How Do Monetary Policies Affect Your Portfolio

Post on: 29 Май, 2015 No Comment

Generally speaking, when we talk about monetary policy what we’re really talking about are a number of different rates, particularly interest rates, which are set by the Federal Reserve. The original purpose of any central bank is to provide liquidity when it’s needed and to reduce liquidity when the economy has an excess of it and is overheating.

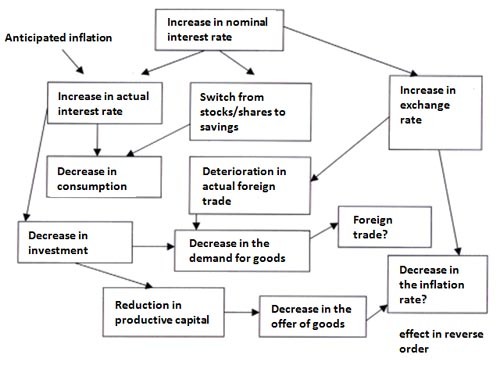

The Fed implements low interest rates (currently at historic lows) in order to stimulate economic growth, investing and risk-taking. When interest rates are low, they tend to be supportive of higher equity prices. Part of the reason for this is that low interest rates make less risky investments such as bonds and savings accounts less attractive, because they yield very little, or next to nothing. On the other hand, as long as earnings remain stable, U.S. equities and stocks in general are buoyed by low interest rates.

Investors can afford to be much more demanding of stocks, particularly U.S. equities, when interest rates are high (which they currently are not), because in such an environment, lower risk investments are available that still provide quite acceptable returns. In a high interest rate environment, equities also need to provide high levels of growth in order to keep pace with inflation. Of course, high interest rates are typically implemented by the Fed to cool off an overheated economy.

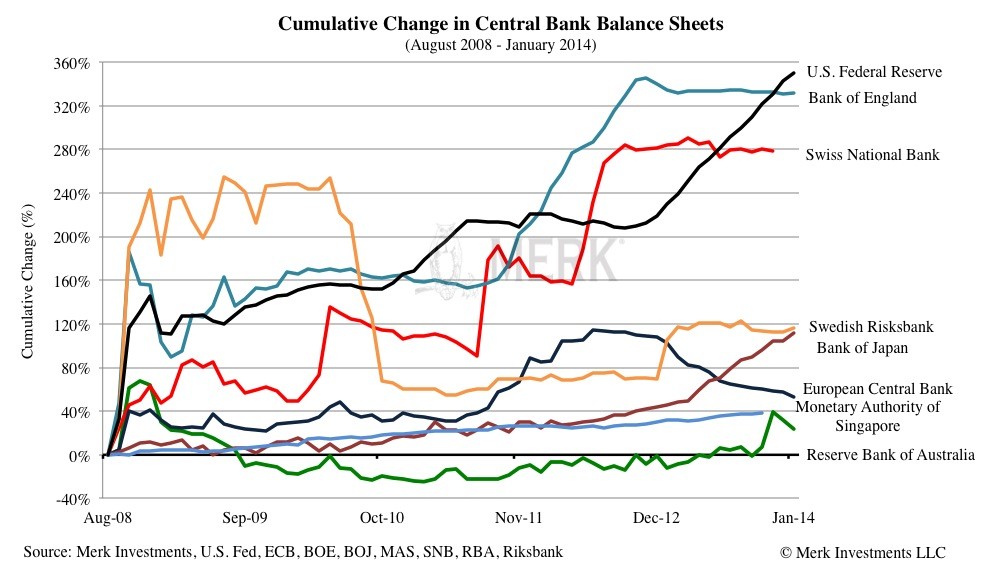

Today, the U.S. Federal Reserve and its counterparts around the world (the European Central Bank, the Bank of Japan, Swiss National Bank, People’s Bank of China) are now conducting various quantitative easing (QE) via permanent open market operations (POMOs) to inject liquidity into markets by purchasing various government bonds from dealers. These operations are intended to add even more liquidity than low interest rates (ZIRP) currently have provided. POMO has partially had its intended effect, raising equity prices, but it hasn’t necessarily stimulated increased lending or borrowing or jumpstarted the economy in the way it is intended.

Investors should be aware of the POMOs that banks around the world conduct, particularly the U.S. Fed. As each round of Quantitative Easing (QE) has ended, equity prices have fallen. In other words, QE is then only a temporary safety net for bullish investors given limited duration. The Fed has recently announced a third round of QE with no termination date. In essence, this is like training wheels for the market — as soon as the market can normally sustain itself, the Fed can remove the training wheels and end the third round of QE. At least that’s the hope.

Investors should also remain cognizant of monetary policy enacted by the Fed because these open market operations have a tendency to ripple out across the U.S. economy, affecting nearly everything from interest rates to food and equity prices. Remaining aware of these important, news-making events will help both do-it-yourself investors and financial advisors remain agile in changing investment landscapes.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.