minimum risk. It is important that diversification is done within each asset class as well, for complete portfolio diversification.